The rise of decentralized finance is particularly strong in regions with weak banking systems, such as Sub-Saharan Africa, Latin America, and Eastern Europe. Experts believe this is because defi offers financial tools and services traditionally unavailable to people in these areas. Experts point to the user-friendliness and security of defi compared to traditional financial institutions in these regions. However, challenges like complex onboarding processes, regulations, and hacking threats hinder widespread adoption.

Pre-Crypto Winter Enthusiasm Returns

According to experts, interest in decentralized finance (defi) and defi-related services in Sub-Saharan Africa, Latin America, and Eastern Europe is largely due to economic instability and the respective regions’ weakened banking systems. Citing the recent Chainalysis crypto adoption index, the experts insist that defi is making inroads in these parts of the world because it gives users access to services and financial tools that have traditionally been the preserve of the few, mostly users in Western countries.

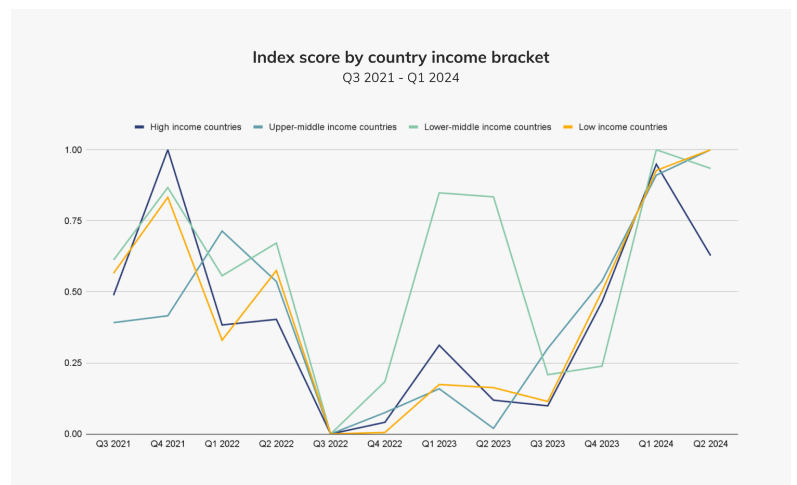

While the Chainalysis index indicates growing crypto activity across all regions, a closer look at the data shows a decline in high-income countries beginning in the first quarter of 2024. Interestingly, this drop in activity appears to have coincided with a period when bitcoin (BTC) hit a new all-time high and the approval of bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC).

Meanwhile, the index shows that the trajectory of crypto activity in lower and lower-middle-income countries remained largely unchanged. This may be an indication that people in these regions are embracing crypto with the same enthusiasm as they did before the start of the so-called crypto winter.

Fragmentation Stalls Defi

Commenting on the Chainalysis data, which hints at increased defi activity in some of the less developed regions of the world, Ivo Georgiev, CEO and co-founder at Ambire Wallet, explained to Bitcoin.com News that this may be happening because defi seen as “extremely useful”, particularly in markets where financial institutions are perceived to be unfriendly to users.

Georgiev’s sentiments are echoed by Justin Wang, founder of Zeus Network, who argues that people in these regions are always seeking alternative financial solutions that offer security and transparency. According to Wang, defi stands out because it provides a trustless and decentralized financial system managed by smart contracts. This offers the kind of “financial autonomy” and security that they cannot get from traditional financial institutions.

Still, despite seeing notable growth in lower-income or less-developed countries and promising to disrupt the global financial system, the decentralized finance industry faces challenges that hinder the envisaged worldwide adoption. Some of these challenges include complex onboarding processes, regulatory uncertainty, and the threat of hacking which continues to grow.

Nevertheless, a spokesperson for the crypto exchange Bybit identifies the fragmentation of liquidity as one key problem hindering progress in the defi space. While admitting that solutions to this problem are coming online, the spokesperson however said more needs to be done to improve the “on-chain experience so that users can access the assets they’re seeking with sufficient order book depth to minimize slippage.”

‘Growing Pains’

Explaining why fragmentation is not helping the industry’s cause, Kiril Nikolov, a defi Strategy Specialist with Nexo, said:

Liquidity is highly fragmented across numerous networks and long lists of derivatives for the underlying assets. Greater fragmentation results in less efficient markets, which in turn encourages value extraction practices like MEV (Miner Extractable Value) and high slippage.

Although the challenges holding back defi are part of the “growing pains” that come with attempting to redefine the financial system, experts believe that when industry participants eventually find the ideal solutions, adoption will explode.

Do you agree with the experts’ views? Share your thoughts in the comments section below.

news.bitcoin.com

news.bitcoin.com