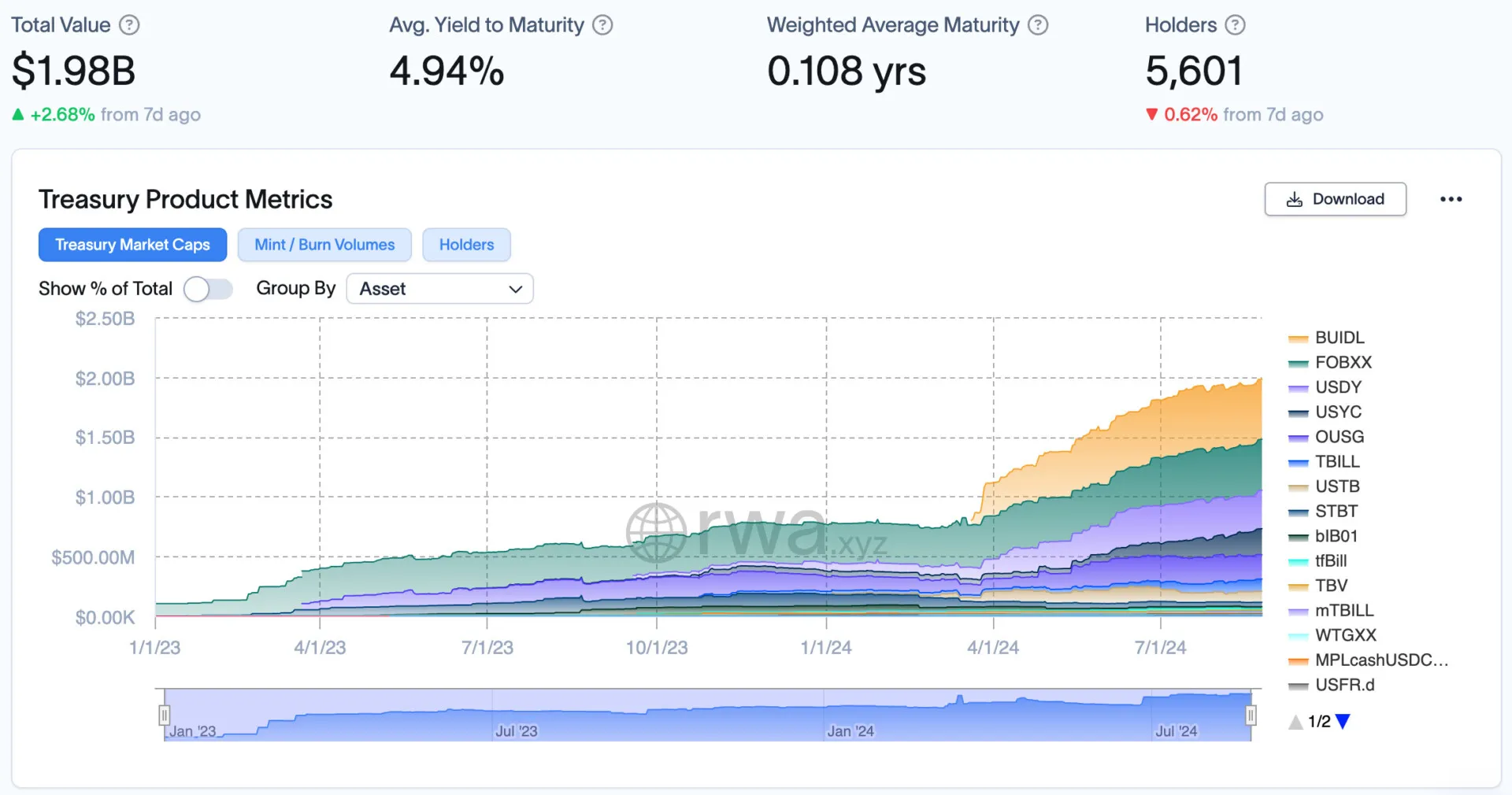

Just five months after tokenized Treasury notes hit a $1 billion market cap, they’ve doubled again, smashing past $2 billion. Tokenized treasuries are digital versions of U.S. government bonds, and now they’re flying off the shelves—or, in this case, the blockchain.

You can trade them like tokens on Ethereum, Stellar, Solana, Mantle, and other blockchains. Sure, $2 billion sounds like a big number—and it is for a fresh player—but let’s be real: it’s a drop in the bucket compared to the entire $27 trillion U.S. Treasury market.

But don’t count these digital assets out just yet. The potential here is enormous, especially with crypto enthusiasts and traditional finance guys sniffing around, looking for ways to merge these worlds.

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) is leading the charge. It launched late March and shot straight to the top like a rocket. Six weeks in, and it was already the biggest tokenized Treasury fund out there, with a market cap of $375 million.

Now, it’s sitting pretty at $503 million. Franklin Templeton’s OnChain U.S. Government Money Fund (FOBXX) and Ondo’s U.S. Dollar Yield (USDY) are also making some serious noise.

But, don’t think this boom is just about the big dogs. Smaller issuers are stepping up, too. Hashnote, for example, saw its offering explode nearly 50% over the past month, hitting a cool $218 million.

Meanwhile, OpenEden and Superstate aren’t far behind, with growth rates of 37% and 18%, respectively. Both are creeping up on the $100 million mark.

cryptopolitan.com

cryptopolitan.com