Uniswap has now shown a shift in traffic, with significant growth coming from Base users. Adding smart wallets and lower fees means Uniswap is now more accessible to retail traders.

Uniswap is present on Ethereum and the top L2 scaling blockchains, with inflows of users, stablecoins, and ERC-20 tokens. Recently, a shift in user profiles has happened. Monthly active users from Base accounted for a much larger share, with a growth trend from the past months.

Uniswap MAUs by chain (market share view): pic.twitter.com/Qd4Rf3e6pT

— Token Terminal (@tokenterminal) June 20, 2024

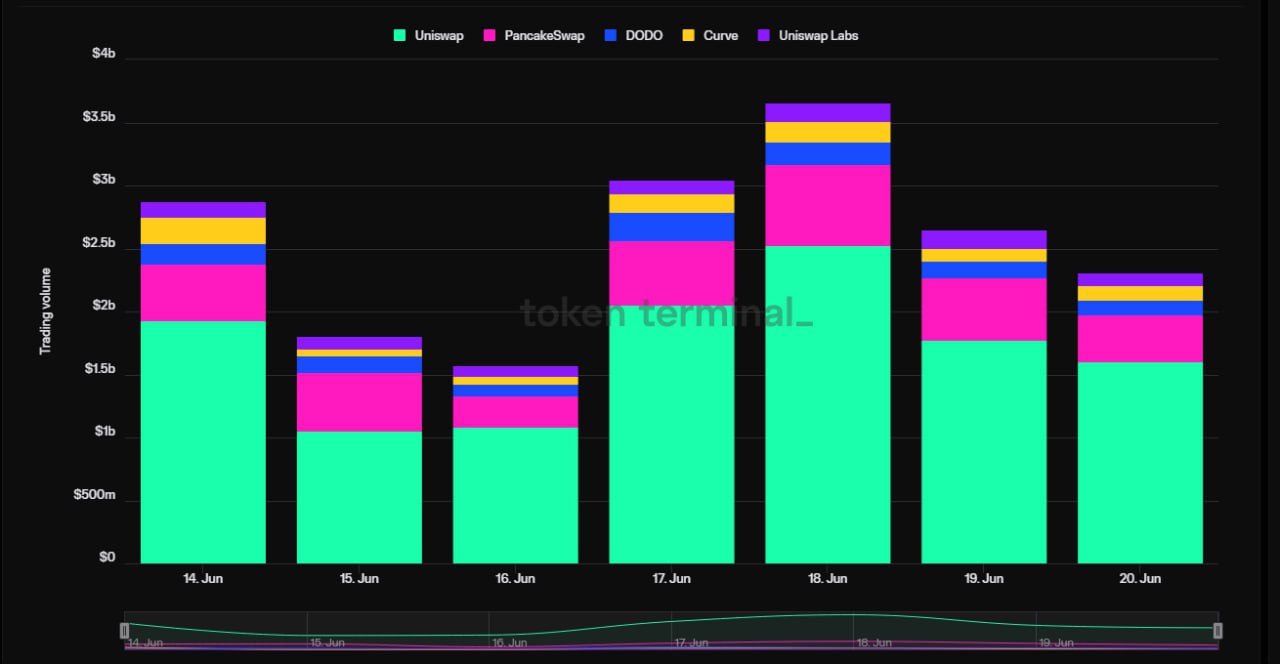

Uniswap dominates trading volume, boosted by the Ethereum ecosystem and new L2 chains like Base. Source: TokenTerminal

Uniswap is also a leader in fees, except for the Aerodrome DEX, its close competitor also represented on the Base blockchain. Aerodrome is also the more efficient DEX in terms of revenues.

Uniswap Labs logs between $200K and $400K daily earnings. The results are based on up to 460K active daily wallets communicating with the exchange. Uniswap also leads in terms of direct deposits.

The exchange faces competition for riskier trades and specialized protocols, but remains the most widely used swap service. Except for the Solana ecosystem and Raydium DEX, Uniswap was the go-to listing facility for multiple tokens.

Uniswap is also experiencing a boom in new liquidity pool launches, some with deposits as low as 1 ETH. Most of the pairings are against various forms of WETH and are extremely volatile.

Despite the positive developments, UNI trades at $9.80, still 50% down from its yearly peak. The token gained more than 100% in the past 12 months, though, as users flowed back into DEX and more tools became available for gaining from old and new tokens.

Uniswap joins Base campaign for onboarding more users

The growth of Uniswap on Base is part of the chain’s campaign for onboarding new mainstream users. Base marked a significant growth in smart wallets, which aim to resemble an Internet login, though with the same security as self-custodial wallets. Uniswap is now linked to Moonpay, a new service linking new Base accounts to the exchange.

Celebrating Onchain Summer is easier with @Uniswap.

— MoonPay 🟣 (@moonpay) June 20, 2024

Everyone’s favorite crypto unicorn has supported over 100 billion dollars of L2 volume in the last 90 days.

If you want to join the fun, it’s pretty simple.

Just top it, then swap it, at https://t.co/lFVFXgPxdD. pic.twitter.com/IKFXzzie9z

Until recently, Uniswap was instrumental to the Ethereum ecosystem. However, it almost blocked retail traders and those who just wanted to dabble in crypto due to extremely high fees, even for small-scale trades and transactions.

Uniswap already recovered its value locked to $5.67B, after a season of highly active token generation. Uniswap V3 carries more than $877M in daily trading volumes on Ethereum, $80M on Polygon, and $57M on Optimism. The Uniswap V3 app on Base surpassed the smaller blockchains with more than $163M in daily volumes.

Volumes have also accelerated the pace of growth, surpassing even the levels of the 2021 bull market. Increased L2 activity and wider adoption are also helping Uniswap despite some market downturns in 2024.

Is Uniswap V4 coming this summer?

Uniswap announced the upcoming V4 a year ago. This June, the DEX once again did not share an exact date but set up expectations for a launch during the summer months or in the fall.

The main effect of V4 would be to resemble an exchange with order books. Decentralized orders are permissionless, but they can easily fall prey to bot frontrunning, MEV bot activity, or sandwich attacks. Uniswap aims to optimize liquidity and become more friendly to newcomers expecting a more predictable liquidity without unexpected losses.

Uniswap’s next version will support on-chain limit orders and a time function to spread out large orders. The other big difference will be that all pools will be united and controlled by a Pool Manager, able to control liquidity from multiple orders. The exchange will also only move net balances, and not all assets during a swap. The goal is to limit gas usage and fees, while retaining real on-chain trading.

Cryptopolitan reporting by Hristina Vasileva

cryptopolitan.com

cryptopolitan.com