The launch of restaking protocol Symbiotic brought another evolving step to the restaking landscape, according to IntoTheBlock’s “On-Chain Insights” newsletter. Symbiotic reached its cap for liquid staking tokens in less than 48 hours, and its popularity is bolstered by a $5.8 million investment from Paradigm and cyber.Fund.

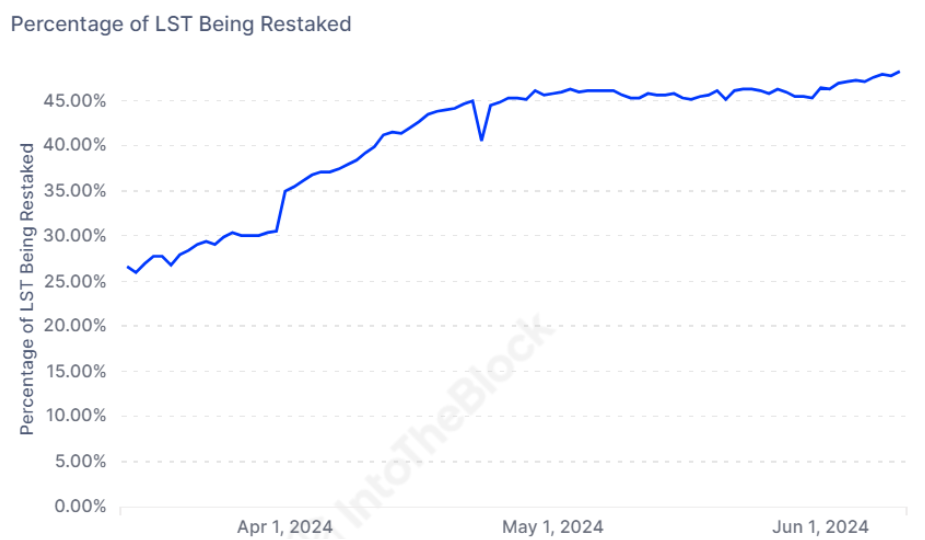

EigenLayer has seen 48% of all Liquid Staking Tokens (LST) being restaked within its protocol, the highest proportion to date. It has also placed limits on the deposit of Lido’s stETH, which has prompted some users to transfer their LST from Lido to EigenLayer in search of higher yields.

Restaking was popularized in the Ethereum ($ETH) ecosystem by EigenLayer, consisting of a layer that uses staked $ETH to provide dedicated security for decentralized applications. Consequently, projects don’t have to focus on creating their own set of validators, as they can tap into restaking layers.

However, Symbiotic sets itself apart by accepting a variety of ERC-20 tokens for restaking, not just $ETH or certain derivatives, mirroring Karak’s open restaking model. The project’s unveiling aligns with the start of its bootstrapping phase and the integration of restaked collateral.

Moreover, Mellow, Symbiotic’s first liquid restaking platform, launched simultaneously with the protocol itself. Lido’s endorsement of Mellow suggests a potential shift of wstETH deposits from EigenLayer to Symbiotic.

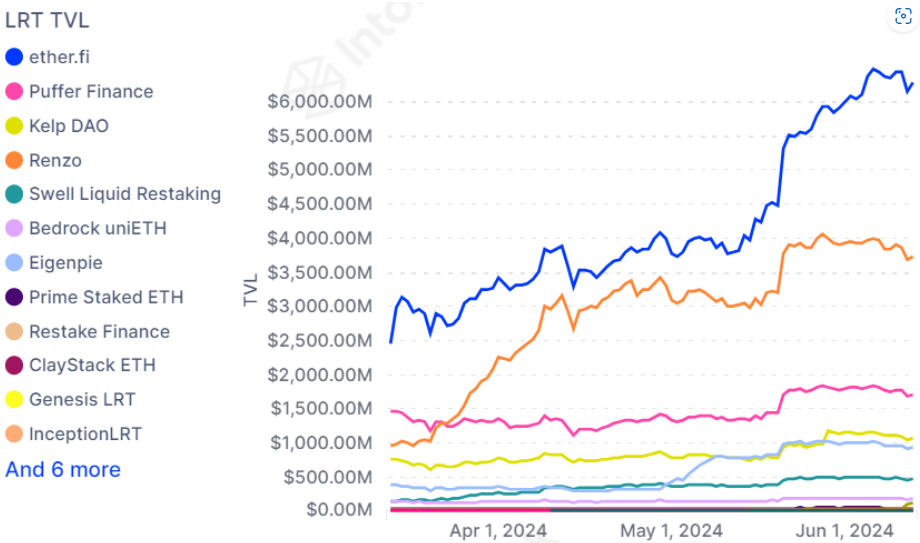

Additionally, the ongoing points distribution phase for both Mellow and Symbiotic, prior to their token launches, may attract airdrop farmers. Established LRT protocols such as Etherfi or Renzo might soon begin collaborations with Symbiotic.

IntoTheBlock’s analysts assess that the liquid restaking protocol landscape is in a state of flux, with Symbiotic’s entry introducing new capabilities that challenge the status quo, signifying a shift towards a more diverse and competitive environment.

cryptobriefing.com

cryptobriefing.com