As traders and investors seek gains, this year’s Solana rebirth has buoyed SOL-native exchanges to the forefront of defi activity.

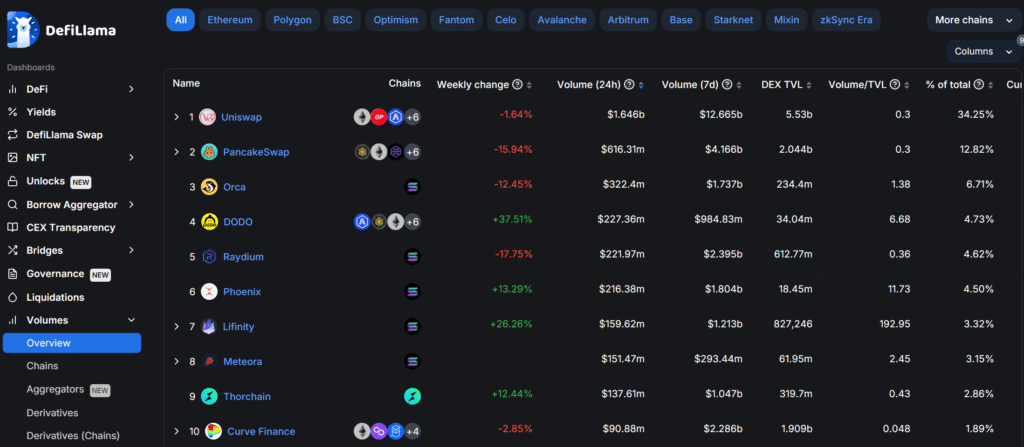

DefiLlama data shows five Solana-only protocols appeared in the top 10 decentralized exchange (DEX) volumes in the past 24 hours.

A DEX is a trading venue built atop a blockchain that allows users to buy, sell, and swap cryptocurrencies. On-chain investors can also provide liquidity through decentralized exchanges, earning yield or passive income to support trading with capital.

Top 5 Solana DEX providers

Uniswap and PancakeSwap lead the DEX space with daily trading volumes of $1.6 billion and $616.3 million, respectively. Solana’s (SOL) Orca exchange ranked third after amassing $322.4 million in the past day. Arbitrum-based platform DODO was fourth, recording $227.3 million, while SOL’s largest DEX by total value locked, Raydium, came in fifth with $221.9 million.

Rounding out the top 10 are Phoenix, Lifinity, and Meteora. All three are Solana-powered exchanges and boasted respective volumes of $216.3 million, $159.6 million, and $151.4 million. Thorchain and Curve Finance completed the top 10 DEX protocols by volume, placing ninth and 10th per DefiLlama.

SOL-native protocols are drawing attention during a period of memecoin demand. As crypto.news reported, SOL’s ecosystem has become the premier network for meme token speculation. The entire blockchain has also garnered mentions from asset management giants like Franklin Templeton, as well as venture capitalist firms such as Andreessen Horowitz.