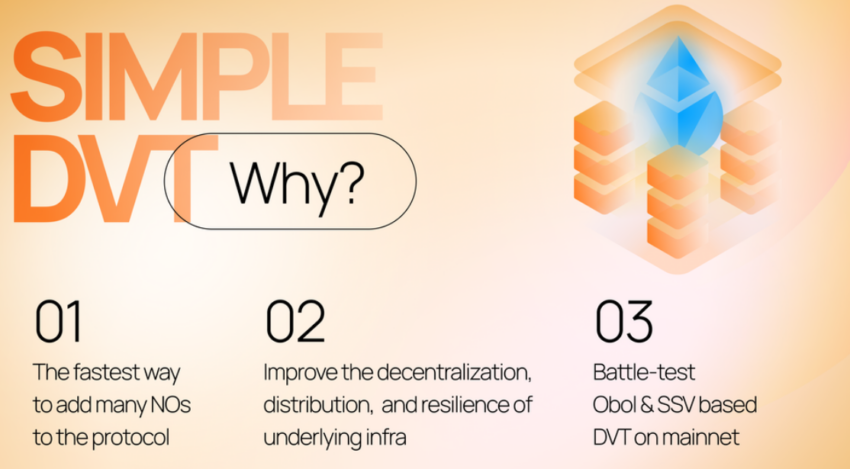

The decentralized finance (DeFi) landscape has been brimming with activity over the past week. Leading the charge, Lido Finance announced the launch of its Simple Distributed Validator Technology (DVT) on the Ethereum mainnet.

This innovation enables individual and community stakers to operate validators, democratizing participation and enhancing the security and decentralization of the node operator ecosystem.

Aave Continues to Make Strides in DeFi with Simple DVT Deployment

In a move to streamline staking, Aave’s community introduced the FastPass proposal, aiming to allow a portion of Safety Module stakers to skip the typical 20-day cooldown period for a fee. This proposal, if accepted, could significantly increase the liquidity and flexibility for Aave stakers.

Aave marks another advancement in the decentralized finance (DeFi) sphere with the rollout of its Simple Distributed Validator Technology (DVT) module. Following a decisive Lido DAO vote six months ago, the protocol has laid the groundwork for a diversified node operator set, integrating community and solo stakers into the Ethereum staking ecosystem.

The recent activation of the Simple DVT module means new ETH staked with Lido will automatically flow into this system. This mechanism remains in place until it reaches full capacity, after which new stakes will revert to the Curated Module. This development reflects Aave’s commitment to decentralization and innovation.

Already surpassing minimum performance benchmarks, the third Obol testnet ushers in onboarding the first cohort of 12 clusters. The upcoming completion of the third SSV Network testnet further underscores the robust performance metrics crucial to Aave’s pioneering efforts in the DeFi space.

With expectations to add 250 new Node Operators, Aave demonstrates that DVT is a rapid path to bolstering operational robustness and decentralization, a vital step in the protocol’s evolution within DeFi.

Other Notable Happenings This Past Week

Amidst these updates, the Angle protocol’s USDA stablecoin went live for public use. The USDA aims to offer a native 10% yield, backed by real-world assets, and incorporates mechanisms to counter de-pegging scenarios alongside liquidity comparable to USDC.

However, not all developments were positive. Hedgey Finance fell victim to a substantial security breach, with exploits on Ethereum and Arbitrum blockchains resulting in a combined loss of $44.7 million, highlighting the ever-present need for robust security measures in DeFi platforms.

Ether.fi announced plans to introduce wrapped Ethereum (weETH) across various Layer 2 solutions, expanding its reach and utility. Moreover, in the wake of Ether.fi’s update, the week saw a plethora of integrations, partnerships, and proposed changes, all pointing toward an interconnected and rapidly evolving DeFi ecosystem.

In light of these rapid developments, industry observers are closely monitoring the potential impacts of these innovations on the DeFi sector. With significant funds flowing into various projects, from infrastructure to gaming and AI, the implications for investment strategies and market dynamics are profound.

The community also eagerly anticipates upcoming releases and proposals, such as Worldcoin’s World Chain on Optimism’s stack and Myso Finance’s Initial Open Offering. These events are expected to fuel the DeFi space’s momentum further, presenting new opportunities and challenges.

beincrypto.com

beincrypto.com