Users of the decentralised finance (DeFi) app Pac Finance reportedly faced $24 million in liquidations on April 11 due to an unexpected parameter change made by a developer wallet. Social media reports and the app’s official Discord server indicate that this change occurred without prior announcement. The app’s Discord admin said the team had been notified of the issue, but there has been no formal announcement about the incident.

Pac Finance is a crypto lending app operating on the Blast network, allowing users to deposit funds and earn interest by lending their assets. Borrowers can take out loans up to a certain percentage of their collateral, known as the loan-to-value ratio (LTV). Typically, changes to the LTV ratio are announced beforehand.

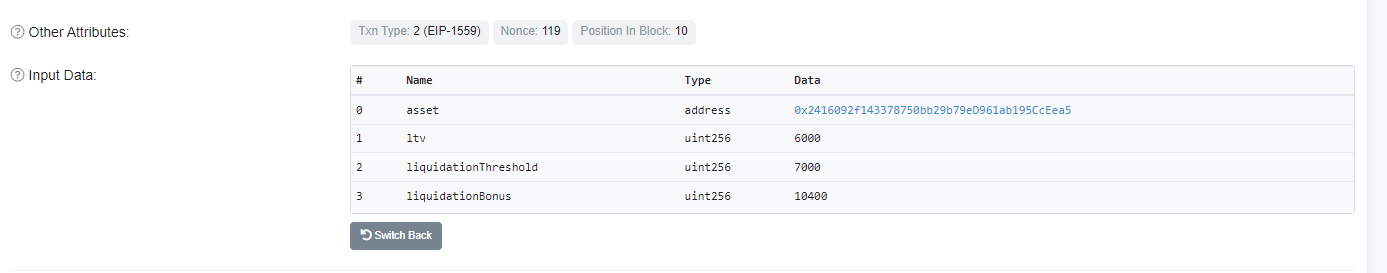

On April 11, a developer wallet adjusted the LTV for Renzo Restaked Ether (ezETH) to 60% through a function on Pac Finance’s PoolConfigurator-Proxy contract.

According to smart contract developer Roffet.eth, this adjustment led to the liquidation of many ezETH leveraging farmers for violating the protocol’s collateral rules. Roffet described the change as “arbitrary” due to its suddenness.

Parsec Finance founder Will Sheehan criticised the change for happening “seemingly without warning,” estimating that borrowers lost around $24 million in collateral as their assets were automatically sold off to repay loans.

coinculture.com

coinculture.com