The DeFi ecosystem is on edge as Uniswap, a leading decentralized finance platform, faces scrutiny from the US Securities and Exchange Commission (SEC).

The issuance of a Wells Notice to Uniswap’s CEO, Hayden Adams, signals a potential regulatory storm for the DeFi market sector.

A Battle That Could Shape DeFi’s Destiny

According to Nicola Massella, Legal Partner at STORM Partners, this new lawsuit has sent ripples through the DeFi sector, underscoring the gravity of the situation. The SEC’s allegations that Uniswap operated as an unregistered securities broker and exchange have raised concerns.

“This action against Uniswap marks the SEC’s first aggressive move towards a leading entity in the DeFi sector,” Massella told BeInCrypto.

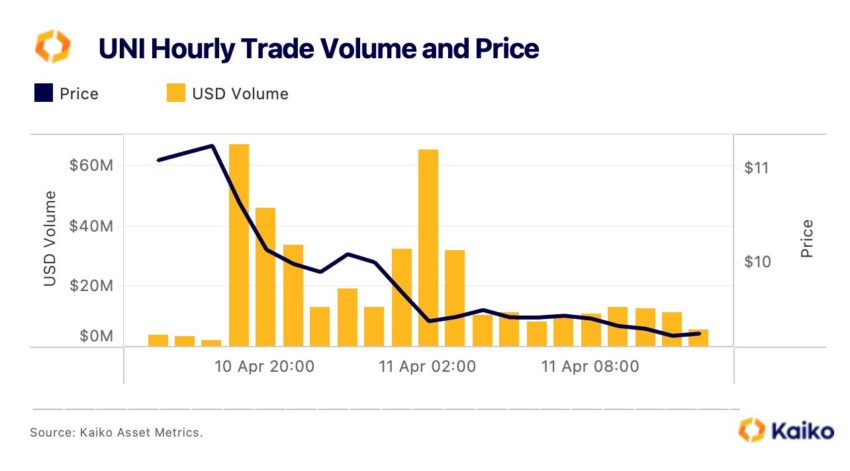

Moreover, the status of Uniswap’s native token, UNI, as a potential security adds another layer of complexity. Analysts at Kaiko noted that the price of UNI dropped by 15%, and trading volumes surged following the announcement. Meanwhile, Santiment reported a “significant amount of FUD” from traders surrounding Uniswap.

Given the importance of this dispute, Massella anticipates it will define further the legal boundaries of DeFi operations in the US. Indeed, at the heart of this legal dispute is the classification of DeFi platforms.

Operators argue they are technology service providers, facilitating independent crypto-asset transactions without exerting control. This model, they contend, differs fundamentally from traditional trading venues, rendering existing financial regulations inapplicable.

Conversely, the SEC is expected to advocate for DeFi platforms to comply with the same regulatory frameworks that govern securities brokers and other financial entities.

The resolution of SEC v. Uniswap is poised to be a landmark moment for the DeFi sector in the US. It will clarify the legal status of DeFi platforms and set a precedent that could either encourage innovation and growth within the sector or impose significant restrictions under the pretext of consumer protection and market integrity.

beincrypto.com

beincrypto.com