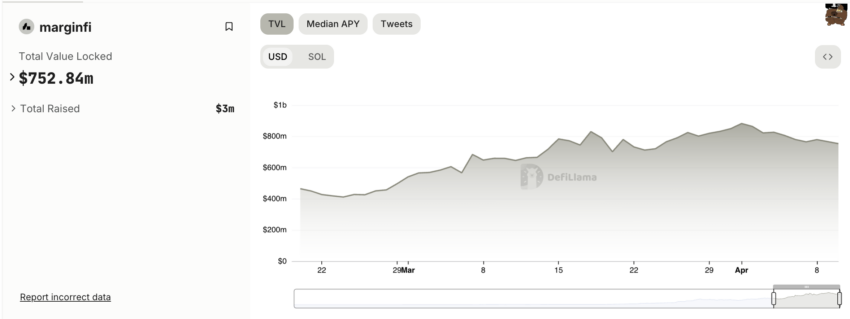

In a dramatic turn of events, marginfi, a prominent player in the Solana decentralized finance (DeFi) ecosystem, saw a sharp 25% decline in its Total Value Locked (TVL).

This happened right after CEO Edgar Pavlovsky announced his resignation.

How Marginfi Users Reacted to CEO’s Resignation

The sudden departure sparked a withdrawal frenzy, with users pulling out nearly $100 million.

Pavlovsky’s exit marked the climax of brewing internal strife, leading to significant unrest within the platform. He left, citing discrepancies with the operational ethos of Marginfi. Consequently, the TVL nosedived to around $600 million, reflecting the eroding trust and uncertainty among its users.

“It’s a world class team — it really is — but I don’t agree with the way things have been done internally or externally,” Pavlovsky said.

Despite the leadership shake-up, marginfi tried to stabilize the situation. The platform assured its community that its services would remain operational. However, the damage to its reputation and user confidence had already taken a toll.

“All products remain fully operational and are unaffected (and can not be affected) by this departure. The point of defi is that core contributors can walk away and the protocol marches on. His departure is a function of internal operational disagreements and of his own personal reasons, and we respect his privacy,” marginfi wrote.

Read more: 13 Best Solana (SOL) Wallets To Consider In March 2024

Moreover, the platform’s recent troubles are not isolated incidents. Prior to the CEO’s resignation, marginfi was grappling with technical glitches and a loyalty program that failed to meet user expectations. These issues had been slowly undermining user trust.

The ripple effect of the CEO’s departure extended beyond marginfi’s internal affairs. Competitors and partners reacted swiftly.

For instance, SolBlaze openly criticized marginfi for failing to meet its token payment obligations, leading to a previous partnership termination. Yet, the platform offered to make amendments amidst marginfi’s turmoils.

Similarly, Solend seized the opportunity to criticize marginfi and attract its disenchanted users. It announced incentives for users transferring their funds to Solend, intensifying the competitive dynamics within the Solana DeFi ecosystem.

The broader Solana network is also experiencing turmoil. Analyst Duo Nine highlighted an ongoing covert conflict among major Solana entities.

Read more: 51% Attacks on the Blockchain Explained: What Are the Dangers?

He pointed out that these entities engage in strategic disruptions, like DDoS attacks, to gain an advantage. Such actions can cripple the network’s efficiency, impacting user transactions and platform reliability.

beincrypto.com

beincrypto.com