Uniswap has introduced three new tools for crypto users to power simpler and more convenient on-chain transactions.

On Feb. 27, Ethereum-based decentralized exchange Uniswap (UNI) launched its latest extension incorporating data, insight pages, and a limit order engine as the trading on-chain trading venue moves toward its vision for a unified platform for cryptocurrency swapping.

Uniswap Extension is a wallet extension attached to a browser sidebar, similar to MetaMask and Phantom. The company plans to deliver constant access to trading facilities with the tool, allowing users to execute swaps instantly. Users can join a waitlist and claim a uni.eth username to access the tool within the next two months.

Introducing the Uniswap Extension 🦄

— Uniswap Labs 🦄 (@Uniswap) February 27, 2024

The first wallet to live in your browser’s sidebar.

No more pop-ups. No more transaction windows.

Waitlist opens today 👇 pic.twitter.com/yNNgiju5zj

Per the firm’s official blog page, the other two features have gone live. The limit order engine enables users to automate trades for up to a year on Ethereum’s blockchain. Traders can use this tool to buy and sell tokens at specific prices on the platform’s web app.

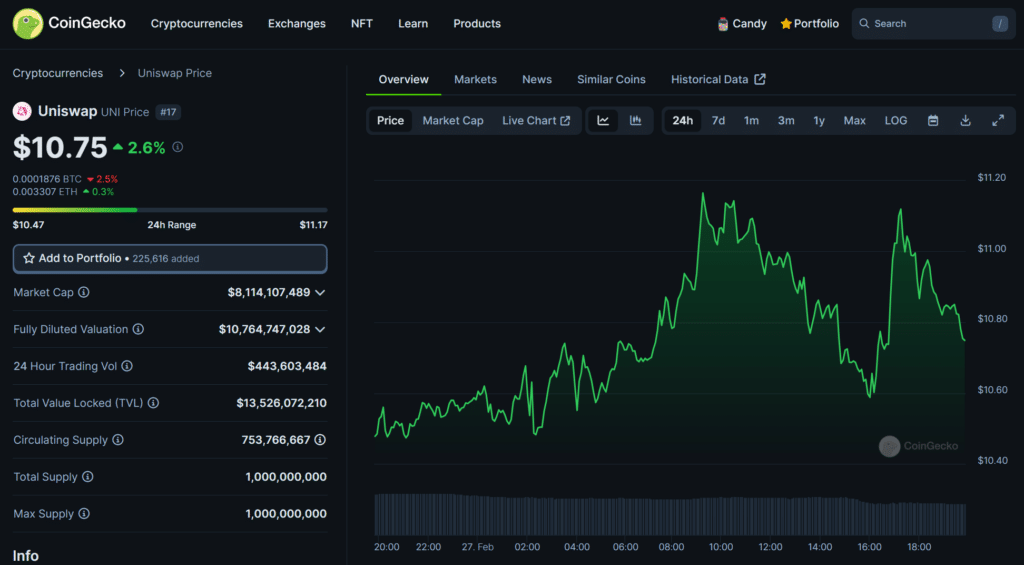

The limit order engine complements data and insight pages, which provide real-time charts and technical crypto analysis. Both tools are integrated, allowing participants to access each utility simultaneously.

Since the beginning, we’ve focused on building products to help users swap anytime, anywhere on the web. A lot has changed since we first launched – the Uniswap Protocol has powered almost $2 trillion in swap volume, helping millions of users swap onchain through both our web and mobile app – and now, we’re expanding our product suite even further.

Uniswap announcement

The platform is the sixth-largest decentralized protocol due to its $5.2 billion total value locked (TVL) and is the biggest DEX in crypto, according to DefiLlama data. Uniswap is one of two on-chain trading hubs available on 13 blockchains, the other being Curve DEX.

The company’s latest announcement comes from a proposal to reward native UNI stakers and governance delegators through an improved fee structure.