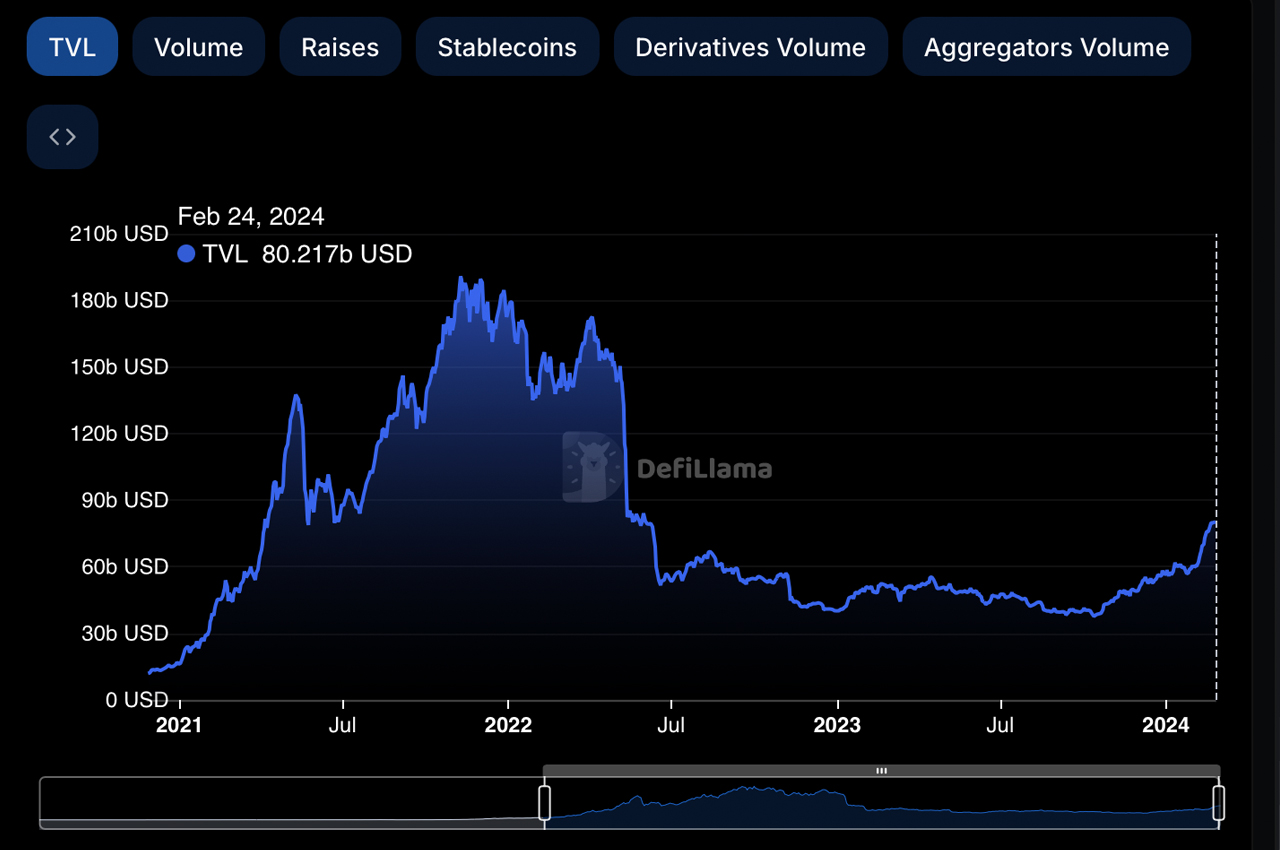

Recent data reveals that the total value locked (TVL) in decentralized finance has jumped past the $80 billion milestone, reaching heights not observed since the downfall of Terra’s stablecoin in May 2022. Leading the charge in 2024 by TVL size is Lido’s liquid staking platform, with ether-based liquid staking derivatives (LSDs) securing a dominant position with $41 billion in TVL.

Value Locked in Decentralized Finance Vaults Past $80 Billion

A span of one year and nine months has elapsed since the UST stablecoin by Terra lost its peg, and Terra’s LUNA plummeted from an $80 valuation per unit to well below a cent in the U.S. Days before the crash, on May 1, 2022, archived records from Bitcoin.com News showed a significant $196.6 billion in TVL. At that juncture, Terra accounted for $28.23 billion or 14.36% of the total TVL, with $16.48 billion tied up in Anchor, poised to be completely vaporized.

Those times have faded into memory, but Terra’s downfall not only erased significant value from the defi sector but also led to the collapse of major firms and trading entities. With the crypto winter now behind us, the amount of value secured in defi has experienced a significant upswing to $80.21 billion. Lido stands at the forefront of the defi sector as the protocol with the largest TVL, boasting a commanding $29.49 billion.

Trailing Lido in the ranking are Makerdao with a TVL of $8.66 billion, Aave closely behind at $8.56 billion, followed by Eigenlayer with $7.95 billion, and Justlend with $6.31 billion, completing the list of the top five defi protocol giants. When it comes to the distribution of this wealth, Ethereum reigns supreme in the defi space, claiming over 60% of the TVL share. As of this weekend, a colossal sum of $46.967 billion is distributed among 979 defi protocols that utilize the Ethereum network.

Tron secures the position as the second-largest blockchain by TVL size, housing $8.484 billion, which represents 11.01% of the total defi TVL. BNB, Arbitrum, Solana, and Bitcoin round out the leading six blockchains in terms of TVL size. Over the last 130 days, the value locked in defi has expanded by more than $42 billion. The revitalized momentum within the defi sector seemingly suggests renewed confidence among defi users. Predicting the momentum’s longevity, however, remains uncertain.

What do you think about the value locked in defi rising above the $80 billion range this week? Let us know what you think about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com