- What is Pancakeswap?

- How Does PancakeSwap Work?

- What is Slippage Tolerance on Pancakeswap?

- What is Pancakeswap Crypto?

- Is PancakeSwap a Profitable Investment?

- PancakeSwap Review: Token Swapping

- Bottom Line

- FAQ

PancakeSwap is a decentralized exchange on the Binance Smart Chain. It has revolutionized cryptocurrency trading with its focus on BEP-20 tokens and an Automated Market Maker (AMM) mechanism. Traditional order books and centralized authorities are eliminated. Users favor liquidity pools over buyer-seller transactions, improving platform efficiency and usability. Users can swiftly and decentralizedly trade cryptocurrency using a dynamic process. PancakeSwap encourages crypto staking and self-sufficient transactions with liquidity pools. PancakeSwap is a dynamic DeFi player with yield farming, lottery involvement, and multi-channel revenue. In this PancakeSwap review, we will cover PancakeSwap in detail including slippage tolerance, BEP-20 coins and CAKE token.

What is Pancakeswap?

Distributed exchange Binance Smart Chain underpins PancakeSwap. PancakeSwap facilitates instant crypto swaps. It focuses on Binance’s BEP20 coins. Decentralized finance (DeFi) powers PancakeSwap’s AMM. This novel trading system eliminates order books and centralization. Users join liquidity pools on PancakeSwap, unlike buyers and sellers.

Automated Market Maker (AMM) solutions allow customers to trade using liquidity pools on decentralized exchanges. Internationally invested funds in smart contracts form liquidity pools for traders. Buyers and sellers do not wait for trade partners to match with this dynamic system. Put tokens in the liquidity pool and get the tokens you need.

A user must discover a liquidity pool to exchange a BEP20 token like ALPHA to BNB on PancakeSwap. ALPHA token deposits immediately generate BNB according to the exchange rate. This method runs smoothly, demonstrating PancakeSwap’s usefulness. PancakeSwap helps traders and liquidity providers. With tokens in a liquidity pool, users can become providers. Doing so lets them share pool traders’ trading costs. This dual capability lets users trade or provide liquidity in decentralized finance.

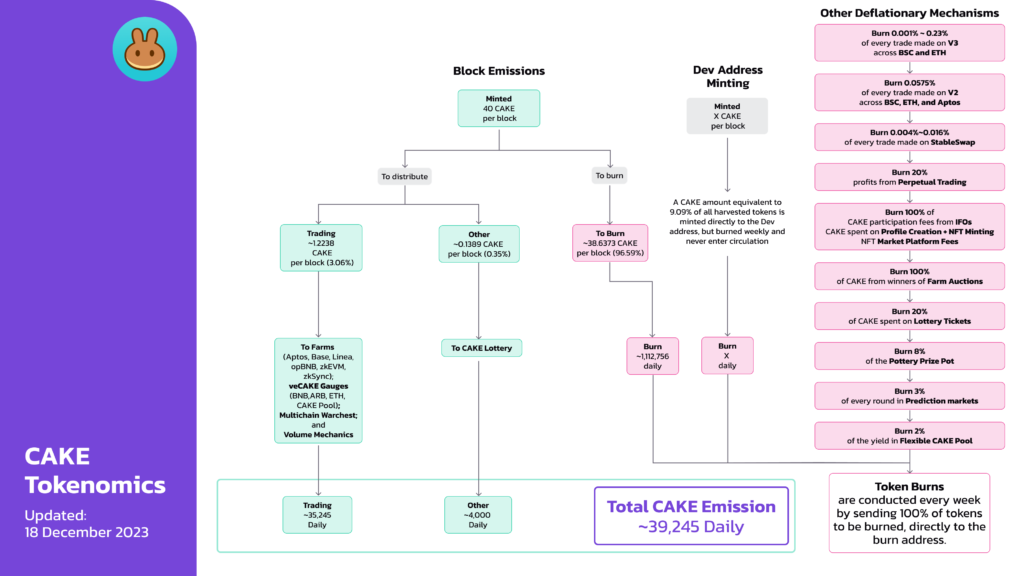

Yield farming is another PancakeSwap revenue stream. PancakeSwap’s native token, CAKE, may be grown for governance and usefulness through yield farming. This versatile coin motivates and benefits PancakeSwap users. Besides trade and yield farming, PancakeSwap has a lottery for randomization. Predicting lottery winning numbers is fun on the site. Moreover, PancakeSwap has introduced v2 and v3 advanced platforms offering better controls, lower trading fees, and higher LP earnings.

How Does PancakeSwap Work?

Decentralized Binance Smart Chain Exchange PancakeSwap lets users swap BEP20 tokens. Platform functionality depends on decentralization and liquidity pools. The PancakeSwap uses liquidity pools. These pools pay depositors CAKE token APRs for pairs of coins. This unique technique encourages cryptocurrency asset staking for self-sufficiency.

The CAKE-BNB liquidity pool combines PancakeSwap’s CAKE coins and BNB, the BNB Chain’s native cryptocurrency. This pool allows equal CAKE and BNB contributions. Thus, they will receive CAKE tokens according to their stake. PancakeSwap’s decentralized system offers various liquidity pools. These pools’ APRs vary by coin and size.

PancakeSwap uses AMM, which removes buyer-seller communication. Users deposit assets to receive LP tokens in liquidity pools for AMM trades. Users own LP tokens and receive a portion of the platform’s trading proceeds. DeFi charges users of these pools’ liquidity and distributes the cost to donors.

Multi-channel money generation is amazing on PancakeSwap. Users can trade LP tokens for profit by contributing to liquidity pools. Users can also grow LP tokens in liquidity pools to get PancakeSwap’s native BEP-20 tokens, CAKE. SYRUP pools offer bonuses for CAKE token deposits.

Decentralized exchange PancakeSwap trades cryptocurrencies on Binance Smart Chain using liquidity pools and AMM. Staking, exchanging LP tokens, and joining specialized pools earn users benefits, making it a dynamic decentralized finance participant.

What is Slippage Tolerance on Pancakeswap?

Slippage tolerance helps decentralized exchange users negotiate the ever-changing environment. Same with Binance Smart Chain-based PancakeSwap. Low transaction fees and dependability make PancakeSwap a popular decentralized exchange. PancakeSwap is among the top 10 decentralized crypto exchanges by trading volume and market share, according to CoinMarketCap.

Understanding slippage is key to PancakeSwap trading. Trade slippage occurs when the price is different than expected. In times of market turbulence, market orders are popular. Slippage occurs when large orders are executed while the intended price lacks trading volume to maintain the difference between the highest bid and lowest ask prices.

Novice crypto traders often slip. When trading crypto, traders usually have a price in mind, but market volatility might affect execution pricing. PancakeSwap handles slippage well because it matters. The slippage tolerance tab appears after connecting wallets and trading. To accommodate market volatility, PancakeSwap sets slippage thresholds of 0.5% or 1.0%.

Choosing 0.1% slippage can cause transaction failures. PancakeSwap advises traders to start small and expand trades to prevent such complications. Customers can set their slippage tolerance based on risk and trading preferences. To balance risk and return, experts urge caution while modifying slippage tolerance. Reduced slippage tolerance lowers prices but increases transaction failures. A higher slippage tolerance makes deals more flexible but exposes consumers to larger price swings.

For better trading, traders should evaluate PancakeSwap’s slippage tolerance. The user-friendly decentralized exchange PancakeSwap has fixed slippage limits and advises prudence while adjusting custom tolerance levels. In order to master the world of decentralized finance and come out on top in the competitive world of crypto, it is imperative that you have a deep understanding of slippage. What’s more, you must be able to skillfully balance risk mitigation with transaction efficiency. Only then can you truly be confident in your ability to succeed. PancakeSwap is a trusted platform for traders seeking a smooth and educated trading experience due to its focus on user education and personalization.

What is Pancakeswap Crypto?

Decentralized finance (DeFi) on the Binance Smart Chain relies on PancakeSwap’s native currency, CAKE. CAKE is PancakeSwap’s governance and utility token as a BEP-20 standard token.

PancakeSwap gives liquidity poolers CAKE tokens. For users to provide liquidity for trading pairings, decentralized exchanges need liquidity pools. CAKE tokens are earned for contributing to these pools. This strategy increases PancakeSwap’s liquidity and engagement.

CAKE token holders can trade on the exchange or consolidate into SYRUP pools. SYRUP liquidity pools from PancakeSwap. Users receive bonuses for depositing CAKE tokens. CAKE holders’ returns are maximized via this feature. PancakeSwap launched vCAKE, bCAKE, and iCAKE for fixed-term CAKE stakes. These coins, which cater to different tastes of consumers, complicate staking.

CAKE, a BEP-20 token, is safe in compatible wallets. Metamask, a popular Ethereum wallet, can store and handle BEP-20 tokens on the BNB Chain. Binance Wallet, a Chrome and Firefox browser extension, makes storing and using BEP-20 tokens on the Binance Smart Chain easy. Decentralized multicurrency wallet users like Trust Wallet. The platform lets users transmit, receive, store, swap, and acquire BEP-20 tokens.

In addition to Ethereum, Metamask’s integration with the BNB Chain proves that blockchain networks may collaborate. Binance Wallet simplifies BEP-20 token management for PancakeSwap and other Binance Smart Chain DApps with its friendly browser extension. Decentralized Trust Wallet integrates with the Binance Smart Chain and gives consumers full asset control.

Is PancakeSwap a Profitable Investment?

DeFi investment in PancakeSwap is promising. In the fast-growing crypto industry, PancakeSwap is the second-most active decentralized exchange by trade volume after Uniswap. This protocol is one of the largest DeFi protocols due to its high TVL. Recently, PancakeSwap has integrated Chainlink as well to boost its Prediction Markets.

By offering accurate and current data with the help of Chainlink, PancakeSwap hopes to create an efficient, fair, and transparent prediction market.#ARB #LINKhttps://t.co/mzgUVS2xyl

— Blockchain Reporter (@blockchainrptr) January 24, 2024

PancakeSwap specializes in easy, affordable transactions. The network competes with Ethereum due to its low costs. The lower prices improve usability, especially for small transactions that competitive platforms would discourage.

DeFi investors should stake in PancakeSwap because it’s simple and effective. Optimized staking takes minutes. Offering APRs for all pools makes PancakeSwap stand out for transparent staking. Openness aids investors in seeking clarity and informed decisions. Many pools and farms draw investors to the platform. PancakeSwap offers numerous stake pools for BEP20 tokens.

These benefits must be weighed against PancakeSwap’s DeFi investing risks. Decentralized finance (DeFi) is still evolving and unpredictable. Despite PancakeSwap’s success, investors should analyze their risk tolerance and prepare for DeFi market volatility. If PancakeSwap seems like a promising investment, be cautious because decentralized finance is always changing.

PancakeSwap Review: Token Swapping

Token swaps on PancakeSwap are easy to start by attaching a BEP-20 wallet. Before a token swap, you must hold the tokens. Participating in liquidity pools gives users Liquidity Provider (LP) tokens. The “Add Liquidity” button in this interface lets you add your digital assets to PancakeSwap’s liquidity pools. By choosing this option, you allocate your tokens to the liquidity pool and receive LP tokens for your assets. LP coins indicate your liquidity pool ownership.

With LP tokens, you can trade them on PancakeSwap. Find the sidebar exchange button in Trade. Select the token pair for your deal after clicking exchange. This method requires you to choose a token from your holdings to trade and another token to receive.

PancakeSwap’s simple interface makes switching token pairs easy, ensuring a smooth trading experience. After selecting tokens to trade, the platform displays the exchange rate and other information. Users can specify the trade quantity, and PancakeSwap will estimate the tokens.

Bottom Line

To conclude, Binance Smart Chain exchange PancakeSwap emphasizes BEP-20 tokens and modifies cryptocurrency trading using AMM. PancakeSwap optimizes liquidity pools for efficiency and usability without order books or centralization. Yield farming and the lottery make decentralized finance (DeFi) dynamic. In volatile, decentralized finance, PancakeSwap is dependable and user-friendly. It uses CAKE, its native coin, for slippage tolerance, rewards, and stakes.

FAQ

What is PancakeSwap?

PancakeSwap is a decentralized exchange built on the Binance Smart Chain, offering users a platform to trade BEP-20 tokens. It utilizes an Automated Market Maker (AMM) model to facilitate trades directly from liquidity pools without the need for traditional order books or centralized authorities.

How does PancakeSwap work?

Users contribute to liquidity pools by depositing pairs of tokens, which then allows them to trade using these pools. PancakeSwap offers features like yield farming, where users can stake the platform’s native token, CAKE, to earn rewards, and a lottery system for additional engagement.

What is Slippage Tolerance on PancakeSwap?

Slippage tolerance is a feature that allows users to set the maximum price change they are willing to accept for their transaction to go through. This helps manage the impact of market volatility on trades.

What is PancakeSwap V2?

PancakeSwap V2 is an updated version of the original PancakeSwap decentralized exchange. It introduces several improvements and new features aimed at enhancing user experience, security, and efficiency. Key upgrades include a more flexible and efficient AMM model, improved liquidity pools that offer better rates and less slippage for traders, and the introduction of new financial products and options. The V2 upgrade is part of PancakeSwap’s ongoing efforts to stay competitive and address the evolving needs of the DeFi community.

What is PancakeSwap Crypto?

PancakeSwap Crypto refers to CAKE, the native cryptocurrency token of the PancakeSwap platform. CAKE is a BEP-20 standard token that serves multiple purposes within the ecosystem, including governance, staking, and participation in various DeFi activities like yield farming and liquidity provision. Holders of CAKE can vote on governance proposals, stake their tokens to earn rewards, and use CAKE to enter the platform’s lottery for a chance to win additional tokens. The CAKE token plays a central role in incentivizing participation and facilitating the decentralized finance activities on PancakeSwap.