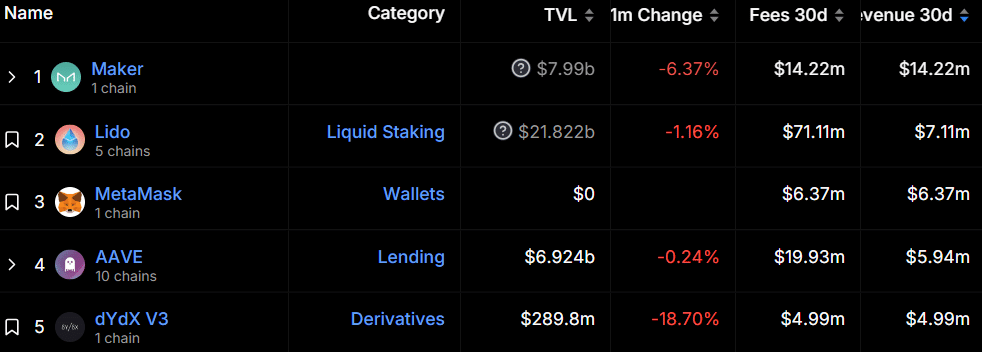

Maker Protocol tops the list in terms of revenue generated over the past month as Total Value Locked in the protocol witnesses swell.

According to data provided by Defi Llama, Maker Protocol generated $14.22 million in revenue — also collected the same amount in fees — in the past 30 days. However, The DAI stablecoin generator’s TVL witnessed a 6.3% decline in the same timeframe, falling to $7.98 billion.

The leading defi protocol, Lido Finance, with a $21.8 billion TVL, accumulated $71.11 million in fees, per the data aggregator. The liquid staking protocol generated $7.11 million in revenue, 50% less than the Maker Protocol.

Moreover, the decentralized wallet platform, MetaMask, comes third with $6.37 million generated in revenue and fees over the past month. Interestingly, the amount of MetaMask’s monthly average fees over the past year is $60.31 million, showing an 89.5% plunge in January.

You might also like: Ripple Labs transfers 27.7 million XRP tokens to Bitstamp

The leading lending protocol, Aave, witnessed a 0.16% rise in its TVL over the past 30 days, currently hovering around $6.91 billion with $19.93 million collected in fees. Per Defi Llama, Aave generated $5.94 million in revenue.

On Jan. 18, Aave Labs, the company behind the defi protocol, proposed a new governance plan to integrate the GHO stablecoin across different blockchains which could potentially increase the asset’s utility and liquidity.

The popular decentralized exchange (DEX) dYdX made it to this list despite an 18.46% decline in its TVL over the past 30 days — dropping to $289.6 million. According to Defi Llama, the DEX generated $4.99 million in revenue in January.

It’s important to note that the Ethereum blockchain tops the chart with a $171.52 million revenue in the past 30 days. Per the data aggregator, Ethereum’s monthly average revenue over the past year stands at $119.89 million — showing a 43.1% increase this month.

The global defi TVL has also been constantly increasing over the past week — rising from $54 billion on Jan. 23 to $58 billion at the time of writing. The surge comes as the crypto market gains momentum after two weeks of constant declines that came after the Bitcoin ($BTC) ETF approvals.

Read more: Bitcoin back at $43k, BlackRock’s $BTC ETF volume closes in on GBTC