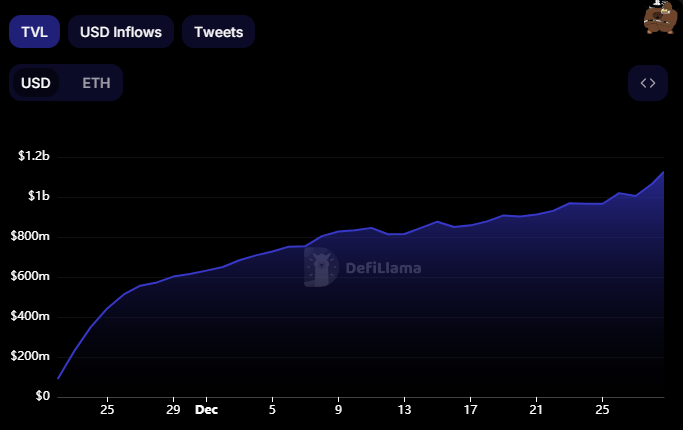

Blast, the upcoming layer 2 blockchain developed by the minds behind the $NFT platform Blur, has amassed over $1.12 billion in deposits despite being months away from its official launch in February.

According to DefiLlama, speculators have deposited $1 billion of staked ether (stETH) and $103 million of dai (DAI) in anticipation of an airdrop scheduled for May.

The platform, which only recently went live, offers depositors a lucrative 5% yield on staked assets, accompanied by "Blast Points" that can be redeemed during the promised May airdrop. This swift accumulation of deposits has raised eyebrows within the crypto community.

Critics Voice Concerns

Led in part by Tieshun “Pacman” Roquerre, a co-founder of Blur, the largest $NFT marketplace, Blast aims to replicate Blur's success by rewarding users for depositing crypto, primarily staked Ethereum ($ETH) and stablecoins. The platform operates as a layer-2 scaling network on Ethereum, competing with others like Arbitrum and Optimism.

The practice of allowing deposits on a platform yet to go live has sparked criticism, with some comparing it to a pyramid scheme.

squad goals @Blast_L2 🫡☪️

— kook ☪️ (@KookCapitalLLC) November 21, 2023

JOIN US: https://t.co/4koYHgg9Pd pic.twitter.com/poDIGSuBIw

Critics argue that early depositors and affiliate marketers may disproportionately benefit from the eventual airdrop. Even Paradigm, a backer of Blast, expressed reservations, with Head of Research and General Partner Dan Robinson stating that the marketing campaign "crossed lines."

The Catch and Future Plans

Investors are unable to withdraw their assets until Blast's bridge launches in February. The platform, pledging returns through staking and trading real-world assets (RWAs), advertises annual interest rates of 4% for $ETH and 5% for stablecoins.

Blast, however, faces skepticism regarding the meaningful influx of new liquidity, with some suggesting that funds are merely shifting within existing L2 or Ethereum Virtual Machine protocols.

Despite reservations, Paradigm expressed excitement about several aspects of Blur. The venture capitalist firm acknowledged the controversy surrounding the marketing approach but remains optimistic about the project's potential.

However, Blast’s rapid rise, despite skepticism, reinforces the current wave of optimism in the crypto market. During the past year, Bitcoin has risen 150% to $43,100, while Ethereum has doubled to $2,400, making it easier for ambitious projects like Blast to gain traction.

bsc.news

bsc.news