The total value of assets locked on Cardano-based DeFi protocols has surpassed $400 million for the first time ever.

The Cardano DeFi ecosystem has had a year to remember. DeFi protocols on the layer-1 network have attracted significant capital, increasing their TVL by more than six times compared to the start of the year.

The TVL metric measures the value of tokens locked across different protocols built on a blockchain. While Cardano has received its fair criticism for not enabling DeFi for several years, the network has gained momentum in recent times.

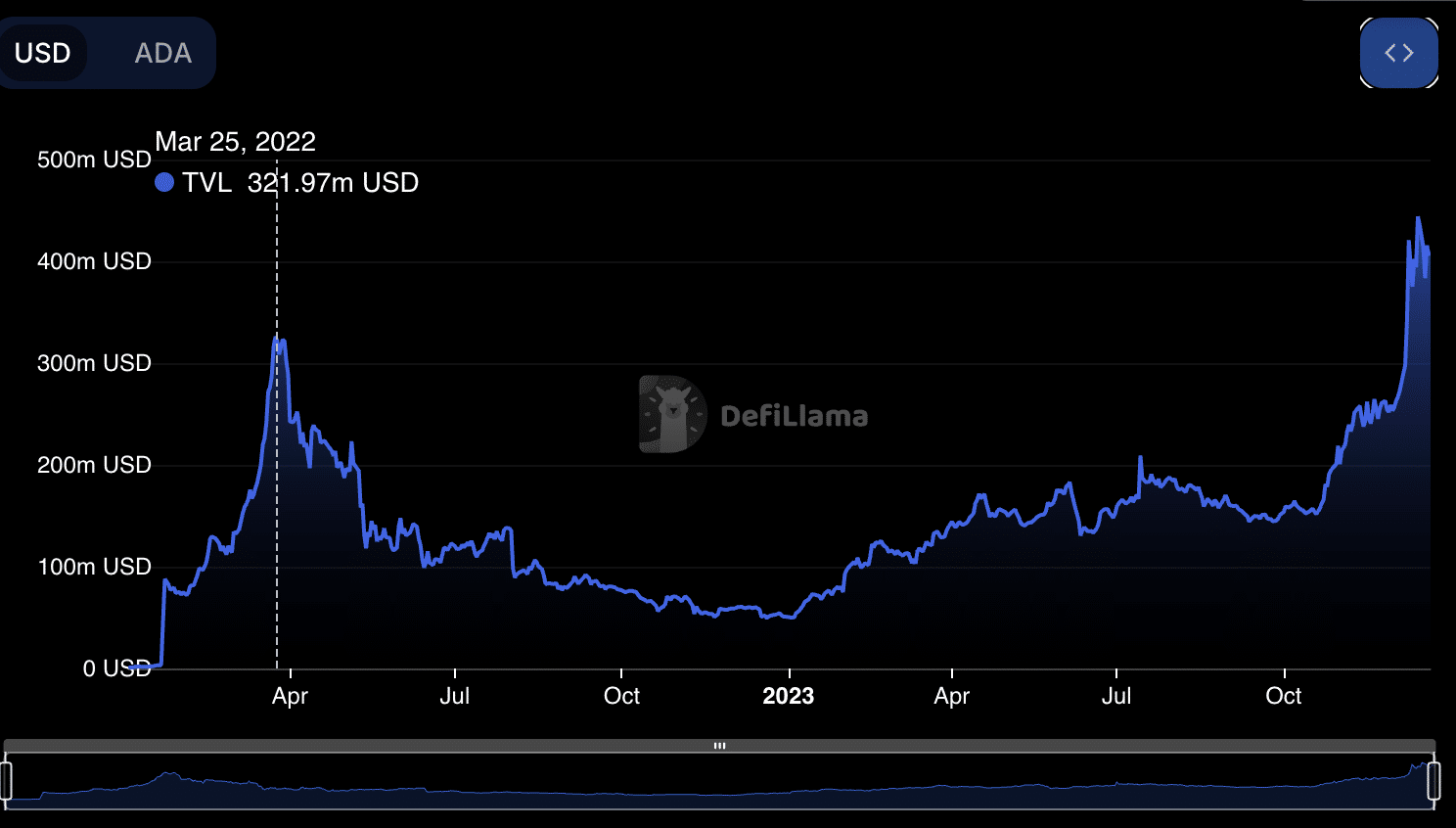

TVL on the network stood at a mere $50 million in January. However, the network’s TVL recently broke and stayed above the $400 million mark for the first ever.

As the above chart reveals, the new high beats the previous record of $322 million, which the network posted in March 2022, four months after the crypto market peaked in late 2021. Since then, the Cardano DeFi ecosystem has caught the eye.

First, TVL on the chain experienced a downtrend that mirrored broader crypto market action in 2022. Thereafter, a V-shaped recovery followed, with the most gains coming this month as TVL jumped from around $250 million to the current record above $400 million.

The leading destinations for DeFi users on Cardano include synthetic asset protocol, Indigo, and decentralized exchange Minswap. Indigo and Minswap account for $200 million of the total TVL and have gained over 50% in the past month.

$ADA Gains 137% Amid DeFi Growth

It is notable that the surge in TVL on Cardano has had a corresponding effect on the native $ADA coin, albeit at a different rate. Since the start of January, $ADA has gained 137%, helping it maintain a position among the top ten cryptocurrencies by market capitalization.

$ADA trades at $0.64 at the time of writing, with a $21 billion market cap. It is ranked as the eighth largest crypto asset, with a $5 billion advantage over Avalanche (AVAX) and a further $8 billion over Dogecoin (DOGE).

thecryptobasic.com

thecryptobasic.com