The total value locked (TVL) of Solana's DeFi ecosystem more than tripled in the last two months. Inspired by $JTO payouts, airdrop farmers set one record after another. Their potential "targets" are surpassing heavyweight Ethereum (ETH) DEXes in crucial metrics.

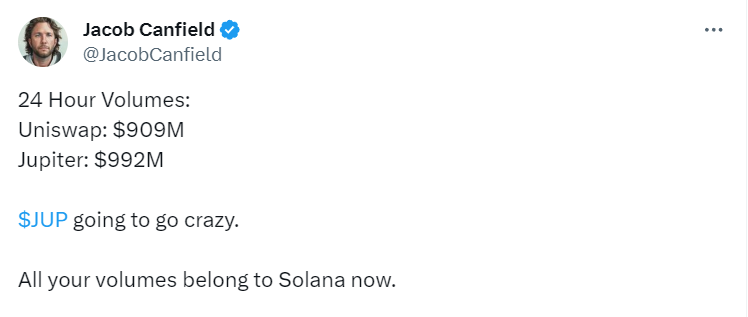

Solana's Jupiter shows larger 24h volume than Uniswap, Jacob Canfield says

Jupiter ($JUP), a decentralized finance (DeFi) aggregator on the Solana ($SOL) blockchain, processed larger trading volumes that Uniswap ($UNI), the most popular Ethereum DEX. Jupiter ($JUP) almost reached $1 billion in aggregated daily volume, as noticed by trader and analyst Jacob Canfield.

$UNI) by trading volume">

$UNI) by trading volume">Meanwhile, Ethereum's heavyweight Uniswap ($UNI) only registered $909 million in equivalent.

The interest in Solana's DeFi is catalyzed by the potential participants in Jupiter's $JUP airdrop that is set to happen next January. As per the announcement of its anonymous founder, 50% of the $JUP supply will be distributed between community enthusiasts.

A total of 10% of $JUP will be allocated for contributor support and grant programs, while 40% will be shared between the airdrop participants.

The token distribution will be organized in four phases. The team does not plan to hold more token sale rounds, so, the $JUP airdrop is the only mainstream opportunity to get $JUP allocations early.

Commentators on the statement of Canfield stressed that the trading volume spike on Jupiter might be short-lived and driven solely by the euphoria around the upcoming airdrop prospects.

Solana ($SOL) is in focus for airdrop farmers

Earlier, Canfield forecast that the interest in Solana ($SOL) airdrops will drive the price of its main asset $SOL higher, since every airdrop farmer needs $SOL for their strategy.

As covered by U.Today previously, the Jito Network ($JTO) airdrop excited farmers with generous rewards.

Solana's DeFi ecosystem is on fire in Q4, 2023: The aggregated volume of liquidity locked in various protocols soared from $315 million to $1.064 billion in the last two months.

Besides Jupiter's $JUP, Solana-focused retro airdrop farmers are tracking MarginFi, Zeta Markets and Drift Protocol, large-scale DeFis on the blockchain.

u.today

u.today