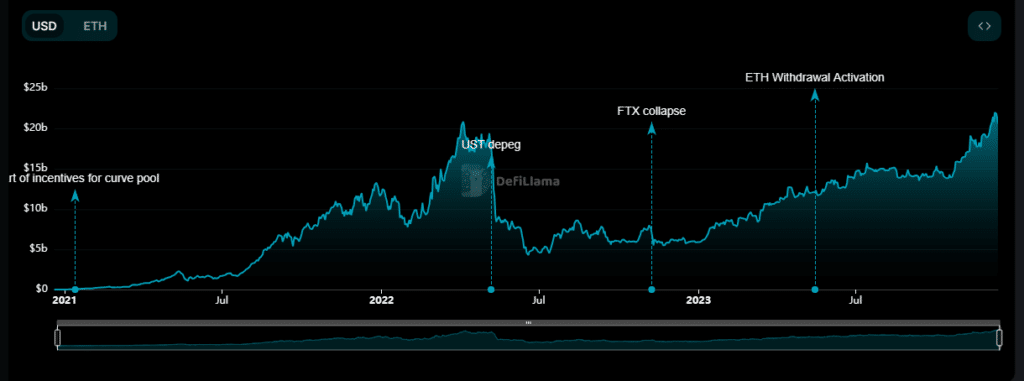

Leading decentralized staking solution Lido’s TVL has reached an all-time high of nearly $22 billion today.

This growth is attributed to an increase in net $ETH deposits and a rise in $ETH price, resulting in an 18% upswing in TVL. Additionally, Lido reached over 200,000 first-time $ETH stakers, and its stETH, including wstETH, saw a 10.34% growth in defi ecosystems, totaling 3.52 million stETH.

The governance aspect of Lido has also seen notable developments, with successful Snapshot votes endorsing proposals related to the wstETH bridge components and the Simple DVT staking module. The advancements are pivotal in enhancing Lido’s functionality and user experience.

Additionally, Lido has expanded its presence in the defi space through strategic integrations and partnerships. Notably, it has integrated with Aave V3 on Base and gained listings on the Hashkey Exchange. These steps bolster Lido’s market position and extend its reach and accessibility to a wider audience in the decentralized finance sector.

As Lido’s dominance in the defi market continues, there have been significant concerns about the protocol controlling too much liquid staking. For context, the TVL of the entire defi market is $50.5 billion and nearly half of it belongs to Lido. Despite such concerns, the platform continues to be the primary choice for liquid tokens in the market.

Read more: Experts: Final lap before spot Bitcoin ETF in play