In addition to portfolio management, Jellyverse will feature JellySwap, a decentralized exchange that will serve as home to its native crypto JLY.

Jelly Labs AG and Fintonomy LTD, the companies developing the initial protocols for Jellyverse, a decentralized finance network built on the Ethereum Virtual Machine (EVM)-compatible layer-2 DeFiMetaChain (DMC), have announced the completion of their joint seed funding round.

According to a press release shared with Coinspeaker, the two companies secured $2 million from undisclosed investors to bolster the development of Jellyverse and drive the evolution of the next phase in the DeFi ecosystem – DeFi 3.0.

Jellyverse to Provide Portfolio Management Services

Both Jelly Labs AG and Fintonomy LTD have been diligently working on a groundbreaking solution to connect real-world price feeds – especially those related to traditional assets like securities and commodities – with decentralized finance applications. The companies aim to address these challenges in the market with Jellyverse.

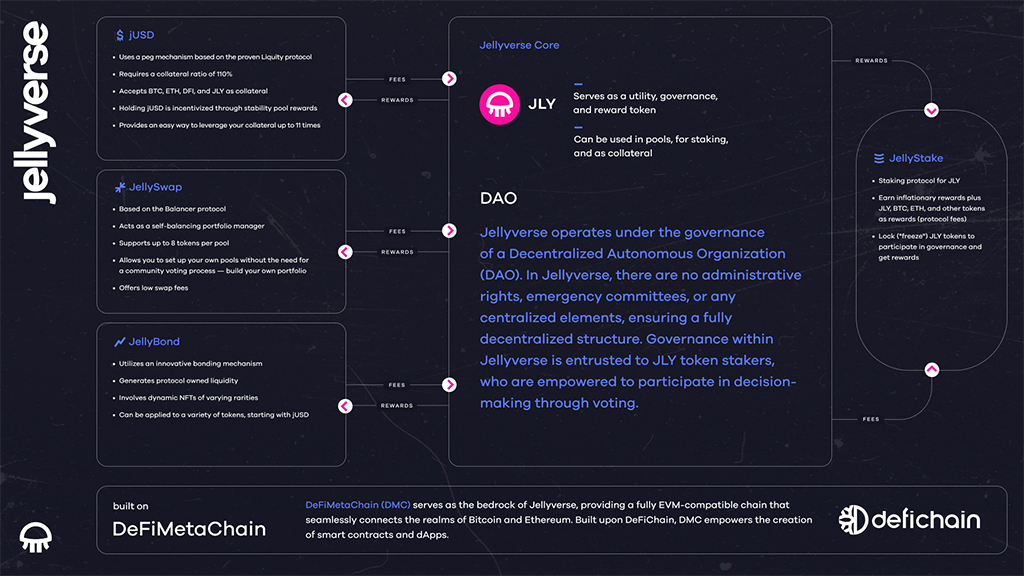

According to the release, the protocol initiated by the team behind the development of DeFiChain Accelerator will be fully developed and governed through an on-chain decentralized autonomous organization (DAO). Upon completion, users can expect a suite of groundbreaking products, including decentralized portfolio management services, bonds, lending, and more sophisticated staking alternatives.

“Jellyverse merges the pinnacle of past DeFi achievements with a fresh perspective. We present decentralized assets that pioneer a novel way to diversify your crypto portfolio, complemented by self-balancing multi-token pools,” said Santiago Sabater, the Co-Initiator of Jellyverse.

The portfolio management feature will introduce tokens designed to track real-world price feeds, empowering investors to create complex portfolios comprising multiple assets while earning yields.

Innovative Features of Jellyverse

In addition to portfolio management, Jellyverse will feature JellySwap, a decentralized exchange (DEX) that will serve as home to its native crypto JLY. The DEX will be designed with extended functionalities to operate as a non-custodial portfolio manager and liquidity provider.

Users can also stake their favorite crypto assets in JellyStake, including JLY tokens, to receive additional incentives, including rewards and increased voting power.

Upon launch, Jellyverse will debut with a stablecoin dubbed jUSD based on the “rigorously tested and proven stability mechanisms from LUSD by Liquidity protocol”. According to the press release, users can borrow jUSD against DFI, dETH, JLY, and other cryptocurrencies.

The Jellyverse ecosystem will also feature jAssets, user-generated tokens backed by digital assets that reflect the prices of stocks, commodities, or ETFs through real-time price feeds. The offering will allow users to explore the traditional financial markets indirectly to expand their crypto portfolio.

Jelly Labs AG and Fintonomy LTD said the product offering will be developed alongside a community team and integrated into the Jellyverse ecosystem through a future governance approval.

Another interesting feature to be added to the Jellyverse network is dubbed JellyBond. According to the release, the protocol will introduce the first bonding mechanism to the DeFiChain, offering amplified yield to token holders and generating protocol-owned liquidity at the same time.

coinspeaker.com

coinspeaker.com