Today, Hashflow, a leading multichain trading platform in the decentralized finance landscape, announced that it will be enabling fees, in echo of its community governance vote in mid-October, which was approved with near unanimous verdict.

The implementation of fees on Hashflow will constitute the first revenue stream applied by the platform and will be dynamic in nature, dependent on the particular asset pair being traded. The fee will be “baked directly into the price quote, paid automatically when the trade is executed”.

According to Varun Kumar, co-founder and CEO of Hashflow, “We are pleased to announce that Hashflow will be turning on trading fees starting today, after the approval of the proposal via DAO governance. This is a major milestone for the protocol, which we believe will strengthen Hashflow’s position as a leading multichain decentralized exchange. By distributing fee proceeds amongst token stakers as well as the Foundation, this proposal creates a sustainable model that will benefit all stakeholders in the Hashflow ecosystem.”

Fee Distribution

Unlike recent fees imposed by competing platform, Uniswap, Hashflow’s new levy will be, in no small part, diverted towards bringing value to existing stakers of the HFT token.

According to a release shared with BSC News ahead of time, the breakdown of the fee will be as follows:

- 50%: allocated to stakers of the HFT token.

- 30%: allocated to the community treasury for use in HFT buyback initiatives.

- 20%: allocated to the Hashflow Foundation to cover operating expenses.

Hashflow Today

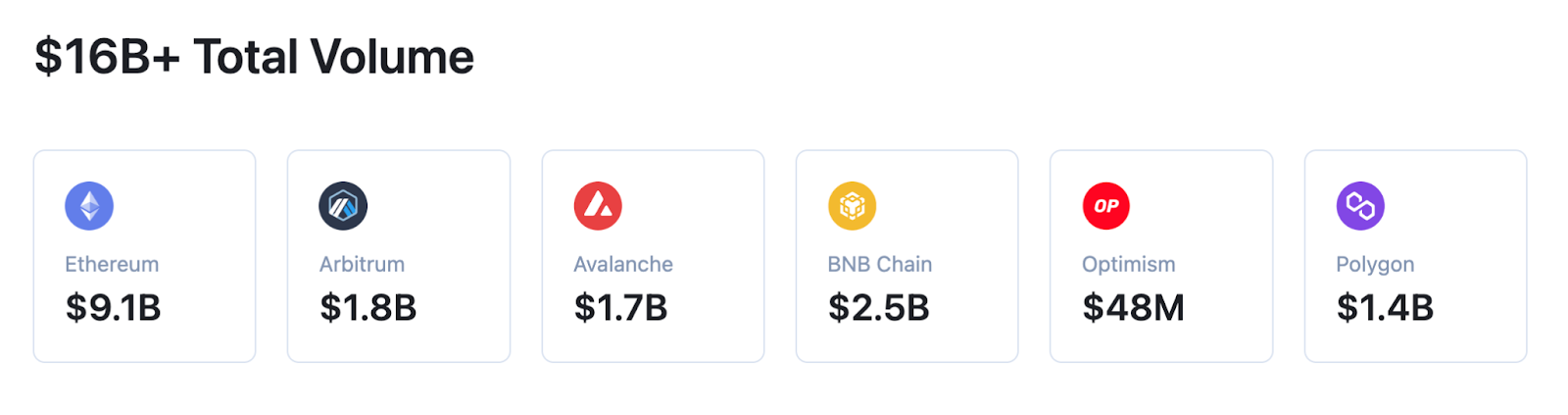

According to a release,Hashflow is a multichain decentralized exchange (DEX) that enables users to trade digital assets on leading blockchains including Ethereum, Arbitrum, Avalanche, $BNB Chain, Optimism, and Polygon in just a matter of seconds. Unlike AMMs, Hashflow leverages a request for quote (RFQ) model to provide traders with guaranteed price quotes directly from professional market makers (PMM), eliminating inefficiencies prevalent in decentralized finance (DeFi) including slippage and MEV.

According to Hashflow’s website, the platform has already seen some $16 billion in trading volume, across prominent networks such as Ethereum, $BNB Chain, and Arbitrum.

bsc.news

bsc.news