Decentralized finance (DeFi) platform Ergo has decried the $5,000 fee CoinMarketCap (CMC) is demanding to update the circulating supply of the Ergo (ERG) token. It argues that CoinMarketCap’s six-step data vetting process is far more complicated than its competitor CoinGecko.

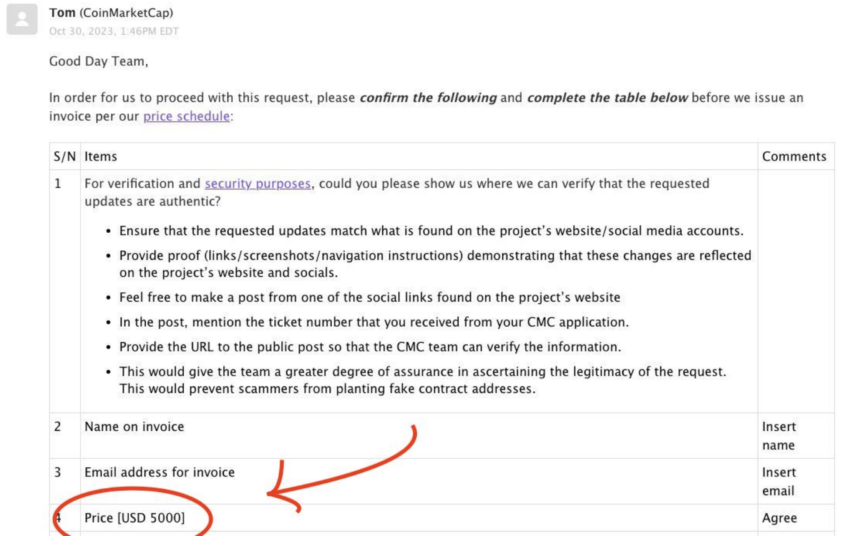

CoinMarketCap asked Ergo to create a social media post to allow CMC to check that the requested data changes have been posted to the project’s website. The post would need to contain the CMC ticket number.

Ergo Says Cost of Verification is Too High

CMC told Ergo it needed the information to invoice Ergo for the requested update. A successful verification would attract a $5,000 fee before CMC updates the circulating supply.

Ergo suggested that the high fees could discourage regular updating of the data. This, in turn, could mean much of the information CMC hosts as irrelevant.

“It begs the question… how much overall data is out of sync on CMC for projects that refuse to pay these hostage fees? Data integrity issues are not a good look for #CMC considering accuracy is their product. Let’s get this cleaned up!”

Founded in 2013 by a New York programmer, CMC offers cryptocurrency metrics like prices, trade volumes, and market capitalization. The platform was acquired by crypto exchange Binance in 2020 for a reported $400 million fee.

Read more: What Is Market Capitalization? Why Is It Important in Crypto?

CoinMarketCap Attracted Scrutiny

A listing on the platform can mean the difference between the successes and failures of smaller altcoins. CMC has attracted criticism for its alleged opaque listing criteria and its outsized role in retail trading and links to crypto exchanges.

Read more: 10 Best P2P Crypto Exchanges You Need To Know About in 2023

CMC competitor CoinGecko, founded a year later, claims to independently source and aggregate cryptocurrency data and charges a fee for an ad-free trader experience. The website claims its independent aggregation and application programming interface is superior to the free API exchanges offer developers.

This is because, even if verified, an asset price from an exchange will only reflect the activity in that exchange’s order book. CMC hadn’t responded to the Ergo inquiry at press time.

beincrypto.com

beincrypto.com