Uniswap DAO, a major player in decentralized finance (DeFi) world, has shown significant support for a proposal to invest a substantial amount of its treasury funds into Ekubo, a decentralized exchange (DEX) operating on Ethereum’ Starknet network.

The proposal suggests investing 3 million $UNI tokens, equivalent to $12 million, in Ekubo in exchange for a 20% share in a future governance token that the project plans to launch, The Block reported on Sunday.

In the proposal, Moody Salem, the founder of Ekubo, said he sees the investment as a “vitally important step” toward decentralizing Uniswap’s protocol development by incorporating the Ekubo team as core developers.

This sentiment resonated with a significant portion of the Uniswap community.

The preliminary vote on the Snapshot platform indicated that 63% of participating tokens were in favor of the proposal, with 21 million $UNI tokens supporting it against 12 million opposed.

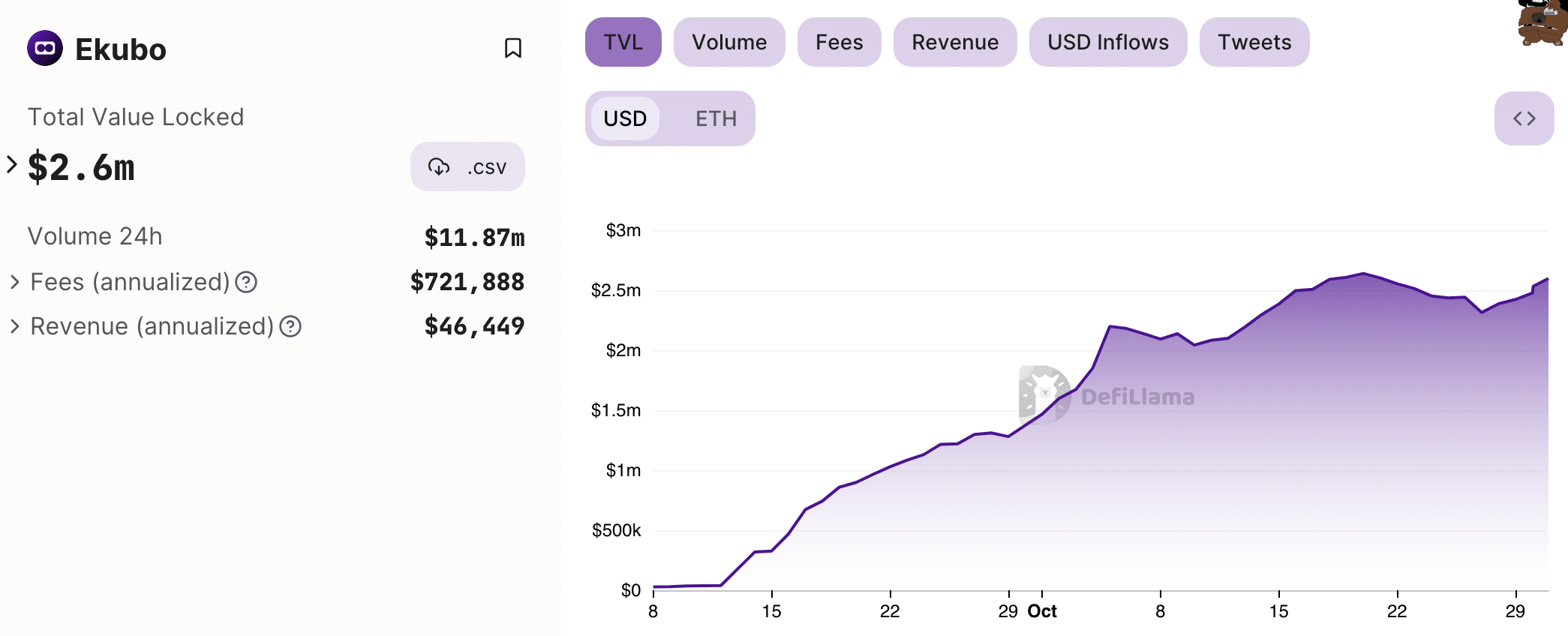

Strong growth in TVL

Ekubo, operating as a decentralized exchange on Starknet, currently boasts $2.6 million in total value locked (TVL) within its smart contracts, according to DefiLlama.

The protocol has seen significant and consistent growth in TVL since its humble beginnings in September this year.

If the proposal proceeds through the necessary voting stages, the 3 million $UNI tokens allocated for the investment will serve to fund Ekubo’s operations and contribute to the Uniswap protocol.

Ekubo has stated that it aims to create a governance token within a month of proposal approval, with 20% of the token supply dedicated to the Uniswap DAO treasury.

Uniswap, in return, will update its license to grant Ekubo unlimited use of Uniswap v4.

Despite the support for the proposal, it has faced opposition, with some members of the Uniswap community expressing concerns about governance, accountability, and valuation.

cryptonews.com

cryptonews.com