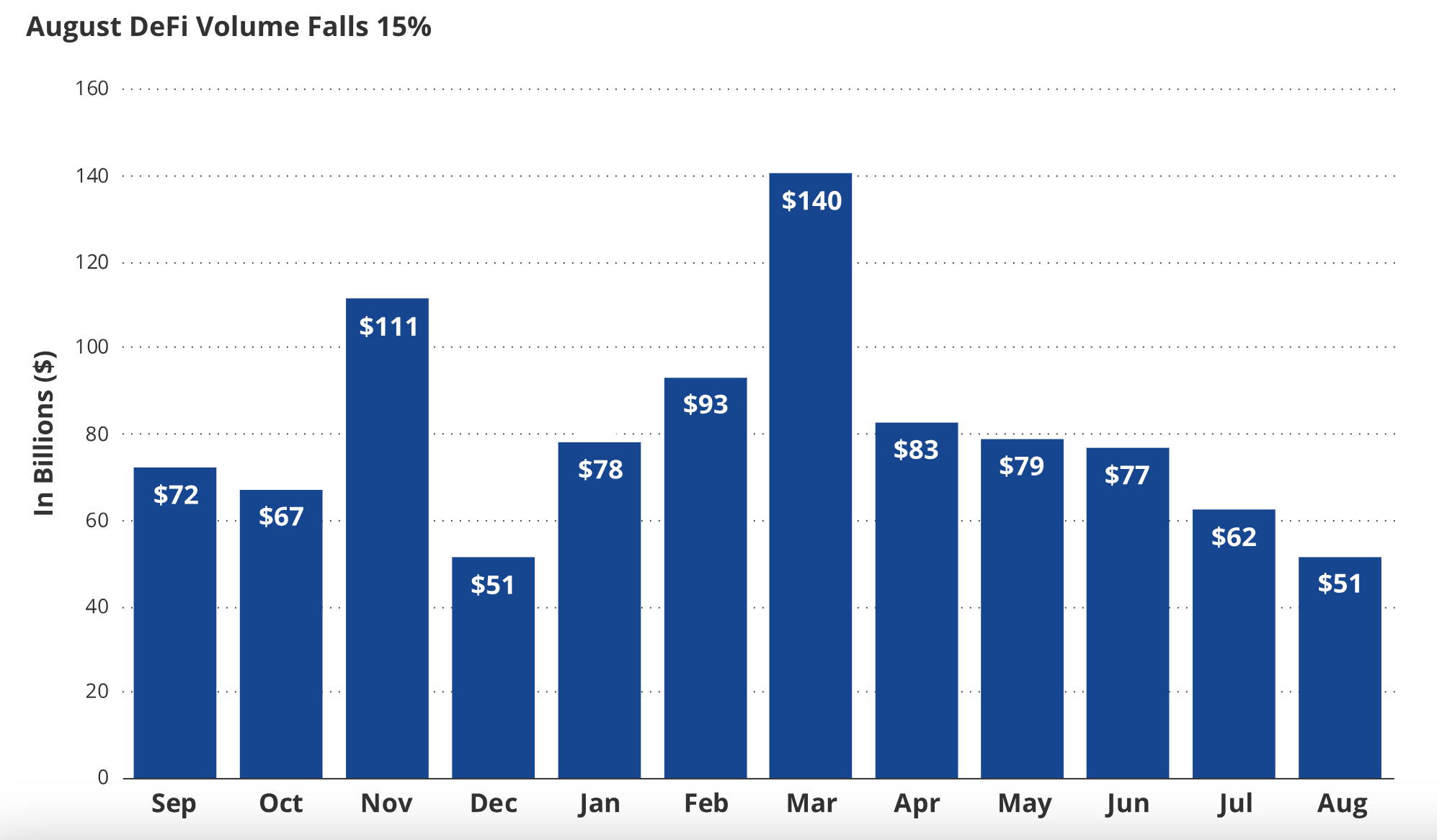

In the decentralized finance ecosystem, the number of users of DeFi experienced a greater decline in August compared to previous months. Following this development, according to on-chain data analysis by investment manager VanEck, the market volume in the DeFi sector decreased by 15.5% in August compared to July, reaching $52.8 billion. The total locked value (TVL) decreased by 8% in August, reaching $37.5 billion, but the DeFi ecosystem continued to experience positive developments.

Worst Performance in the Last 8 Months

These data are based on the MarketVector Decentralized Finance Leaders Index, which analyzes the performance of the largest and most valuable crypto assets in DeFi protocols, including Uniswap, Lido DAO, Maker, THORChain, and Curve DAO, according to investment manager VanEck.

According to VanEck’s data, the DeFi index fell by 21% in August, performing below the earnings data of Bitcoin and Ethereum. This situation worsened especially due to the 33.5% decrease in the value of $UNI as a result of $UNI selling tokens to catch up with the gains in July.

The total locked value (TVL), an important data for the DeFi sector that ecosystem users closely follow, experienced an 8% decrease in August, dropping from $40.8 billion to $37.5 billion. This development was considered a better performance compared to Ethereum’s 10% decline in August.

Notable Detail in the Report

The report also emphasized that although DeFi tokens experienced a loss in value in August, the ecosystem witnessed significant positive developments throughout the month. The report included Uniswap Labs rejecting a lawsuit and the growth rates of DeFi protocols Maker and Curve.

Curve Finance suffered a major attack in July, causing a shock to the entire DeFi ecosystem. However, no user was harmed as the attacker returned the seized assets. In August, Curve experienced significant growth and reached its all-time high TVL level of $114 million. The protocol’s stablecoin, CrvUSD, is a token pegged to the US dollar and is based on a collateralized debt position (CDP) model. With this model, users can use their Ethereum assets as collateral to acquire crvUSD.