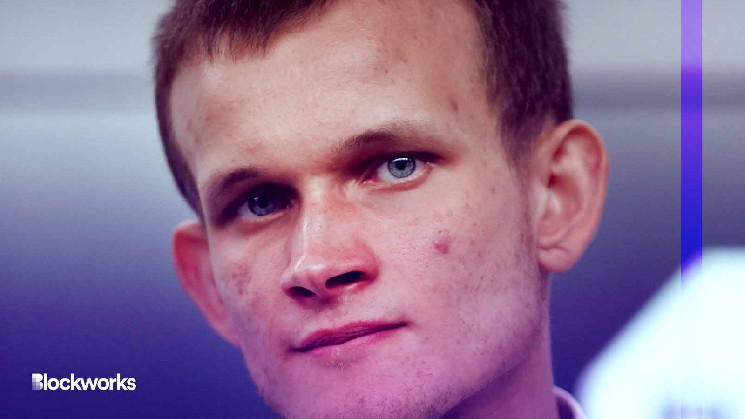

On the final day of Blockwork’s Permissionless II conference, Vitalik Buterin told a packed audience that builders seeking a niche might consider developing a new type of enterprise blockchain based on Ethereum.

The Ethereum co-founder remarked on the progress made towards adoption of account abstraction, particularly by teams in East Asia building wallet software — part of a growth trend he sees in engineering talent in the region.

“I remember five years ago, it definitely felt like East Asia had great exchanges and great mining, but very little contribution to the dev and research side,” Buterin said. “And I feel like that has really massively flipped, which is interesting.”

“Asia is back,” he added, noting “a deep community and technical involvement” that exceeds pre-COVID times.

Opportunities to build

Buterin emphasized the ongoing need for software that makes it safer to transact on blockchain. As an example, he pointed to the Fire browser extension, which parses wallet signature requests into a more readable form.

“I think really going deeper into that space and building things that help users understand what the heck it is that they’re doing when they’re interacting with DeFi is probably one [opportunity].”

Today at @Permissionless, @VitalikButerin talked about Fire and the need for:

— Fire (@_joinfire) September 13, 2023

"Building things that help users understand what the heck it is that they are doing"

We couldn't agree more and there is lot more to come for Fire users with our wallet! pic.twitter.com/q0L785zaC3

He also highlighted the necessity for infrastructure that simplifies the transition from Ethereum’s mainnet to layer-2 ecosystems. Buterin cited the potential for a “Merkel proof verifier that basically lets you do full decentralized verification of ENS names on layer-2,” rather than relying on a centralized provider.

Lastly, he called for an “enterprise focused stack that encourages existing enterprises that do centralized things to instead build validiums,” a type of rollup that uses a third-party data availability layer rather than Ethereum mainnet.

Buterin recalled a period of time from 2014 to 2019 when permissioned blockchains for enterprise were all the rage, often structured as a consortium of companies.

These mostly failed, he said, because they still required most of the IT overhead costs of building and operating a blockchain, and building a community around it.

“One pattern that I saw happen over and over again is someone creates a consortium and the first five members happily join the consortium and start working together,” Buterin said. “But then members numbers 6 to 20 just never end up getting interested because they don’t want to join an ecosystem that feels like it’s already dominated by the first five members.”

Validiums are able to preserve the benefits of centralized systems, but still leverage most of the existing infrastructure built for Ethereum layer-2s.

“You are still gaining the efficiencies of keeping things centralized because you don’t have to pay any gas per transaction, and you don’t have to tell your IT people to completely rebuild the system,” he explained, but others can verify certain information in a decentralized way.

Exchanges publishing so-called “proof of solvency” — also known as proof of reserves — is a “weak” variety of this idea, Buterin added, calling it a “semi-successful enterprise blockchain use case.”

Other areas where validiums might shine in an enterprise context are gaming, social media and supply chain management, and opportunities will multiply as zero-knowledge proofs become more mainstream.

Zk proofs are “finally at the level now, where regular developers can go and build things on top of them without having to deeply understand what a polynomial is,” Buterin said.

blockworks.co

blockworks.co