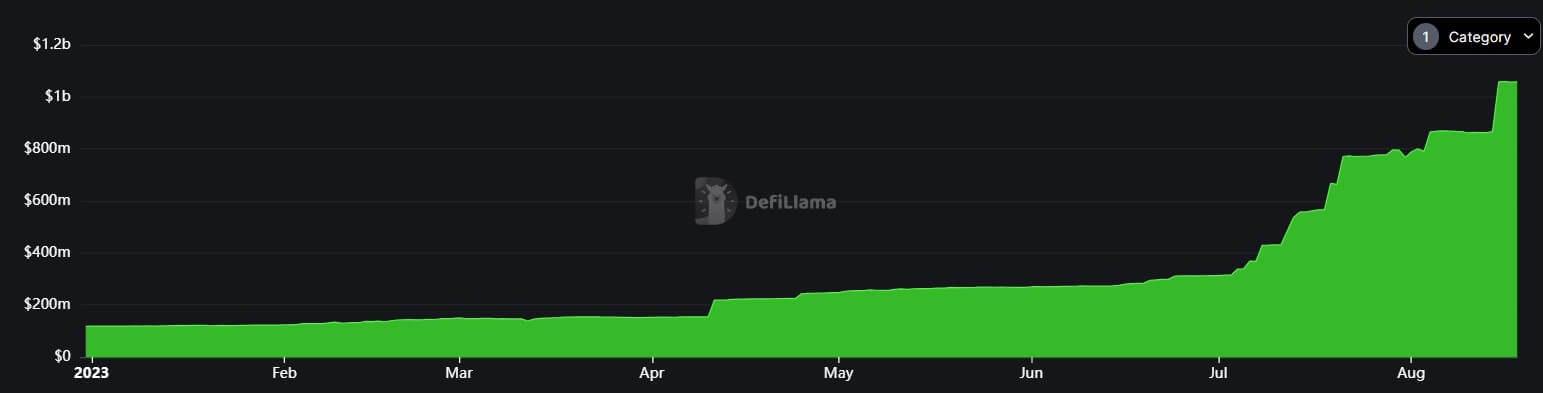

Decentralized finance (DeFi) protocols have seen a substantial decrease in the total value of assets locked (TVL) on them in recent months due to the current bearish sentiments saturating the market.

However, this decline has not impacted the Real-World Assets (RWA) subsector, which has experienced significant growth during the period, with its TVL more than doubling, according to DeFillama data.

Per the data aggregator’s dashboard, RWA’s TVL has more than tripled within the last few months to over $1 billion from the $270.29 million recorded on June 1.

According to data from DeFillama, one project, Staked Tether (stUSDT), stands out as the driving force behind the remarkable growth in this subsector.

What is stUSDT?

stUSDT is the first RWA platform on the TRON network designed to function as a money market fund.

According to its website, stUSDT is the receipt token users receive upon staking USD stablecoins on the platform. The protocol says it pays a yield of 4.21% on the stablecoin in return for investing them in real-world assets.

The protocol’s website claims partnerships with crypto projects like Tether (USDT) and Justin Sun-linked companies like HTX (formerly Huobi) and JustLend.

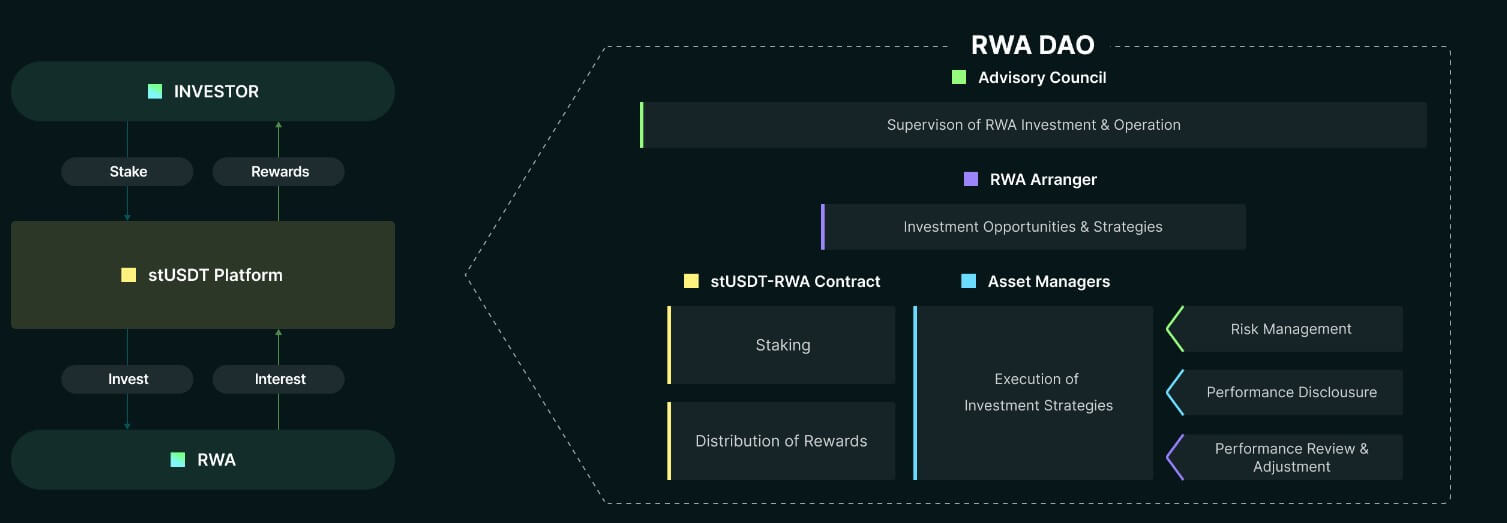

Meanwhile, stUSDT said it is governed by the Real World Asset Decentralized Autonomous Organization (RWA DAO), “offering users a transparent, fair, and secure channel for RWA investment.”

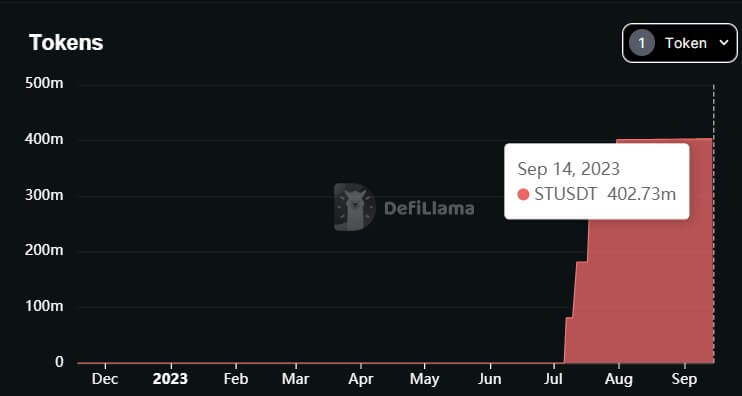

Since its launch, the project has enjoyed a meteoric rise, with its TVL gradually approaching $1 billion in less than three months. This means stUSDT accounts for more than 80% of the total value locked in RWA despite being relatively new to the market compared to rivals like Ondo Finance and others.

Nevertheless, concerns have emerged regarding the protocol, including allegations of Justin Sun utilizing it to finance his investments.

Concerns about stUSDT

stUSDT has come under scrutiny, primarily due to its governance and transparency. While the stUSDT website claims to invest in short-term government bonds, the specific details regarding the types of bonds in its portfolio remain undisclosed.

This lack of transparency, especially compared to other RWA protocols like Ondo Finance, has raised significant concerns within the crypto community. The sole source of information about the protocol’s investments has been its Daily Rebase updates on its Medium page.

Ralf Kubli, a board member at the Casper Association, told CryptoSlate that while “stUSDT is essentially positioning itself as an answer to Alipay’s “Yu’e Bao,” a money market fund product offered by Alibaba., it fails to address the underlying issues with RWAs. Kubli said:

“These current tokenization practices still fail to address the underlying issue that we’ve been talking about time and time again, i.e. ensuring that all cash flows related to the RWAs are algorithmically defined within the asset itself.

Currently, most tokenized financial products do nothing more than take a PDF of the financial contract and hash it into the token. A human still must access and read this definition and process it accordingly. This is in no way innovative and is certainly not scalable.”

Adding to the apprehension is the governance structure of the stUSDT protocol. During its launch, it was asserted that stUSDT would be governed by the RWA DAO and operated under a custody agreement with JustLend DAO.

However, CryptoSlate could not confirm any information on the RWA DAO and could not confirm the integrity of its partnership with Tether.

Besides that, on-chain data shows that a portion of stUSDT’s supply is linked to addresses controlled by Justin Sun, and further scrutiny reveals a substantial presence of stUSDT on HTX, where more than $400 million worth of the asset is domiciled, per DeFillama data.

cryptoslate.com

cryptoslate.com