The supposed future of finance is going backward.

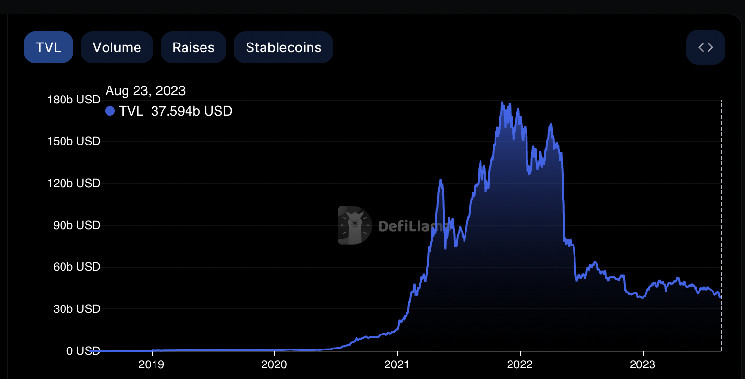

The amount of money stashed in decentralized finance, or DeFi, protocols has dwindled to the lowest level since February 2021, according to data compiled by DefiLlama. Specifically, total value locked, or TVL, has slumped to $37.5 billion, slipping below the previous post–bull market nadir of $38 billion set in December.

Proponents say DeFi will usher in a whole new way of doing finance, shifting conventional ways of moving and trading assets onto blockchains. Hype around that idea drove TVL up to a late 2021 peak of $177 billion. Then came the dramatic crash last year as crypto prices sank and scandals scared people away from the space. This year, the U.S. government's crackdown on crypto has made traditional finance players nervous about DeFi, fearful they might run afoul of regulations.

Several protocols have lost more than half of their locked value in the past month alone. Optimism-based decentralized exchange, or DEX, Velodrome has experienced a 58% decline in TVL. Balancer, one of the largest liquidity protocols, has seen its TVL drop by 35% to $641 million.

Why is DeFi decaying?

The past few days have been rough for crypto as a whole, with bitcoin (BTC) and Ethereum's ether ($ETH) – which underpins much of the DeFi market – embarking on double-digit percentage declines.

Typically, when the largest crypto assets fall, traders pull liquidity out of more speculative assets like those within DeFi to mitigate risk. That certainly played out last year, when bitcoin slumped 77% from its all-time high while several altcoins plunged by more than 95% from records.

However, DeFi has fared worse than $ETH this year. $ETH is up about 40% since December even as DeFi TVL has shrunk, suggesting DeFi's issues are specific to it, not its key token.

Some have alluded to the DeFi's sensitivity to yields on U.S. Treasuries.

"Fundamentally, it's due to U.S. Treasury yields being up and DeFi yields, which are higher risk, giving lower rewards," Doo, co-founder of StableLab and Asia Lead at MakerDAO, told CoinDesk. "When yields were increased to 8%, we saw DSR [Dai Savings Rate] deposits increase by four times."

"There is a wider issue with liquidity as well and this can be verified by looking at overall volumes of major decentralized exchanges," Doo added. "Both Curve and Uniswap see lower trading volumes, which also translate to less liquidity and also interest in the market. It also leads to yields being lower, which reinforces such."

coindesk.com

coindesk.com