The market cap of MakerDAO decentralized stablecoin $DAI has increased by almost $1 billion in the last seven days after the DeFi protocol introduced an increased interest rate to attract more users.

According to CoinMarketCap data, $DAI’s market cap increased to $5.33 billion from the $4.45 billion recorded on Aug. 6.

Growth Driven by Enhanced DSR

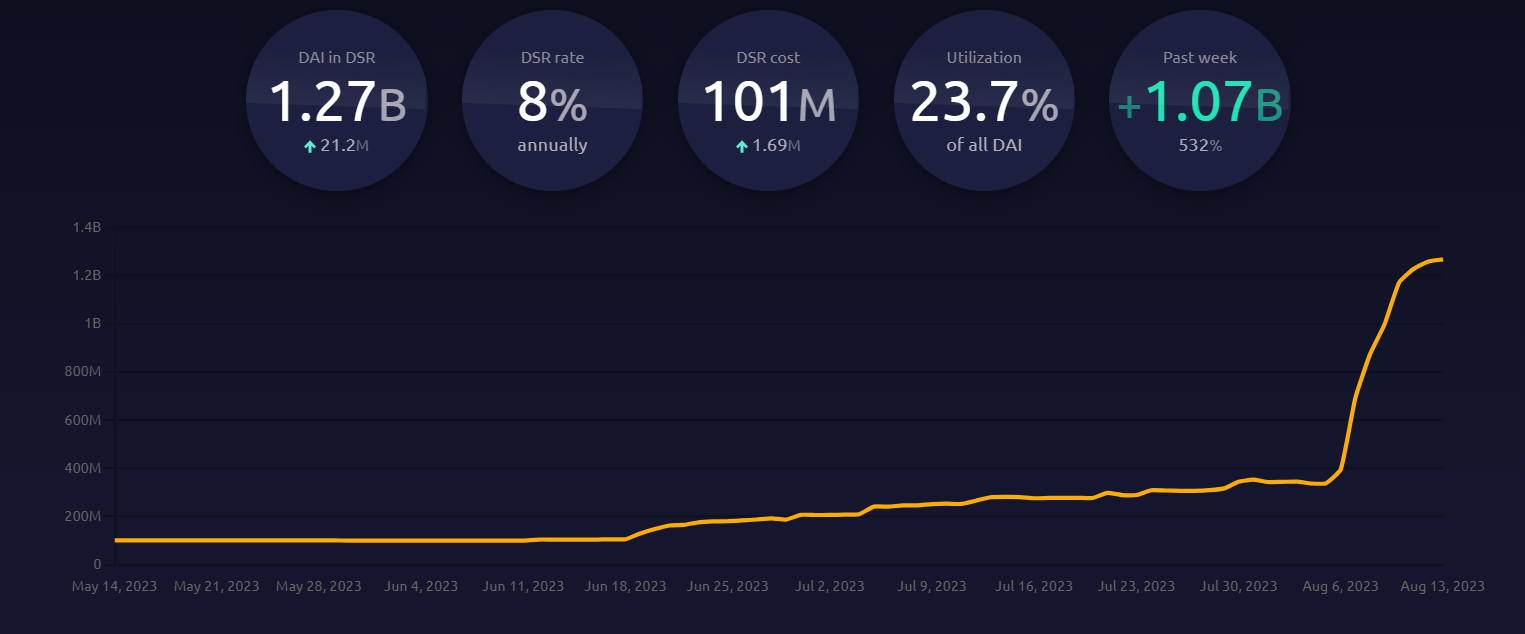

On Aug. 6, MakerDAO founder Rune Christensen revealed that $DAI’s interest rate increased to 8% to attract more holders to use the DSR mechanism at no extra risk.

The incentive immediately impacted the number of the decentralized stablecoins in the DSR contract, rising to 1.27 billion from 339.4 million recorded on Aug. 6, according to the Makerburn dashboard.

The growth is more pronounced considering the high yield rate is unavailable to U.S. residents and virtual private networks (VPN) users.

Read More: 6 Best Copy Trading Platforms in 2023

MKR’s Value Rise

Meanwhile, $DAI’s increased adoption did not positively impact MakerDao’s MKR governance token. According to BeInCrypto’s data, the digital asset slightly declined by 1.24% over the past week to $1,228.

However, it is one of the best-performing cryptocurrencies over the past month, rising by nearly 40%. This is far ahead of Bitcoin and Ethereum price performance which have been muted due to the current market conditions.

Blockchain analytical firm IntoTheBlock noted that MKR “has stood out in the current market” as it has seen strong buying activity from large MKR holders. The firm further said its price has doubled in the past three months.

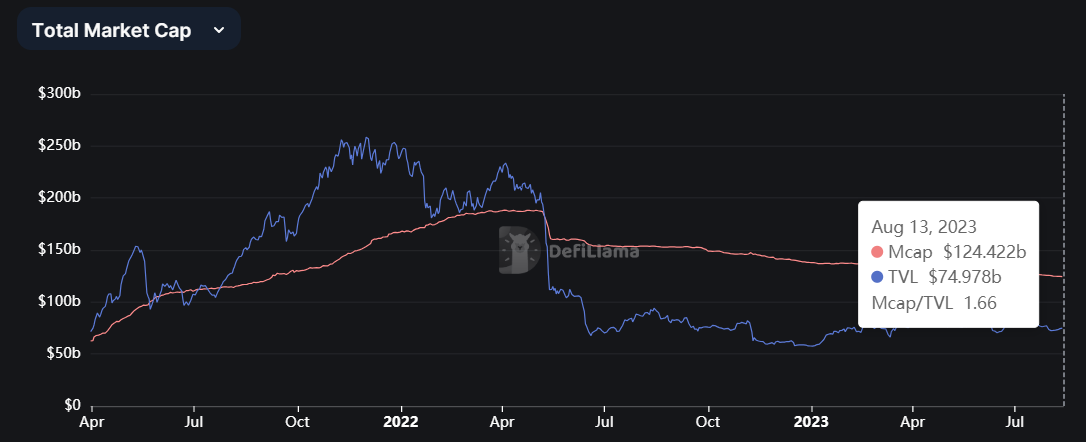

Competition Heats Up in Stablecoin Market Despite Declining Supply

Giant technological firm PayPal introduced the PYUSD stablecoin earlier in the week, increasing competition in an already saturated market.

Dominant stablecoin issuers, Tether and Circle, welcomed competition from the tech giant, hoping the move would further bolster the global adoption of stablecoins.

Meanwhile, available data shows that the stablecoins market capitalization has declined rapidly. Last month, BeInCrypto reported that the total market cap of stablecoins fell to the lowest level seen since August 2021.

beincrypto.com

beincrypto.com