Curve Finance, a stablecoin-focused decentralized exchange (DEX), became the target of a hacking attack resulting in millions of dollars in losses. This incident has led investors to shift their focus to Uniswap’s $UNI token, a rival DEX.

$UNI Funding Rate Rises to 20%

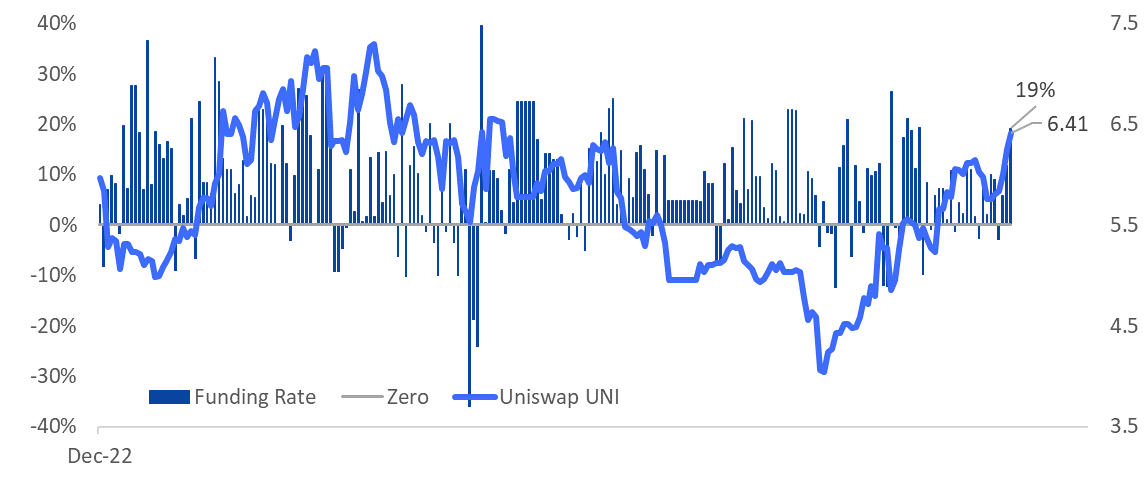

According to data tracked by crypto service provider Matrixport, the funding rate for $UNI perpetual contracts has increased to 19% on an annual basis following the hack attack.

A positive funding rate means that the perpetual contract is trading at a premium compared to the mark price, also known as the market price, or the estimated fair value of a contract. Positive rates also indicate that long positions or leveraged long positions dominate and investors are willing to pay interest on short positions to keep their positions open.

In an email sent by Markus Thielen, Research and Strategy Manager at Matrixport, he stated, “$UNI perpetual contracts are trading at approximately 20% premium as investors expect it to gain more market share following the hack attack targeting $CRV.”

Current data shows that the $UNI price has risen by 2.32% in the last 24 hours, trading at $6.49.

Investors Rush to Withdraw Their Assets from Curve Finance

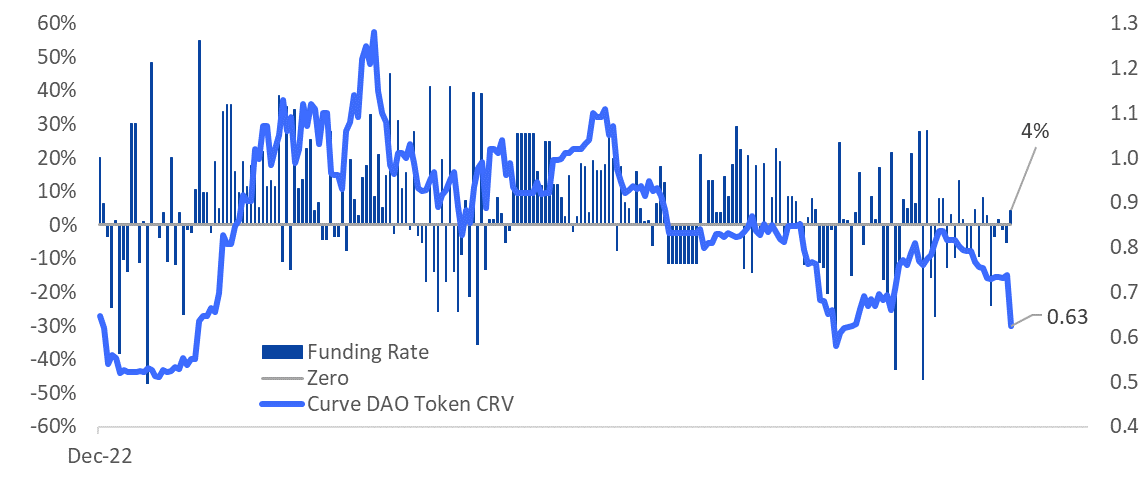

Late on July 30, Curve Finance, the third-largest DEX, fell victim to a flash loan attack, putting $100 million worth of cryptocurrencies at risk. Following the attack, the service token of Curve Finance DAO, $CRV, dropped by over 15% to $0.59. The rapid decline in the altcoin created an additional risk by threatening the liquidation of the founder’s $70 million debt position. However, the perpetual futures market currently shows no signs of panic as the funding rate in the $CRV and AAVE markets remains above zero.

Thielen said, “The perpetual contracts for $CRV are still trading with a small positive premium. This indicates that investors are more focused on moving their positions away from the DEX (in terms of TVL) rather than selling the token short.”