Executive Summary: Tron has made a name for itself as an Ethereum alternative. The blockchain platform has grown a significant user base, primarily in Asia, and has carved out a sizable portion of the DeFi market. However, it’s worth noting that the dominance of the JUST ecosystem on Tron might impact its long-term diversification and growth.

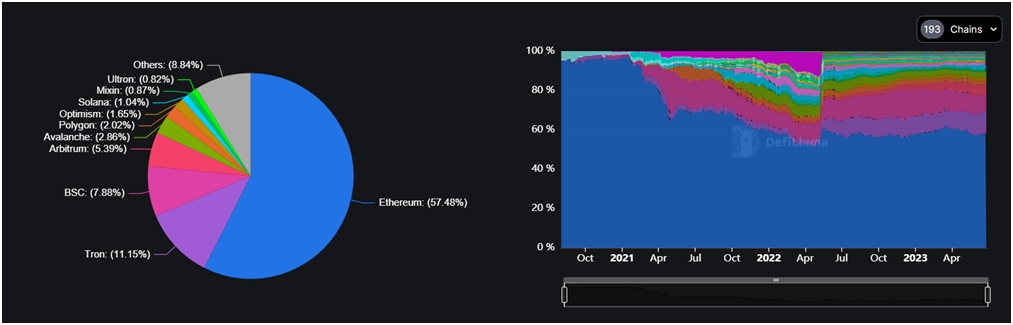

Tron, an Ethereum alternative, has caused a stir in the DeFi space, accounting for over 11% of the total value locked (TVL) in this particular industry. As of this writing, Tron’s native token, $TRX, is among the top 10 cryptocurrencies, with a market cap exceeding $7.15 billion and a YTD return of 45.5%.

The good news for crypto investors is that the growth of Tron’s investment ecosystem has been powered by its robust protocol interoperability, and may be an opportunity for individuals looking to diversify their crypto holdings.

The bad news is that we never know which crypto investments, including Tron, are here for the long haul, regardless of initial promise.

What is Tron ($TRX)?

Tron is an Ethereum alternative created in 2017 by Sun Yuchen, better known as Justin Sun.

The blockchain project has a vision of redefining the internet. With this idea, Tron has managed to gather a global network of investors and developers, although it has a primary focus on China and has often been dubbed “Asian Ethereum.”

Instead of focusing on advancements in cryptography or network design like other blockchains, Tron underscores decentralized applications (dapps), smart contracts, tokens, and delegated proof-of-stake consensus (DPoS), which were previously introduced by other projects. Tron also gained attention through its compatibility with Ethereum.

In 2018, the Tron Foundation acquired peer-to-peer networking pioneer BitTorrent, leading to the launch of a BitTorrent token (BTT) on the Tron blockchain in 2019.

Originally launched as an Ethereum-based token, Tron migrated to its own network in 2018. Tron’s architecture consists of three layers:

- The Core Layer that computes instructions;

- The Application Layer for wallet and dapp creation;

- The Storage Layer for data segmentation.

Tron uses a Decentralized Proof of Stake (DPoS) consensus mechanism where 27 rotating “super representatives” validate transactions and maintain the system’s history. Tron users can participate in the consensus system by staking $TRX, which gives them Tron Power and voting rights. $TRX is also essential for utilizing dapps on the Tron network and participating in the protocol’s operations. TRON 4.0, launched in 2020, introduced privacy protocols, TRC-20 tokens, and cost-efficient shielded transactions. In 2021, Tron became governed by a Decentralized Autonomous Organization (DAO).

Thanks to its support for smart contracts and dapps, Tron became one of the largest ecosystems in decentralized finance (DeFi). At the time of writing, it accounts for over 11% of the total value locked (TVL) in DeFi, second only to Ethereum.

However, Tron’s TVL is dominated by a single ecosystem, which is JustLend. In total, the network hosts only about 20 active DeFi protocols.

| Top Tron dapps | Year Launched | Total Value Locked (TVL) | Market Cap | BMJ Score |

| JustLend | 2020 | 3.7B | $195M | 4.5 |

| JustStable | 2020 | $1.3B | $300M | 4.5 |

| $SUN | 2019 | $589M | $52M | 3.5 |

| UnFi Staking | 2020 | $1.4M | $17M | 2.5 |

| SocialSwap | 2020 | $815K | $1M | 1.0 |

Top 5 Protocols on Tron by Total Value Locked

Here are the 5 largest DeFi protocols on Tron by TVL:

JustLend

JustLend

Type of dApp: Lending

BMJ Score: 4.5

JustLend is a decentralized lending protocol supported exclusively by the TRON network. It represents an ecosystem for lending and borrowing digital assets, including Tron’s $TRX, Bitcoin, Ethereum, and stablecoins.

The app relies on pools with algorithmically-determined interest rates, enabling users to supply and borrow tokens in an automated and risk-controlled environment. Some of its unique features include auto-matching orders via smart contracts, real-time lending and borrowing, and automatic liquidation when the collateral value falls below the threshold.

Interest accrual occurs at each TRON block generation (approximately every 3 seconds). The protocol issues jTokens backed by supplied assets, allowing token holders to accrue interest.

As of this writing, JustLend is the sixth-largest DeFi ecosystem, with a TVL of about $3.8 billion.

JustStable

JustStable

Type of dApp: CDP

BMJ Score: 4.5

JustStable is a Tron-based ecosystem built around the stablecoin JustStable (USDJ). JustStable and JustLend are both part of a wider DeFi ecosystem called JUST, which was established by Tron founder Justin Sun in 2020.

The USDJ stablecoin is pegged to the price of the US dollar and is the main asset of JustStable, a lending platform that issues the stablecoin based on multiple collaterals. JustStable acts as a lending hub where users can borrow stablecoins to be used for yield farming and trading. Specifically, USDJ is generated through so-called collateralized debt positions (CDPs).

As of now, over $1.2 billion worth of crypto has been deposited with these CDPs to generate the stablecoin.

$SUN

$SUN

Type of dApp: DEX

BMJ Score: 3.5

$SUN was developed to support the growth of TRON’s DeFi ecosystem. The protocol has gone through several iterations. JustLend is still $SUN’s main use case, and the ecosystem also features a separate stablecoin swap app and decentralized autonomous organization (DAO) on TRON.

The eponymous native token plays an instrumental role in managing the platform, facilitating buybacks and burn rewards, offering rewards to liquidity providers, among other functions.

Leveraging an array of transaction protocols, $SUN.io aims to develop a comprehensive DEX ecosystem that delivers superior functionality, profitability, and security. Meanwhile, a self-sustaining ecosystem is fostered by the $SUN’s burn mechanism and the voting rights of $SUN token holders.

UniFi Staking

UniFi Staking

Type of dApp: Staking

BMJ Score: 2.5

Unifi Staking is part of the Unifi Protocol – a multi-chain DeFi ecosystem comprising a DEX (uTrade), cross-chain bridge (uBridge), and staking (uStake).

Unifi’s delegated proof-of-stake (DPoS) staking mechanism operates on five blockchains, including Tron, incentivizing security via staking rewards. Unifi Staking involves nearly 5,600 delegators staking UNFI worth over $5 million, yielding an estimated 5.4% APR.

SocialSwap

SocialSwap

Type of dApp: DEX

BMJ Score: 1.0

SocialSwap.io is a DEX aggregator for the Tron ecosystem, supporting staking and liquidity mining capabilities. It relies on its native token, SST, with a supply of 1 billion.

A standout feature is the transaction fee refund pool which covers swap-associated costs. To enhance security, two separate audits scrutinize the contracts. A cross-chain solution is also being developed. Users have the ability to stake in various pools and participate in weekly update calls with co-creators. The aggregator plans to enable live chart tracking and automatic token swapping at predetermined prices on the Tron blockchain.

Investor Takeaway

Tron has made a name for itself as an Ethereum alternative. The project has grown a significant user base, primarily in Asia, and has carved out a sizable portion of the DeFi market. However, the dominance of the JUST ecosystem on Tron might impact its long-term diversification and growth.

Currently, $TRX, priced at $0.07, is in the top 10 largest cryptocurrencies, with a market cap of over $6.6 billion as of June 2023. The token has had many ups and downs, but unlike other cryptocurrencies, it has fluctuated within a much narrower range, peaking in 2018 at over $0.17.

Tron’s compatibility with Ethereum and its facilitation of efficient transactions make it an investment to consider. Yet, the lack of data from the Tron blockchain makes it important to do more in-depth research when it comes to its DeFi protocols.

Subscribe to Bitcoin Market Journal to discover more investment opportunities in blockchain!

bitcoinmarketjournal.com

bitcoinmarketjournal.com