As of July 17, 2023, the decentralized finance (defi) sector has been witnessing a great deal of consolidation with total value locked (TVL) figures standing at $44.19 billion. Throughout most of the year in 2023, except for a brief period of seven days in April, the TVL in defi has consistently remained below the $50 billion range.

Value Locked in Defi in 2023 Remains Above $40B but Stagnates Below $50B

Throughout the first half of 2023, the decentralized finance (defi) landscape has exhibited a lackluster performance, with the value locked in the sector remaining relatively stagnant. Specifically, on Monday, July 17, 2023, the total value locked (TVL) stands at $44.19 billion, according to defillama.com metrics.

Within this sum, Lido Finance commands a significant portion, securing $14.78 billion, which accounts for 33.45% of the aggregate TVL. Following Lido, prominent players in the defi realm include Aave ($5.88B), Makerdao ($5.47B), Uniswap ($3.78B), and Justlend ($3.69B).

With the exception of a notable period from April 12th to the 19th, the TVL in the defi sector has consistently hovered below the $50 billion range throughout the year. In the middle of June, the TVL hit its lowest point in 2023, standing at $40.9 billion. However, it has managed to remain above the $40 billion threshold this year.

Following the recent Ripple ruling, which led to substantial gains in the cryptocurrency markets and smart contract tokens, the TVL in the defi sector approached the $46 billion threshold. However, the top smart contract token economy has since relinquished most of those gains, experiencing a 2.4% decline to reach approximately $351 billion in the past 24 hours.

Despite the overall retracement, solana (SOL) has managed to sustain a 21.5% increase against the U.S. dollar over the past seven days. Cardano (ADA) has also made notable strides, rising by 6.4% throughout the week.

Additionally, polygon (MATIC) has defied the broader crypto market downturn, surging by 3.7% in the same period. Amid the broader market fluctuations, ethereum (ETH) experienced a minor setback of 0.5%, while binance coin (BNB) witnessed a decline of 1.4% over the course of this week.

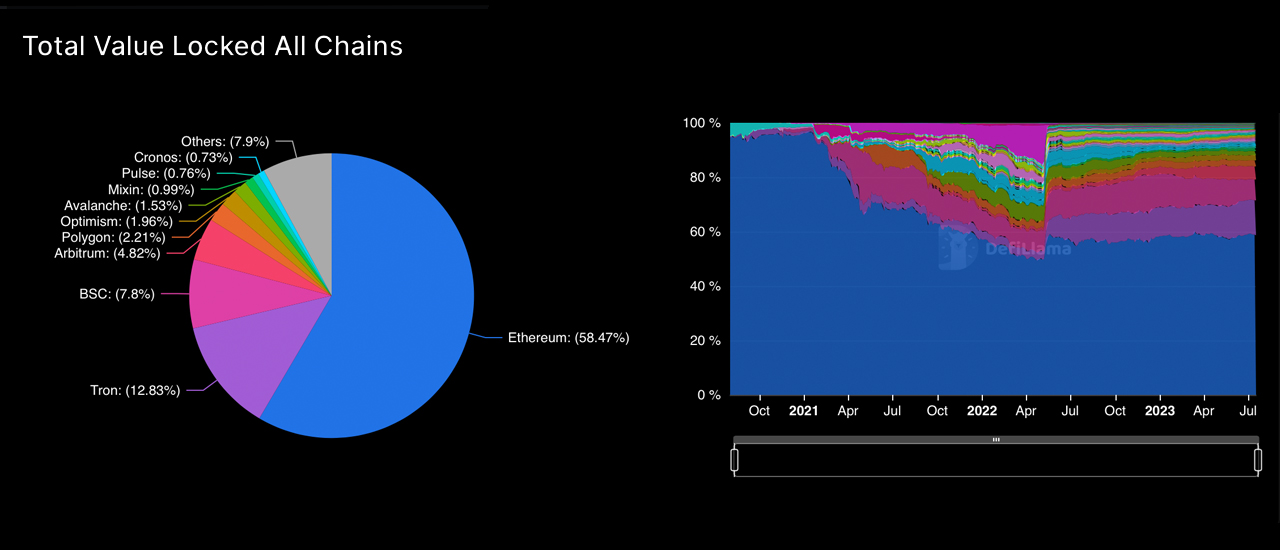

Notably, out of the total value locked (TVL) recorded during this period, Ethereum-based defi protocols accounted for a substantial 58.47%, surpassing the $25 billion mark. Trailing behind Ethereum, Tron holds the second-largest blockchain in terms of TVLs, commanding 12.83% or $5.65 billion.

news.bitcoin.com

news.bitcoin.com