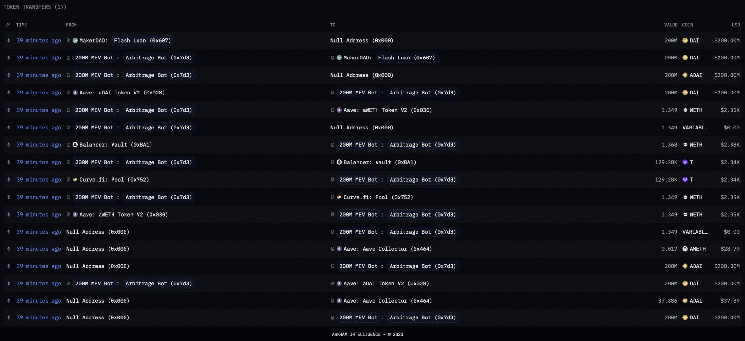

An arbitrage bot flash loaned $200 million worth of the dai stablecoin ($DAI) from MakerDAO on Wednesday, making a $3.24 profit after transaction fees.

The bot took advantage of MakerDAO's 'DssFlash' contract, which permits users to borrow any amount of $DAI without incurring fees, according to crypto data provider Arkham Intelligence.

A flash loan is a type of loan that is received and paid back within a single block without any upfront collateral. In this instance, the bot borrowed 200 million $DAI tokens and supplied them to the Aave $DAI market, borrowing $2,300 worth of wrapped ether (WETH) against it.

That WETH was used to buy Threshold Network (T) on Curve before it was sold on Balancer in a myriad of single-block transactions.

The total profit before fees was $33, however, it incurred almost $30 in transaction and protocol fees, leaving a net profit of $3.24.

Flash loans have been used nefariously in the past, with a string of flash loan exploits on decentralized finance (DeFi) platforms like Platypus and 0VIX resulting in losses exceeding $10 million.

coindesk.com

coindesk.com