Uniswap, the popular Ethereum-based decentralized exchange (DEX) platform, has achieved a remarkable feat by surpassing 250 Million token swaps recently. The news of this achievement was shared by Uniswap Labs, the software firm behind the DEX, on their official Twitter handle on June 9, Friday. By transcending a quarter billion swaps, Uniswap has further cemented its position as a go-to protocol for the decentralized finance (DeFi) enthusiasts globally.

Uniswap Protocol has officially hit 250,000,000 swaps! pic.twitter.com/zwQ3Fua8kX

— Uniswap Labs 🦄 (@Uniswap) June 9, 2023

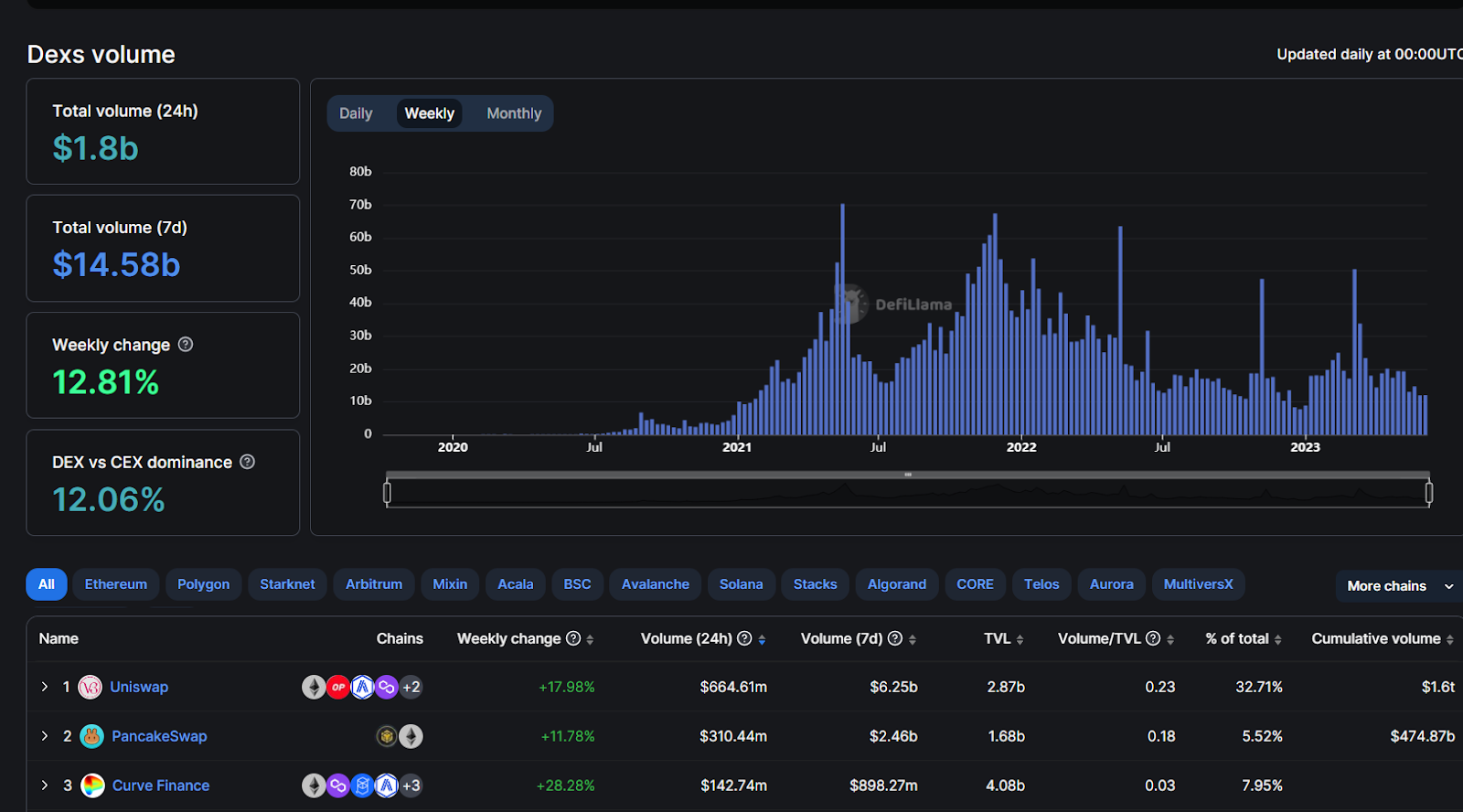

The platform experienced high traffic during this week as the centralized exchanges suffered under the regulatory fire of US Securities and Exchange Commission (SEC). As per DeFiLlama, a total of $14.58 Billion worth of trades were executed on DEXs, of which Uniswap captured a share of 17.98% with a weekly trading volume of $6.25 Billion.

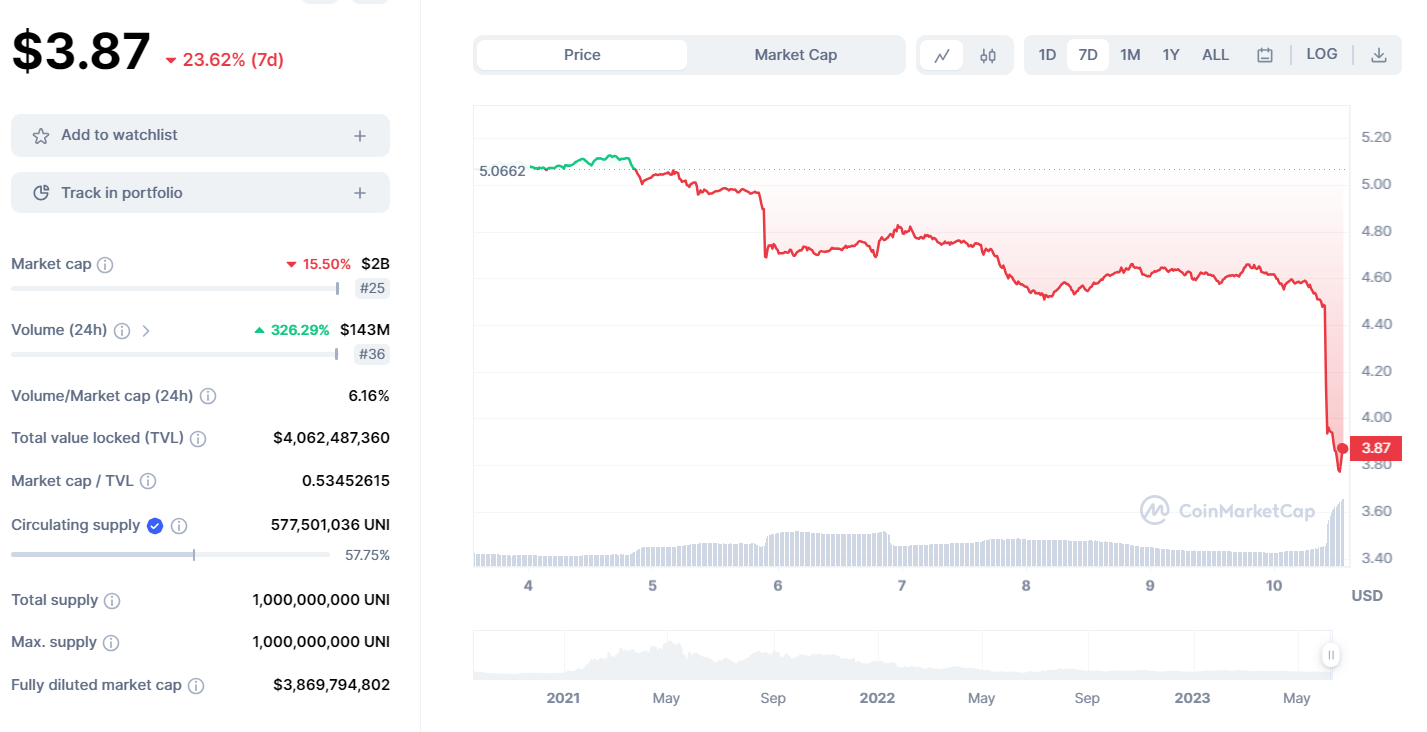

Despite the recent positive announcement, the native token of the Uniswap, i.e., $UNI has registered bearish performance in the market. At the time of writing, $UNI token has seen a price drop of near 20% within the last 7 days while its market cap has witnessed a near 15% drop, indicating a bear market trend.

Uniswap Maintaining its Dominance in DeFi Space

Ever since its launch in November 2018, Uniswap has become one of the most well-known DEX in the decentralized finance ecosystem. It is powered by the Ethereum blockchain and uses a wide range of smart contracts to facilitate the seamless swapping of ERC-20 tokens between the users.

As a decentralized finance protocol running on the automated liquidity protocol, Uniswap solves the inherent issues of liquidity in other exchanges. This approach empowers its users to trade tokens directly from their wallets and maintain control over their assets.

The increasing popularity of this platform in the decentralized finance environment can be owed to its simple and user-friendly interface. The decentralized aspect of Uniswap eliminates the requirement of any centralized auth]orities or intermediaries to oversee the exchanges, which provides users a trustless trading experience.

Uniswap commands over the DEX market with a Total value locked (TVL) of around $3.98 Billion (data from DeFiLlama). In April 2023, Uniswap achieved yet another milestone by processing over $1.5 Trillion worth of crypto transactions since its launch. Uniswap labs, quoting the data from Dune Analytics, shared the news of the accomplishment with a celebratory tweet on April 24, Monday.

The Uniswap Protocol has officially passed $1.5T in trading volume 🚀 pic.twitter.com/Fjd8IP7ngc

— Uniswap Labs 🦄 (@Uniswap) April 24, 2023

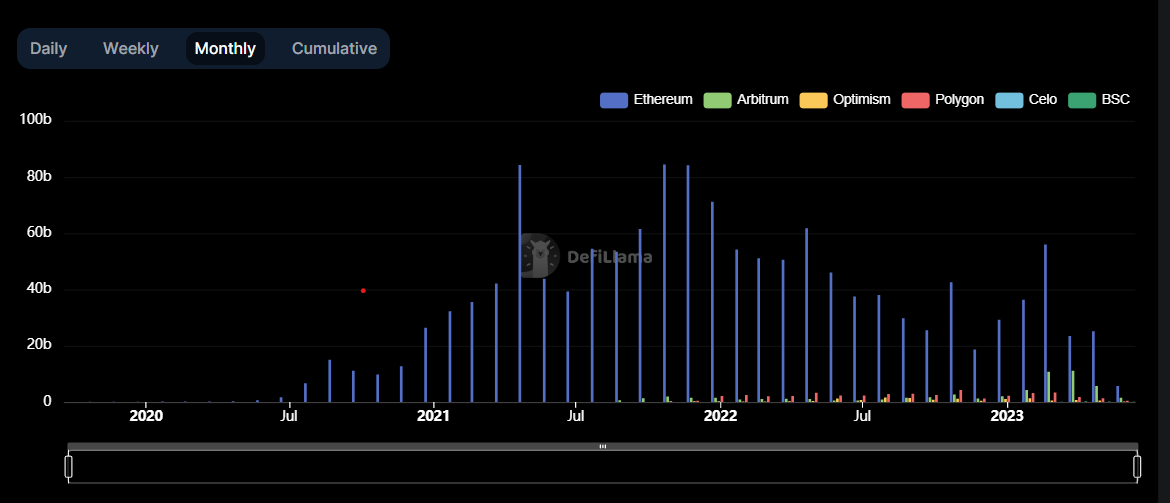

Although Uniswap protocol has been in the decentralized finance scene for nearly four years, the cumulative trading volume worth nearly $800 Billion occurred between May 2021-May 2022, as per the data retrieved from DeFiLlama.

Uniswap handled over $85 Billion transactions in November, 2021 alone, making it the month with the highest trading volume. However, in the year 2023, after recording around $70 Billion in trading volume in March, Uniswap surpassed its centralized counterpart, Coinbase, for the second month in a row.

thecoinrepublic.com

thecoinrepublic.com