The industry experienced a mixed performance in May, with DeFi seeing a decrease in total value locked (TVL) but an increase in its share of on-chain activity. The dApp industry grew, while blockchains, except for Tron, regressed in TVL.

According to the latest DappRadar report, the crypto industry had a mixed bag in May, with different parts of the industry simultaneously progressing and taking steps back.

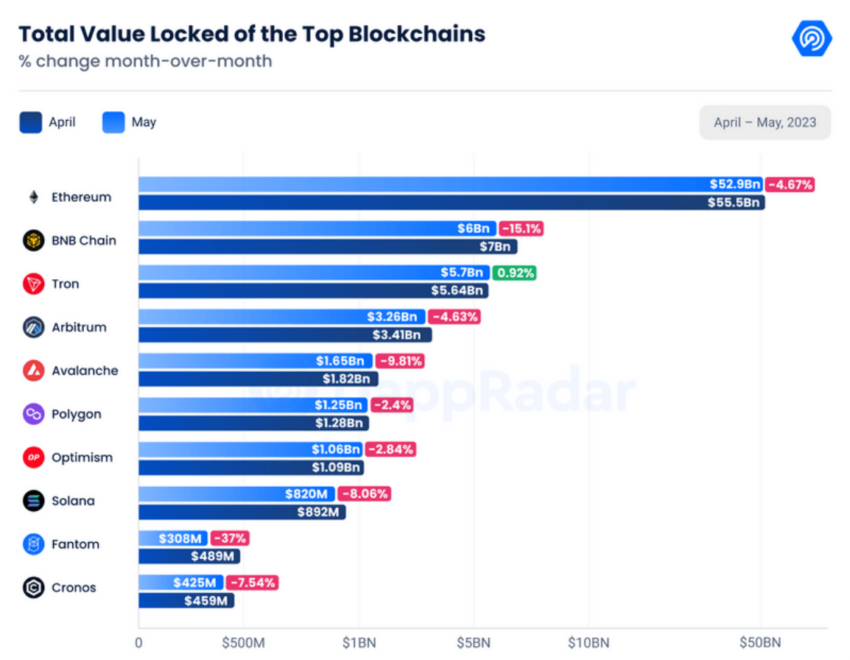

Blockchain TVL Regresses

The total value locked (TVL) in DeFi protocols—or the funds being used in them—saw a 4.3% decrease in May, slipping to $79.16 billion USD. However, DeFi’s share of on-chain activity rose to 31%. So even though more users are taking advantage of its protocols, they’re playing with less collectively.

It wasn’t all bad, though. The dApp industry grew by 9.97% in May, reaching an average of 1,967,051 daily unique active wallets (dUAW), reflecting a steady increase in web3 interest.

Regression was the key takeaway for blockchains in May, as TVL dropped almost across the board. One exception in the report was TRON, which grew a little under 1% over the month.

The biggest loser in this time period was Fantom (FTM). Its TVL dropped by 37% to $308 million due to its association with the Multichain turmoil caused by rumors of potential arrests in China. Multichain’s native token, MULTI, experienced a severe 49% decline, affecting Fantom’s assets and triggering a shift to Arbitrum.

$NFT Trading Volumes Down

The $NFT market experienced a mixed performance in the past month, reflecting a broader trend in the industry. Trading volume dropped below $1 billion for the first time since December 2022, with May’s $NFT trading volume declining sharply by 44% to $675 million compared to the previous month.

In May 2023, Blur took a 65% market share and earned $442 million in $NFT sales. The former king of the $NFT marketplaces, OpenSea, had a 27% market share and $183 million in revenue. Despite Blur’s dominance, OpenSea had a significantly higher number of traders, with 377,087, than Blur’s 36,673. This reflects something we’ve known for a long time: Blur appeals to a certain kind of market participant. Namely, those who want a technical focus on higher-frequency trading and less on collecting.

However, Blur’s $NFT lending service, Blend, has taken some attention away from its trading platform. $NFT traders’ moving from the former to the latter has significantly contributed to the decline in trading volume.

beincrypto.com

beincrypto.com