Decentralized finance (DeFi) innovator MakerDAO has launched a new lending and borrowing system called Spark Protocol.

On May 8, DeFi pioneer MakerDAO announced that Spark Protocol would be launched on May 9.

The platform was described as an end-user, $DAI-centered DeFi product deployed on Ethereum. It features supply and borrow functionalities for $ETH, stETH (Lido staked $ETH), $DAI, and sDAI.

The protocol’s first product is Spark Lend. The marketplace has a focus on lending and borrowing crypto using $DAI, Maker’s native stablecoin.

MakerDAO tweeted, stating:

“Users will be able to interact with Spark’s front-end directly, connecting Maker’s liquidity with a complete DeFi solution.”

MakerDAO Focus on Stability

Furthermore, Spark Lend introduces a tokenized version of $DAI deposited in the DSR ($DAI Savings Rate) called sDAI. However, yields are woefully low at the moment, with just 1.1% on offer for $DAI deposits.

Spark is also connected to Maker’s D3M. This liquidity balancing system uses $DAI to keep liquidity in Spark Lend.

Additionally, it uses a Peg Stability Module (PSM) that connects the liquidity infrastructure for instant swapping of $DAI and sDAI for USDC.

The yields may be low, but DeFi users have grown wary of unsustainable yield promises and high risk. Therefore, stability, liquidity, and lower risks have become the way forward for Maker.

Spark Protocol is part of MakerDAO’s Endgame plan. The protocol has proposed to make $DAI a free-floating asset, initially collateralized by real-world assets (RWA).

Under the Endgame plan, $DAI will remain pegged to the dollar for three years. Maker plans to accumulate as much Ethereum ($ETH) as possible to ultimately increase the ratio of decentralized collateral.

$DAI is currently the fourth largest stablecoin, with a circulating supply of $4.7 billion. This gives it a market share of 3.6%, making it the industry’s largest decentralized stablecoin. Furthermore, $DAI supply has declined by 53% since its peak of almost $10 billion in February 2022.

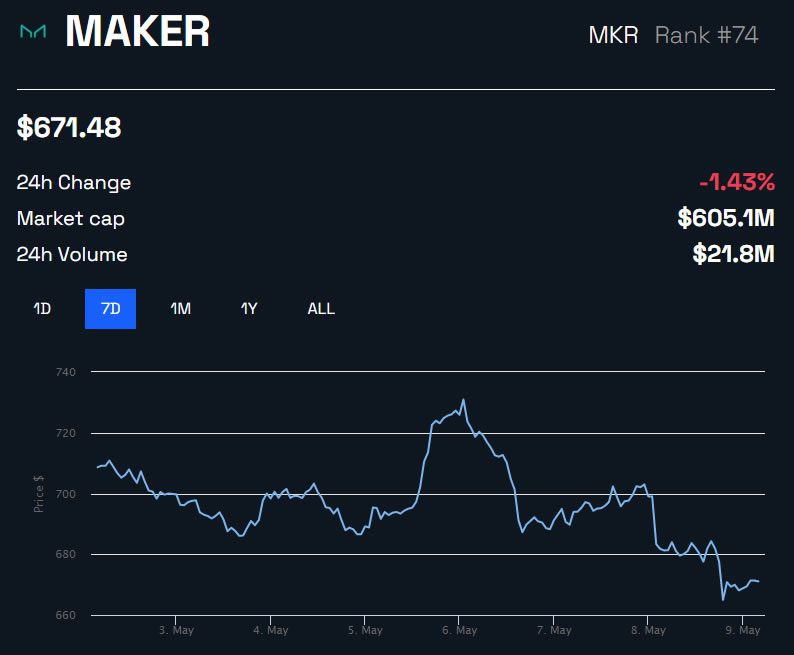

MKR Price Outlook

MakerDAO’s native token has dropped around 2% on the day in a fall to $671 as crypto markets retreat. MKR is currently trading at its lowest level for just over a month.

The DeFi governance token is down 89% from its May 2021 all-time high of $6,292. However, there are only just over 900,000 MKR in circulation.

beincrypto.com

beincrypto.com