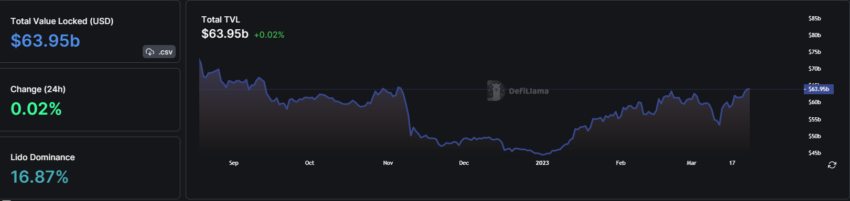

Total value locked (TVL) in the decentralized finance (DeFi) sector has surpassed $63 billion, with Lido Liquid Staking expanding its TVL beyond $10 billion.

Based on data by DefiLlama, this is a record high in 2023 when including the staking market in the DeFi TVL. However, without staking, this is the second time this month that the TVL has crossed the crucial level of $50 billion since the FTX implosion.

Lido Liquid Staking Pushes Defi TVL

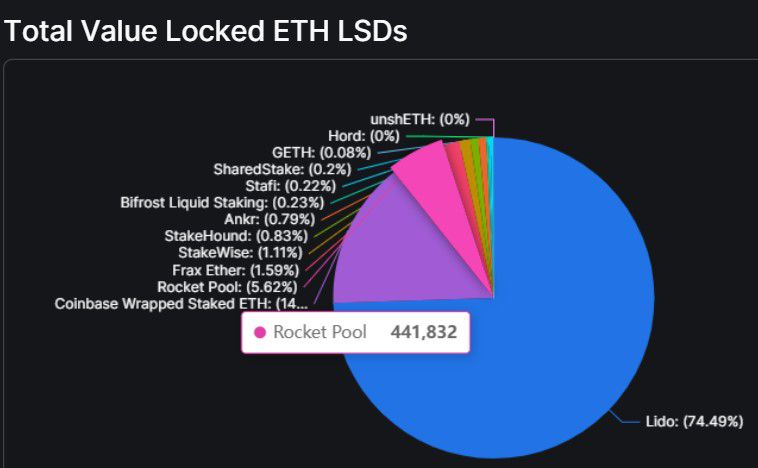

The largest liquid staking protocol, Lido, has expanded its TVL on five chains. It has gained close to 3.6% in the past day, with a dominance of 16.9% in the DeFi market.

The TVL of the Decentralized Autonomous Organization (DAO) includes staked tokens on various chains. Lido has the highest presence on Ethereum, with a value breakdown of $10.75 billion. The rest of the liquidity is distributed on Solana, Moonbeam, Moonriver, and Terra Classic.

Notably, Lido increased its TVL from $1 billion in April 2021 to $10 billion for the first time in November of the same year.

In April 2022, the amount of money held in the pool reached a record high of over $20 billion. However, the LUNA crisis caused a steep decline in its TVL in May. Before the FTX collapse weakened the market, the platform rose from the ruins through incentives in the Curve pool.

The DeFi sector TVL surpassed $50 billion in February for the first since the FTX bankruptcy shook the markets in the last quarter of 2022 (excluding staking). After dipping slightly below that level at the beginning of March, the total value locked has recovered again.

Lido now has a total dominance of over 21% thanks to higher collateral values and liquid staking derivatives. The platform has 280,410 stakers based on its website data. Additionally, it has pulled further away from MakerDAO, the previous leader in DeFi, a strong player in collateralized lending.

While the defi market has gained in the past week, Lido’s governance token $LDO has remained muted. It gained a mere 1% in the last two weeks, losing close to 5.7% in the last seven days. At a price of $2.28, it also displayed a decline in daily trading activity. Meanwhile, $LDO has plunged nearly 70% since its August 2021 peak of $7.30, according to CoinGecko.

Ethereum Upgrade Increases Liquid Staking Interest

With a planned date of mid-April, the Shanghai upgrade for Ethereum is just around the corner. Since stakers will be able to finally withdraw their staked $ETH, demand for Lido has been surging.

The upgrade could also have a positive impact on the price of Ethereum.

Lido has 5.8 million Staked $ETH. According to crypto researcher Fundonomics, the protocol has over 44,000 $ETH depositors.

However, the crypto commentator believes that Rocket Pool is its biggest competitor despite Lido’s solid partnerships.

As per DefiLlama, Rocket Pool has 441,832 staked $ETH and stands third behind Lido and Coinbase Wrapped Staked $ETH. Coinbase customers can obtain an ERC20 utility token by staking $ETH. Meanwhile, Rocket Pool currently contributes $806 million to the total value locked in the DeFi space.

According to Fundonomics, being the first and biggest decentralized node operator for Ethereum provides an edge to Rocket Pool in the liquid staking market.

StakeWise and Ankr are other protocols that have been rising in demand.

beincrypto.com

beincrypto.com