- Euler Finance, a permissionless lending protocol compliant with the Ethereum network was hit by an attack and lost $8 million.

- The protocol completed a $32 million financing round in 2022 with participation from industry giants Coinbase, Jump, Jane Street, Uniswap and the defunct FTX exchange.

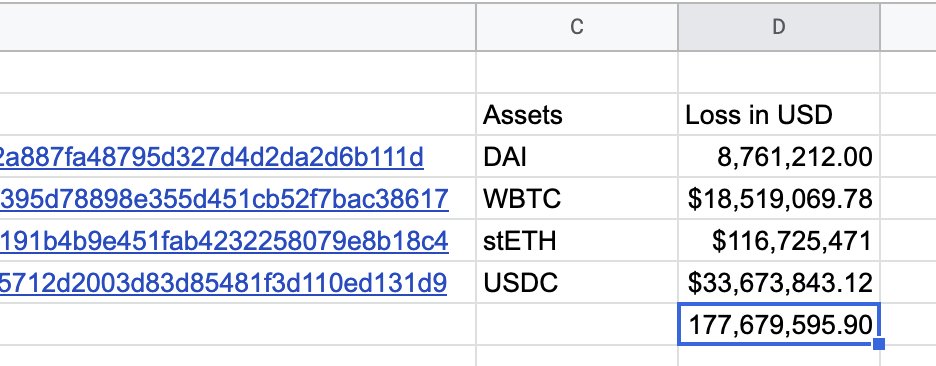

- Smart contract audit firm BlockSec identified the $177 million attack and warned crypto market participants of the threat.

Euler Finance’s token EUL price nosedived 26.2% in response to the attack on the lending protocol. BlockSec, a smart contract audit firm monitored the attack and informed the crypto community. The project lost $177 million in four transactions, a year after completing a financing round that involved industry giants like Coinbase, Jump, and now defunct crypto exchange FTX.

Also read: USDC mayhem catalyzes recovery rally in Uniswap and Curve DAO

Euler Finance hit by $177 million attack

Euler Finance is a permissionless lending protocol built to facilitate crypto lending and borrowing. The protocol’s token is EUL, an ERC-20 token compliant with the Ethereum network.

BlockSec, a smart contract audit firm identified the attack and informed crypto market participants of the threat. Initially, $8 million was suspected to have stolen, the intelligence protocol identified a loss of $177 million in four transactions.

Our system monitored that @eulerfinance is being attacked. Please take action!https://t.co/lINtjcN1Un

— BlockSec (@BlockSecTeam) March 13, 2023

BlockSec identifies loss of $177 million in Euler Finance

Euler Finance made headlines in 2022 for raising financing from industry giants like Coinbase, defunct exchange-FTX, Jump, Jane Street and Uniswap. The protocol

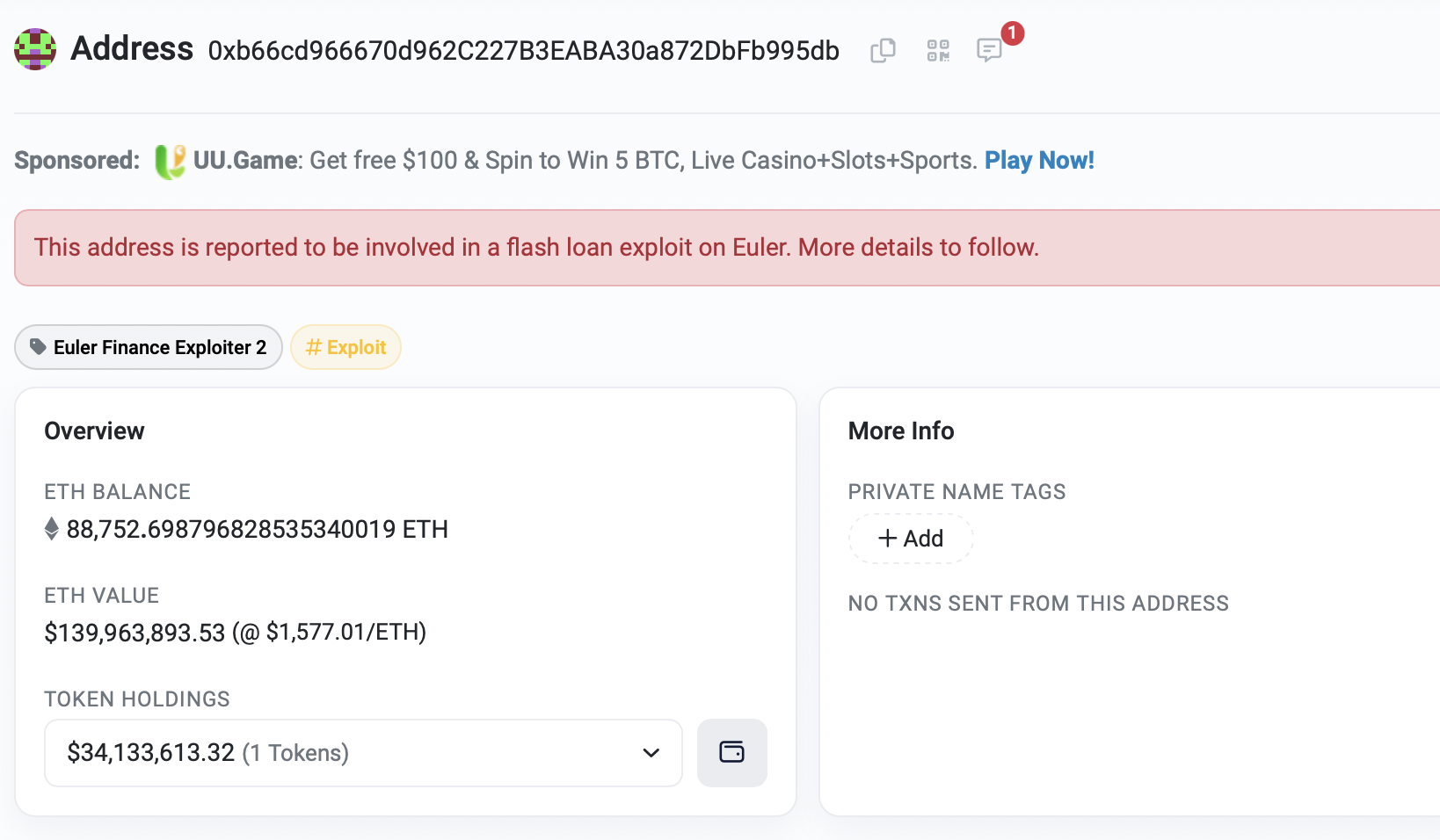

The attackers address on Etherscan

Interestingly, in September 2022, IntoTheBlock announced the development of a risk monitoring dashboard for Euler Finance. The need for risk management and identification of threats in advance, remains key to the DeFi ecosystem.

1/5 At @intotheblock we have been onboarding top institutions into DeFi through advanced yield-generating strategies

— Lucas (@LucasOutumuro) September 13, 2022

Risk management is core to our offering and we are excited to expand these tools for DeFi protocols, starting with @eulerfinance https://t.co/lqzljQS41S

EUL bleeds in response to news of the attack

The lending protocol’s ERC-20 token nosedived by 26.2% since the news of the attack on the project, dropping from $6.14 to $4.44 within a few hours. The possibility of recovery of hacked funds is bleak according to crypto expert ZachXBT who terms the attack was “blackhat.”

Almost certainly is blackhat as they were exploiting some random protocol on BSC a few weeks ago and then the funds deposited to Tornado https://t.co/v7W4t3qR6f

— ZachXBT (@zachxbt) March 13, 2023

We are aware and our team is currently working with security professionals and law enforcement. We will release further information as soon as we have it. https://t.co/bjm6xyYcxf

— Euler Labs (@eulerfinance) March 13, 2023

The expert identified the attacker’s address as the one that exploited a random protocol on Binance Smart Chain a few weeks ago and deposited funds to the mixer, Tornado. This poses a challenge for the Euler Finance team that has affirmed users that the investigation is ongoing.

fxstreet.com

fxstreet.com