Decentralized finance (DeFi) platform Maverick Protocol has unveiled its decentralized exchange (DEX) on Ethereum, the protocol’s developer team told CoinDesk Wednesday.

The protocol is powered by a native smart-contract-based, automated market making (AMM) engine that the Maverick team had been building for over a year and lets investors earn more revenue than on UniSwap, one of the top DEXs, Bob Baxley, Maverick’s chief technology officer, told Coindesk in an interview.

Maverick’s latest addition comes in an increasingly competitive space as investors seek decentralized trading venues after FTX’s spectacular demise and concerns about the stability of centralized exchanges.

“One of the biggest challenges that crypto faces in realizing its potential as the future of finance is how to increase on-chain liquidity,” Paul Veradittakit, managing partner at digital asset investment firm Pantera Capital, investor in Maverick. “Maverick makes liquidity work harder, and opens the door to the next phase of DeFi’s expansion and development.”

Maverick started with six liquidity pools, fundamental building blocks of DEXs similar to trading pairs on centralized exchanges, with more than $10 million of combined size to trade tokens of the largest liquid staking protocol Lido Finance, decentralized stablecoin issuer Liquity and web3 identity data network Galxe.

Higher capital efficiency

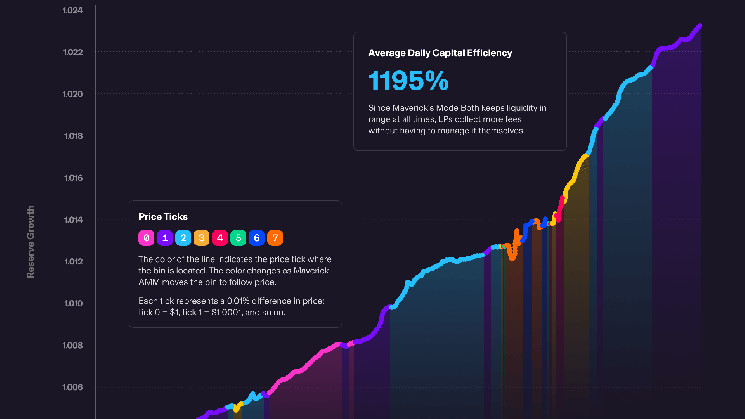

Maverick’s novelty is its dynamic automated market maker behind the protocol, which lets investors capture more fees and maximize revenues from providing liquidity with a customizable liquidity distribution tool.

DEXs are built around liquidity pools, where traders can exchange assets while investors – also called liquidity providers – earn rewards from transaction fees for providing liquidity to make a market. Liquidity distribution is the price range where investors deploy their capital for the pair of assets in the liquidity pool. Naturally, investors are attracted to deploy their capital on protocols with higher,steadier rewards.

Instead of standard liquidity distribution, liquidity providers on Maverick can automate their own distribution range and bet on the future price of the liquidity pool’s assets.

With that, investors’ capital can work more efficiently covering wider price movements, with less inactive periods when their capital is sitting idle because the asset price is out of range.

“If liquidity providers (LPs) in existing AMMs want to keep their capital as active as possible, they are forced to adjust their liquidity positions hourly, costing them time and gas,” Baxley said. “By giving LPs the option to choose if and how their liquidity moves with price in a given pool – something that no other AMM does natively – Maverick enables markets to run more efficiently, resulting in more consistent fee generation.”

In a backtest for last month, Maverick claimed that the strategy reached 1195% of average capital efficiency without any inactive periods, which translates to about ten times more potential income for liquidity providers compared to UniSwap.

Liquidity pools for stablecoins, liquid staking derivatives

At the beginning, crypto traders can access six liquidity pools on Maverick with an initial liquidity – total value locked (TVL) – of more than $10 million.

Maverick integrated the popular liquid staking protocol Lido Finance, making its wrapped ether derivative a key asset in the pools.

On top of the wstETH/$ETH pool, Maverick also partnered with decentralized stablecoin issuer Liquity to offer trading pools for its LUSD stablecoin against $ETH and wstETH, and with Galxe for a wstETH/GAL pool.

Those investors who deposit wstETH into the pools, may also earn the derivative’s staking reward as well as the usual revenue by providing liquidity.

Additionally, the protocol hosts a $USDC/USDT stablecoin pool and $ETH/$USDC pool.

DEX competition

During a torrid last year for centralized crypto trading platforms, highlighted by the spectacular collapse of FTX, the resiliency of decentralized alternatives spurred interest in DEXs. However, less-than-user friendly interfaces and occasionally subpar efficiency has stifled their emergence, executing only 5% of the daily trading volume of centralized exchanges.

Currently, decentralized exchanges compensate for the largest sector within DeFi, with a combined $18.8 billion of total value locked on the protocols, according to data from DefiLlama. The leading platforms are UniSwap and the stablecoin-focused swap protocol Curve Finance.

“Our goal is to be among the top five decentralized exchanges by volume within the next six months,” Baxley said.

The protocol’s developer firm raised $9 million of venture capital from backers including Circle Ventures, LedgerPrime and Jump Crypto, according to Crunchbase, with Pantera Capital being the latest investor last year, Maverick added.

coindesk.com

coindesk.com