Trading volume on decentralized finance platform Curve Finance (CRV) is going parabolic following news that Paxos will stop issuing Binance USD (BUSD).

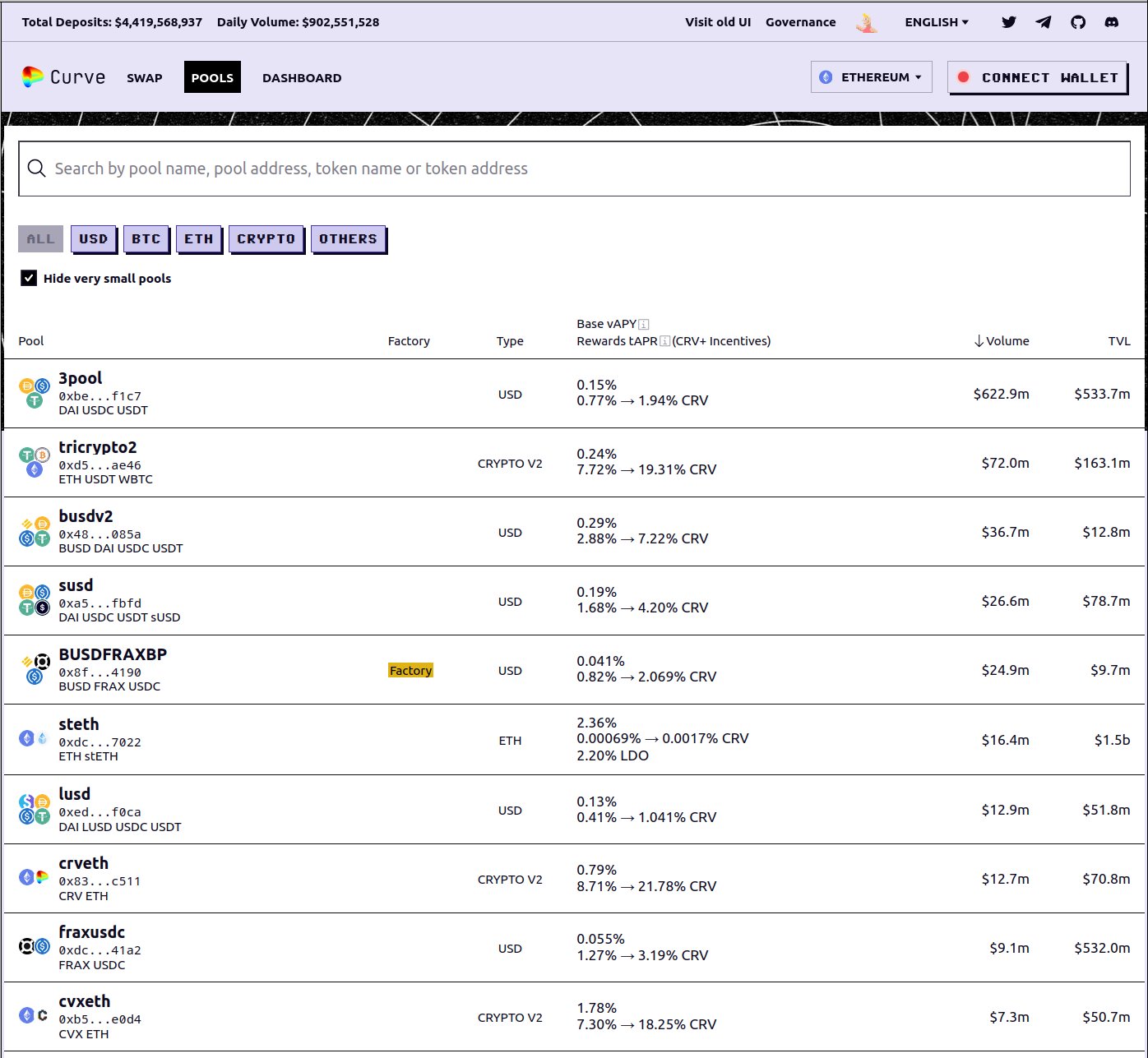

Curve Finance is a decentralized exchange (DEX) focused on stablecoins, and has some of the biggest liquidity pools available in DeFi.

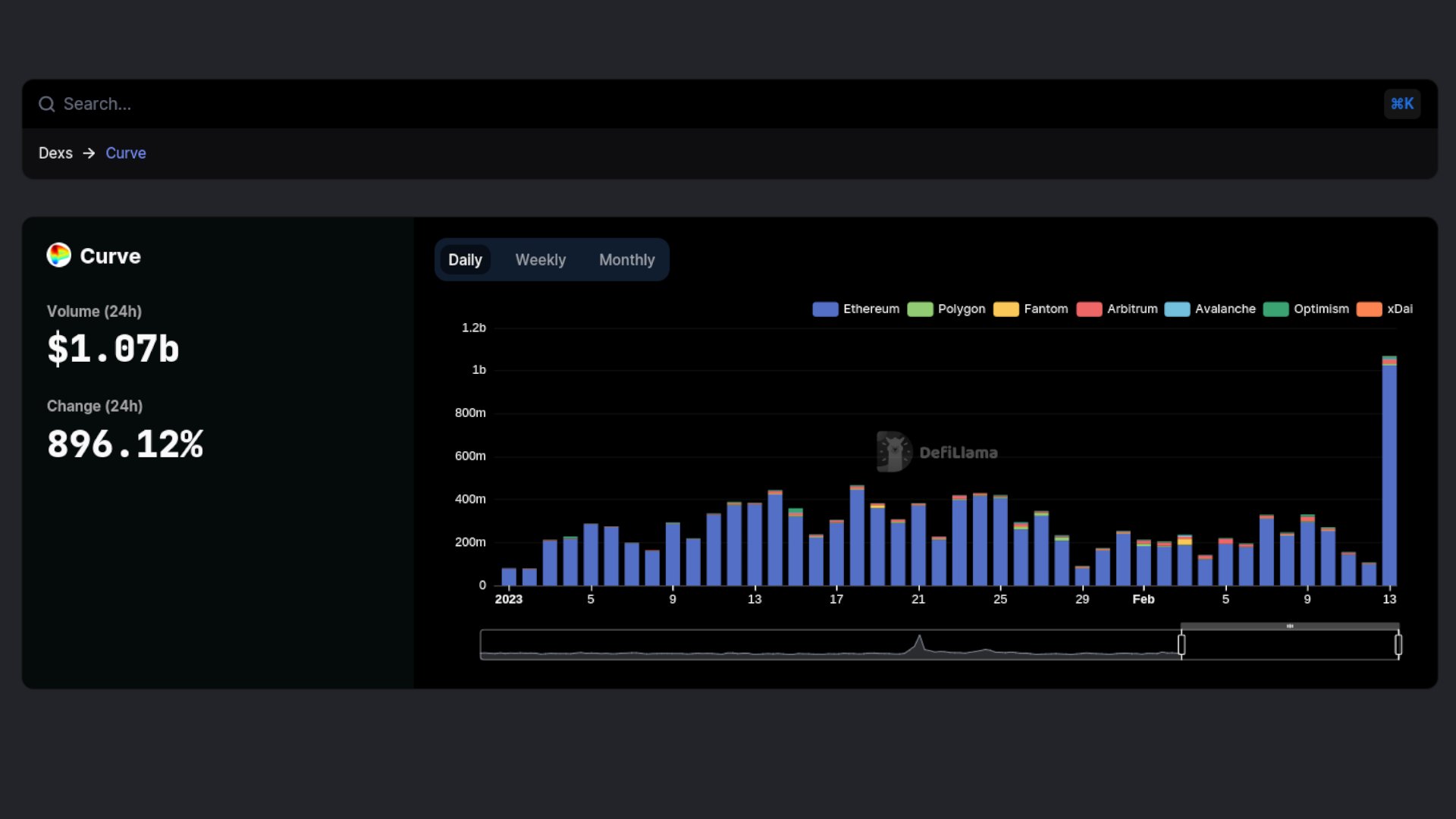

According to blockchain tracker DefiLlama, volume on Curve Finance soared to the third-highest level in its entire history early this week.

“CurveFinance has recorded a trading volume of $1.07 billion over the past 24 hours, marking a new high for the year. Only two other days in its history have seen a higher volume, and they both occurred immediately after the collapse of FTX.”

CurveFinance’s Twitter page also acknowledged the explosion in activity, saying that “good drama makes good trading volumes.”

Just before the platform’s trading volume surged, the New York Department of Financial Services (NYDFS) ordered Paxos, which issues and operates BUSD in a partnership with Binance, ordered the firm to freeze production.

The activity on Curve Finance appears to be linked to traders shifting around capital to different stablecoin pools due to uncertainty surrounding BUSD.

Curve Finance is also working on its own USD-pegged stablecoin known as crvUSD, which it released a whitepaper for late last year, but no release date has been given.

CRV, Curve Finance’s governance token, has also turned green in the last day, currently up 6% in the past 24 hours as it trades at $1.07.

dailyhodl.com

dailyhodl.com