MakerDAO, the decentralized finance (DeFi) giant that facilitates the generation of the $DAI stablecoin, is releasing a lending platform that will rival Aave, one of Ethereum's largest DeFi products.

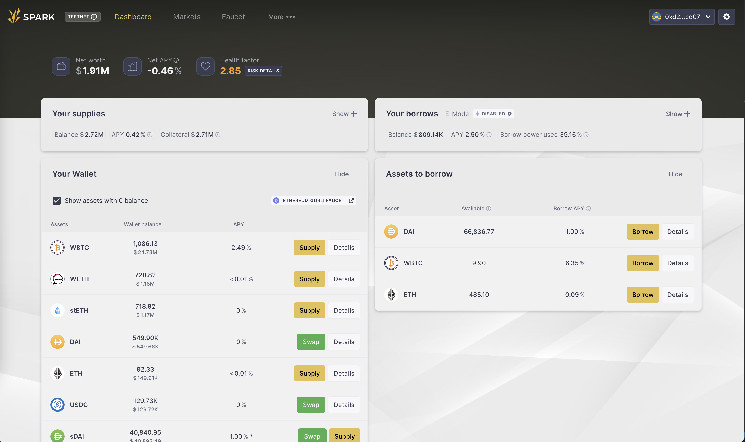

Spark Protocol, which is a fork of Aave's version 3 (v3), will be a front-end app that allows users to interact with $DAI in the form of borrowing, lending and staking, according to an announcement on the MakerDAO forum.

The development of a dedicated lending protocol represents a shift in focus from MakerDAO, which has aligned its revenue model with the issuance of $DAI since the latter's inception in 2017. MakerDAO has formed Phoenix Labs, a research and development company that will be tasked with building the Spark Protocol.

Spark Protocol's emergence as a potential rival to Aave, which has $4.6 billion in total value locked (TVL), comes after Aave voted to introduce its own yield-generating stablecoin dubbed GHO last year.

The new protocol will be reinforced by pricing oracles, or data sources, provided by Chronicle Labs and Chainlink to enhance security in case one of the two goes down or suffers an exploit.

MakerDAO also announced the forthcoming deployment of etherDAI, a synthetic liquid staking derivative (LSD) for ether ($ETH) that will be pegged at a one-to-one ratio with $ETH. Liquid staking allows users to generate extra yield on top of standard rewards for staking tokens in a network.

The MakerDAO token (MKR) is currently trading at $771.85 having risen by 1.39% over the past 24-hours, according to CoinDesk data.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

coindesk.com

coindesk.com