The total value locked (TVL) on Cardano’s decentralized finance (DeFi) space has more than doubled so far this year, to the point there are now over $100 million worth of $ADA locked on Defi protocols on the network.

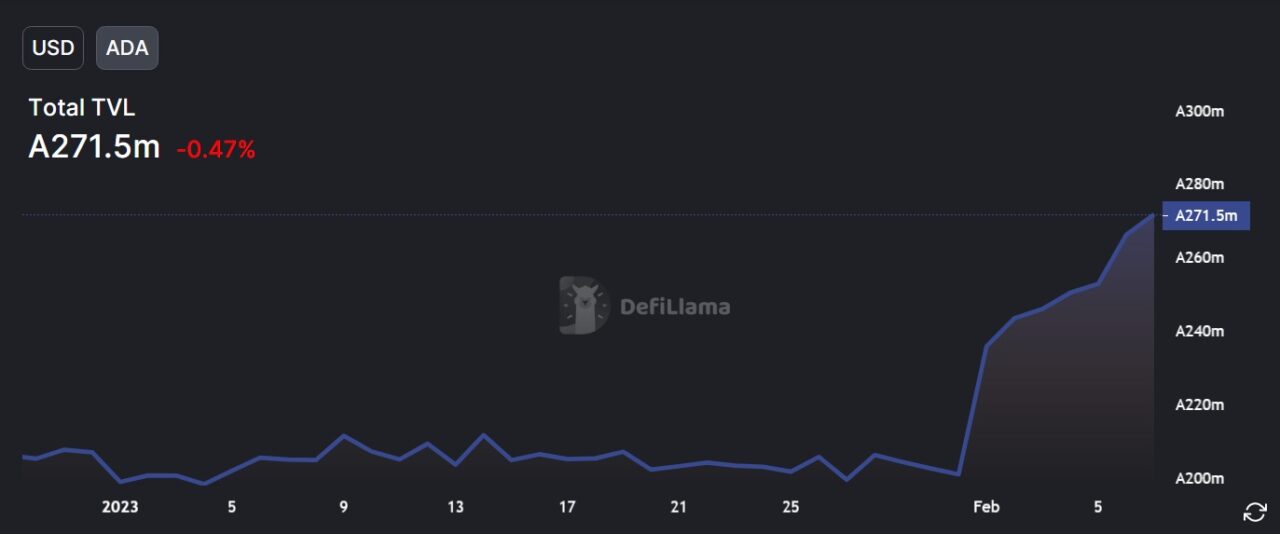

According to data from DefiLlama, the total value locked on the Cardano network started 2023 at around $49 million, and has since surged to now be close to the $104 million mark. The rise can be partly attributed to Cardano’s price appreciation, as the cryptocurrency moved from around $0.25 at the beginning of the year to roughly $0.39 at the time of writing.

The cryptocurrency’s price rise was significant, but failed to keep up with the cryptocurrency community’s price target at $0.495 for the first month of the year, as investors expected $ADA to nearly doubled in January.

Notably, Cardano’s total value locked when measured in $ADA has also risen significantly, going from 198.6 million $ADA to 27.5 million at the time of writing.

The amount of locked $ADA on the network exploded shortly after the launch of the Cardano-powered algorithmic stablecoin Djed ($DJED), which is a formally verified algorithmic stablecoin for Cardano that is backed by cryptocurrency. IOG, the company behind the development of Cardano, designed the stablecoin, while COTI Group is responsible for issuing it. The stablecoin was announced back in September 2021, and launched earlier this month.

As reported, the reserve ratio for $DJED surpassed 600% shortly after launch, with investors moving over 30 million $ADA to its base reserves to mint over 11.8 million DJED in roughly a week.

The growing total value locked comes at a time in which the number of smart contracts deployed on Cardano has surpassed the 5,000 mark. As CryptoGlobe reported, Cardano surpassed the 3,000 smart contract mark in August of last year, after adding around 100 smart contracts in a month at the time.

The leading Defi protocol by total value locked on Cardano is decentralized exchange Minswap, with $34.3 million in total value locked. It’s followed by rival DEX WingRiders, and by collateralized debt protocol Indigo, with $16.3 million and $15.9 million in TVL, respectively.

cryptoglobe.com

cryptoglobe.com