The dYdX Foundation, a Swiss non-profit organization, recently issued new governance tokens for its Layer 2 protocol on the blockchain.

The purpose of the token is to allow the community to govern the protocol. And to align incentives among traders, liquidity providers, and partners. The DYDX token also creates an ecosystem around governance, rewards, and staking that is designed to drive growth and decentralization of the Layer 2 protocol.

1 Billion DYDX Tokens to Govern the Protocol

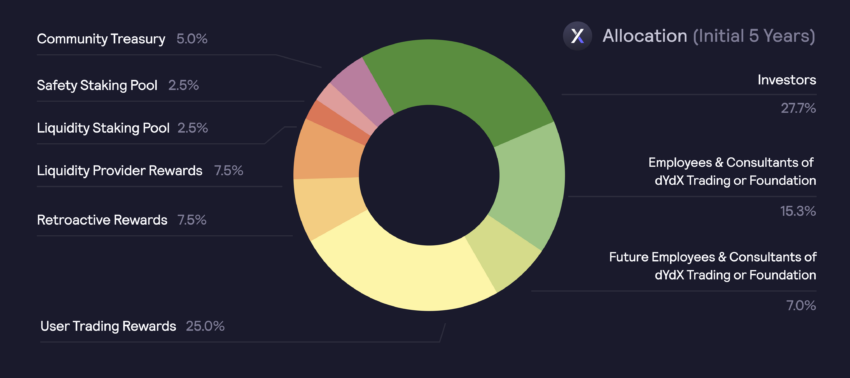

A total of 1 billion DYDX tokens were minted and programmed to become accessible over five years, starting on Aug 3, 2021 at 15:00:00 UTC. Part of the initial allocation was reserved for past investors of dYdX Trading Inc. (27.7%), founders, employees, advisors, and consultants of dYdX Trading Inc. and dYdX Foundation (15.3%), and future employees and consultants of dYdX Trading Inc. and dYdX Foundation (7.0%).

The transfer restriction on tokens is enforced threw off-chain contractual agreements with the dYdX Foundation and dYdX Trading Inc. The dYdX Foundation tracks wallet addresses to determine if any transfers have been made in violation of the restriction. If so, the Foundation can expressed a willingness to take legal action against investors who do not comply.

Past investors, founders, employees, advisors, and consultants of dYdX Trading Inc. and dYdX Foundation are subject to the transfer restriction schedule outlined in the investor warrants, which have recently been amended. Approximately 99.5% of locked tokens remain locked under the new transfer restriction schedule.

The recent amendment to the investor warrants did not alter the staggered unlock schedule. The tokens will be released from the transfer restriction as follows:

- 30% on Dec 1, 2023 (the new Initial Unlock Date)

- 40% in equal monthly installments from Jan 1, 2024 to Jun 1, 2024

- 20% in equal monthly installments from Jul 1, 2024 to Jun 1, 2025

- 10% in equal monthly installments from Jul 1, 2025 to Jun 1, 2026

Potential Price Impact

The potential effect of newly minted tokens on the market and price action of this cryptocurrency can vary. It can depend on several factors such as the overall supply and demand of the governance token, the purpose of the token issuance, market sentiment, and regulatory environment, among others.

In some cases, a large influx of newly minted tokens can lead to increased supply and decreased demand. Such dynamics can potentially lead to a decrease in the price of the cryptocurrency. On the other hand, if the newly minted tokens are used to incentivize certain behaviors or drive growth for the underlying platform, it can lead to increased demand for the token. This can potentially lead to an increase in price.

Ultimately, the impact of newly minted tokens on the price action of a crypto is complex and subject to market forces.

The governance token is a unique and innovative way for the community to govern the dYdX Layer 2 protocol, and it will be interesting to see how the token distribution and unlock periods play out in the coming years.

beincrypto.com

beincrypto.com