Bluefin, the most well-known derivatives DEX within the SUI world, has just announced the integration of Google accounts as a means to access their crypto trading platform.

With a simple click, users can now create a profile and quickly access Bluefin without worrying about security and decentralization, thus improving the overall experience with the web3 product.

This is an important step for one of the niche DEXs in the SUI ecosystem that has grown significantly in recent months, increasing its user base and the number of locked funds.

Let’s see everything in detail below.

Summary

Bluefin, the DEX of the SUI crypto ecosystem, now allows access to the platform using a Google account

Bluefin, one of the most well-known DEX protocols in the SUI ecosystem, has publicly announced the integration of platform access through Google accounts, making the path to start trading crypto more immediate and intuitive.

Today many newcomers are struggling to sign up for a DEX through traditional onboarding methods of web3, which include connecting the non-custodial wallet and setting the reference chain.

Thanks to the practice of abstracting the account through the use of Google accounts, Bluefin can solve this problem, leading the user to interact with the SUI blockchain with a simple click and effectively facilitating potential new adoption in the cryptographic product.

It is worth noting how the new feature does not compromise the decentralization of the network and the security of the individuals who are interacting with the crypto platform.

Zabi, co-founder of Bluefin, a few weeks ago had already announced the news to his own community, pointing out that his team was working on the integration.

Bluefin is only two weeks away from introducing a redefined onboarding experience! seamlessly start trading with the ease of your Google account, all enabled by zkLogin – an exciting new native authentication primitive on @SuiNetwork https://t.co/P7nyDcsBKV

— Zabi | Bluefin ⛵️ (@zabimx) January 26, 2024

Thanks to this latest improvement, DEX Bluefin proves to be proactive in trying to bridge the gap between user experience with CEX and the expansion of new and emerging decentralized platforms.

The entire philosophy of the project based on SUI is based on the concept of “one-click trading“, which involves making the experience with crypto trading easy, fast, and secure.

It is worth noting how the integrated solution natively supports Multisignature and sponsored transactions, improving the efficiency and security of transactions.

Access with Google is fully compatible with existing OpenID Connect providers, allowing you to maintain the values of decentralization while using a predominantly centralized service.

Ahmad Jawaid, founder and CTO of Bluefin, commented on the news publicly stating the following:

“By leveraging cutting-edge cryptographic techniques, we have integrated zkLogin to radically transform the user authentication process on the Sui blockchain. By using zero-knowledge proofs (ZKP) and ephemeral public key commitments in JWTs, we eliminate the need for persistent management of private keys and relying on third-party credential verification. This system ensures that only a cryptographic proof and a temporary signature are sent to the chain, maintaining user privacy and security to the highest standards.”

We look forward to finding out in the coming months whether this new feature will attract new users and lead to the desired results.

Meanwhile, Bluefin continues its effort to make DeFi accessible to everyone, in the midst of an efficient trading experience.

Some metrics of the Bluefin platform

Bluefin, thanks to the integration of DEX access with the use of Google accounts, aims to increase its user base, already expanded thanks to the wave of enthusiasm that has flooded the SUI ecosystem between the end of 2023 and the beginning of 2024.

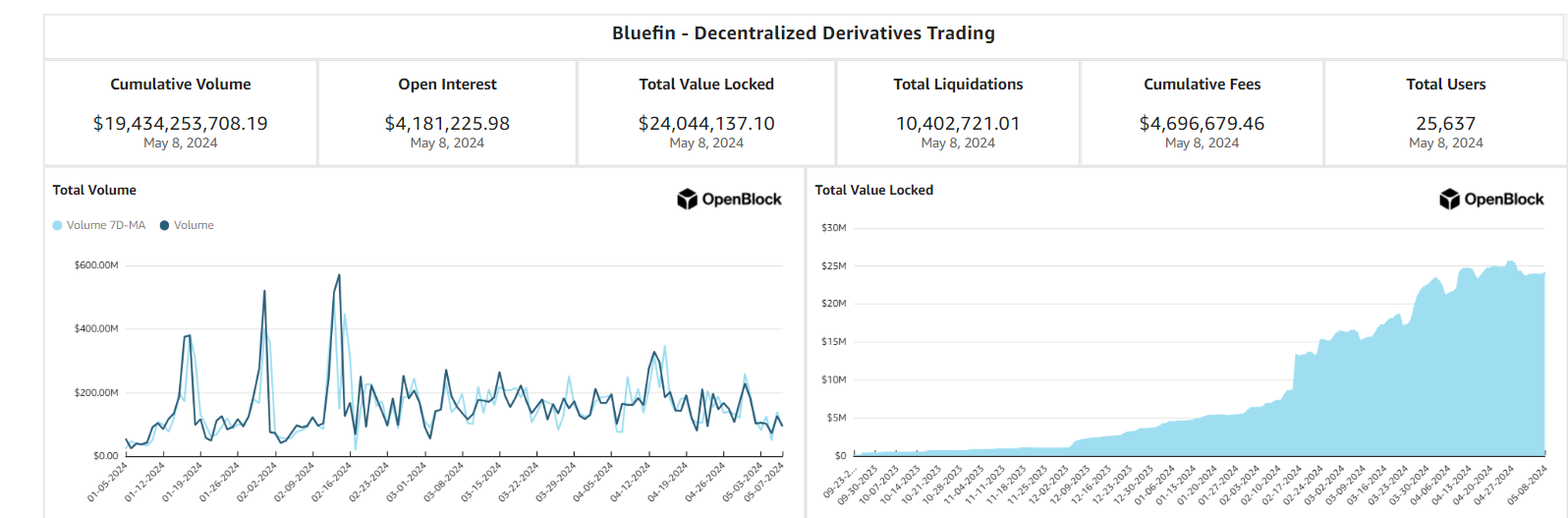

We remind you in this regard that in these first months of the year, Bluefin has recorded an unprecedented growth, surpassing the threshold of 20 billion dollars in cumulative volumes.

Bluefin has surpassed $20B in volume – powered by @SuiNetwork pic.twitter.com/nEMgHQxDgv

— Bluefin (@bluefinapp) April 18, 2024

As reported by the on-chain data platform Openblock Labs, the decentralized exchange has facilitated over 65% of the transaction volume within the SUI chain, establishing itself as the reference DEX for derivatives in the ecosystem.

The TVL, which at the beginning of December was just 1 million dollars in locked funds, has skyrocketed to about 24 million dollars today, for an increase of 24X.

Since its launch in October, Bluefin has raised a whopping $4.69 million and caused liquidations of $10.4 million.

The open interest of 4.18 million dollars is significant in the sense that, despite the moment of uncertainty in the market, traders are confident and maintain a high propensity for derivative trading.

Despite all the positive data, it must be acknowledged that volumes are significantly decreasing compared to the first months of 2024, when the 7-day average sometimes exceeded the threshold of 500 million dollars in daily exchange.

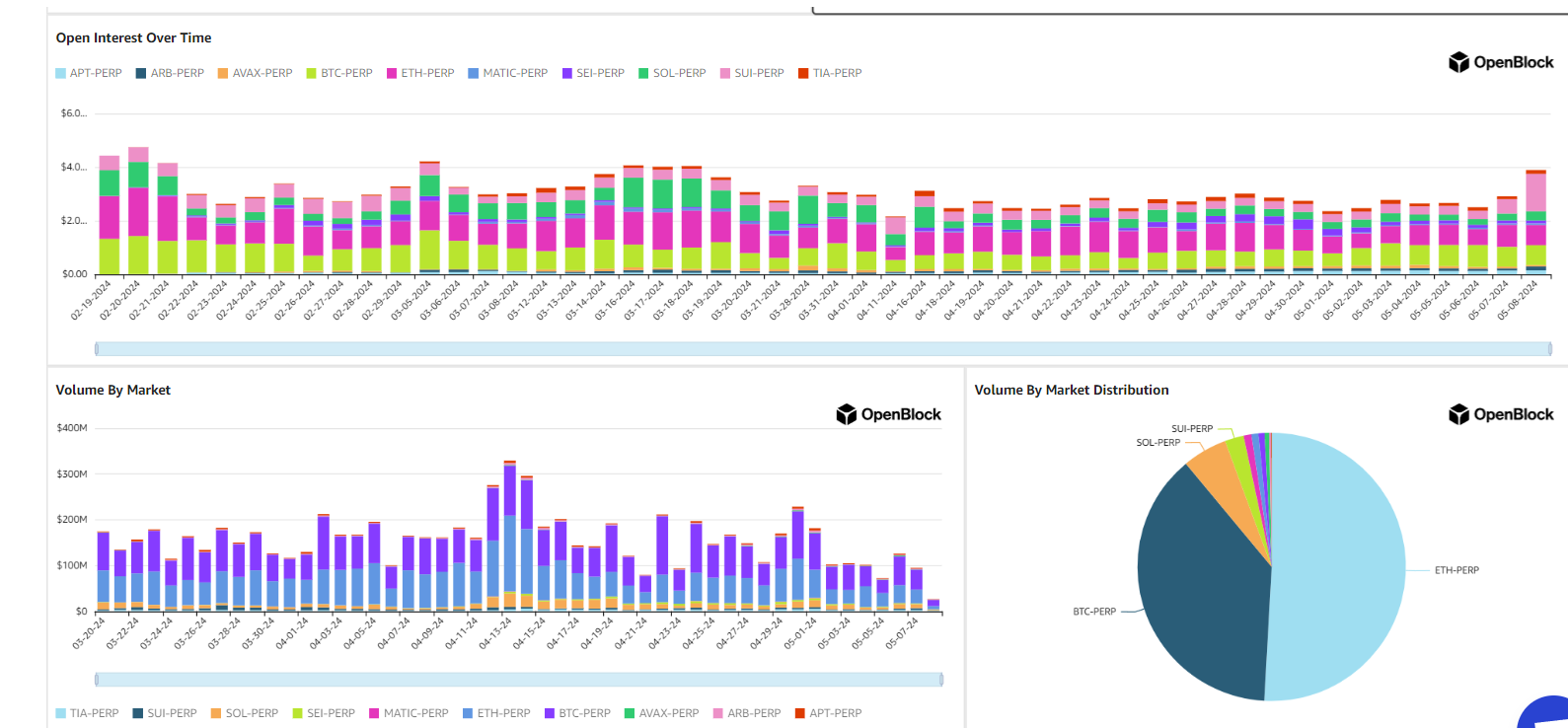

It is also very interesting to observe how the trading activity is distributed within Bluefin: over half of the volume (51%) is led by the ETH perpetual, with the second largest portion managed by the BTC perp (38%)

At the top of the podium, we find the SOL perp (5%), while the SUI perp manages much less value (2%). Overall, the top 4 markets account for 96% of the trading volumes recorded on the DEX.

Even on the open interest front, the story is the same, with trades in ETH, BTC, and SOL being the most popular choices among end users.

It is worth noting this very interesting last piece of data: until yesterday, the open interest on SUI’s perpetual amounted to just $536,000, while today it has more than doubled to $1.39 million.

The influx of money, according to OpenBlock Labs data, seems to be attributable to the opening of new short positions against SUI, which today is losing 6% of its value on the market.

en.cryptonomist.ch

en.cryptonomist.ch