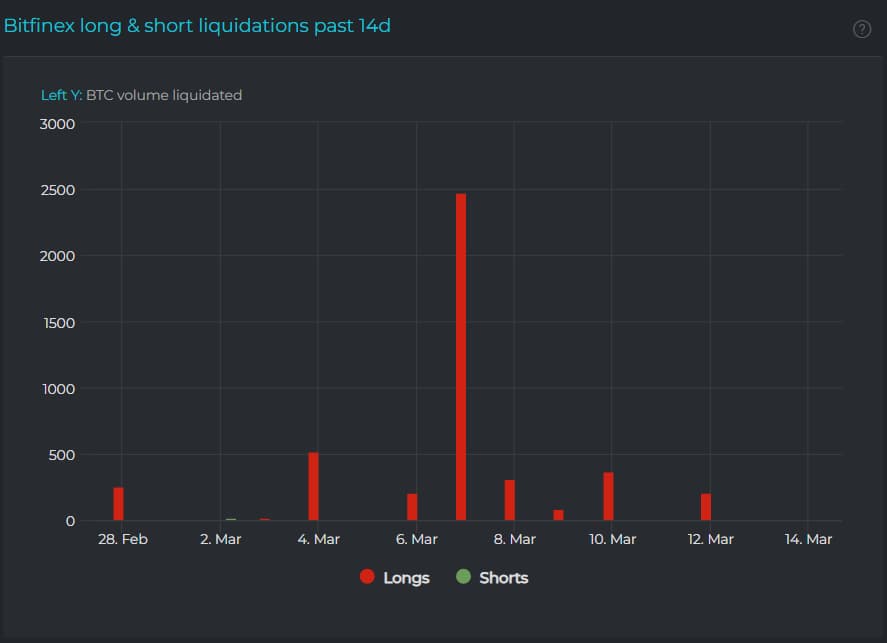

Liquidations have traditionally been used as a gauge of market sentiment and direction, and judging by the Bitcoin (BTC) trades on Bitfinex, traders are feeling the heat of a long squeeze in March 2025.

According to the data Finbold retrieved from the crypto lending analytics platform Datamish on March 14, Bitfinex saw a wave of liquidations this month, with long positions taking a devastating hit

Specifically, out of the total of 4,226.8 BTC liquidated, 4,196.9 of those were related to long positions, a staggering 99.29%.

Generally, such long and short squeezes occur when the market moves against traders who made a leveraged trade – borrowed money to set up their investment – thus rendering the collateral (margin) insufficient and forcing the closing of the position.

Why are Bitcoin long positions getting wiped in March?

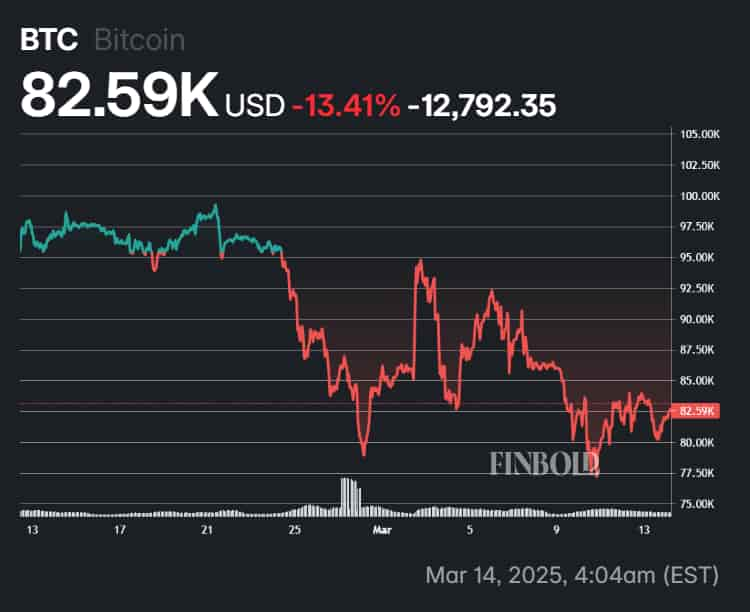

Examining Bitcoin’s price action in 2025 and March, the long squeeze appears to be a natural extension of the cryptocurrency market bloodbath.

Though BTC has been showing resilience in the $80,000 to $83,000 range, even such a support level appears somewhat underwhelming, given multiple dips, including the one toward $77,000 on March 10.

Additionally, though the press time price range remains impressive when compared with historical levels, it, yet again, becomes bearish given that Bitcoin hit its all-time highs (ATH) above $109,000 as recently as January.

In the last 30 days, the world’s premier cryptocurrency dropped 13.41% to its press time price of $82.596, while the March share of the drop is a more modest 3.5%. Still, the month featured substantial volatility with highs above $94,000 and lows near $77,000.

What is next for Bitcoin in 2025

Despite high hopes that Bitcoin’s bullish cycle is not over, the coin has slowly been forming a pattern akin to the summer of 2024. Specifically, between June and November of the year, BTC was on a slow downtrend, continuously finding lower lows followed by lower highs.

During the time frame and akin to the cryptocurrency’s March performance, it managed to maintain a somewhat stable level near $60,000. Such a trajectory was abruptly reversed with Donald Trump’s November re-election.

At press time, no comparable events are scheduled for the future, making the ending of the current turmoil – provided Bitcoin’s performance truly mirrors the previous summer – difficult to speculate on.

Still, previous analysis, regulatory developments, institutional adoption, and historical halving cycles have left many investors optimistic that a breakout to a new high will occur in 2025.

Featured image via Shutterstock

finbold.com

finbold.com