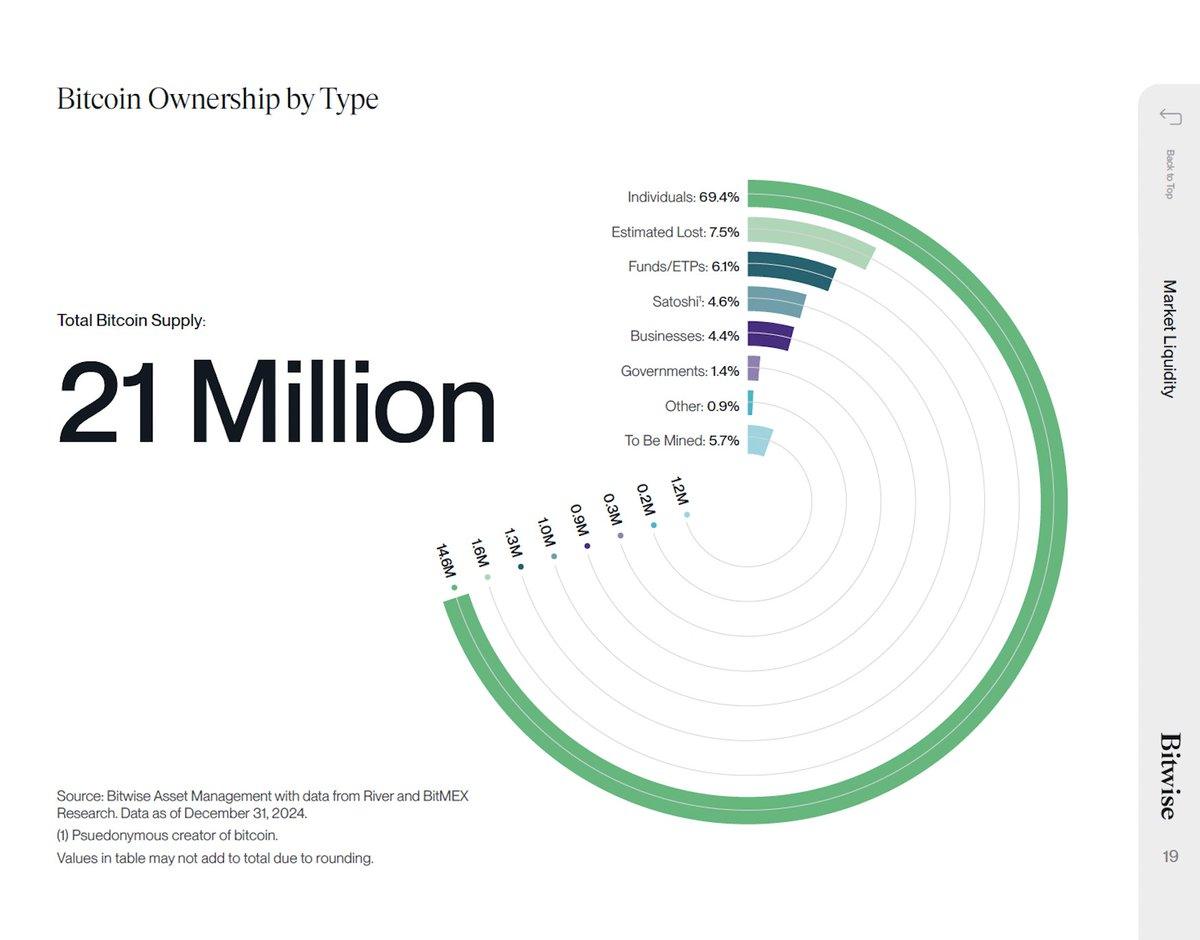

As bitcoin hovers just above $97,000 per unit, conversations are intensifying over the possibility of a future supply squeeze. On Monday, digital asset manager Bitwise highlighted a crucial reality: if corporations and governments seek to acquire substantial quantities of $BTC, they will need to persuade current holders to part with their assets—a task that may prove increasingly difficult.

The Bitcoin Liquidity Squeeze: Are Institutions Running Out of Options?

Over the past year, spot bitcoin exchange-traded funds (ETFs) have accumulated more than 1 million $BTC, now collectively managing $113.09 billion worth of bitcoin—equivalent to 5.96% of the cryptocurrency’s total market capitalization. In parallel, a growing number of publicly traded companies are stockpiling bitcoin as part of their corporate treasuries, with Microstrategy steadily approaching the 500,000 $BTC threshold.

Meanwhile, discussions have surfaced regarding governments potentially deploying strategic bitcoin reserves (SBRs). On Monday, Bitwise, a digital asset manager overseeing various $BTC and cryptocurrency funds, remarked on the social media platform X that, sooner or later, these entities will have to convince everyday holders to part with their $BTC.

“If companies and governments want to buy bitcoin, they’ll largely have to buy it from individuals who are willing to sell,” Bitwise stated on X sharing an image. “That market dynamic between buyers and sellers could get very interesting.”

On Sunday, the X account dubbed ‘The Modern Investor’ posted that over-the-counter (OTC) markets have only a small amount of $BTC left. A few more large purchases by entities could exhaust all remaining institutional supply, leaving almost no bitcoin available.

He stated:

The accelerating depletion of accessible bitcoin reserves highlights a pivotal shift in market dynamics, placing unprecedented leverage in the hands of individual holders. As institutional and governmental demand collides with finite supply, the reluctance of retail investors to divest could amplify scarcity-driven price pressures. This tension may catalyze innovative financial frameworks aimed at redistributing ownership without destabilizing the asset’s perceived value as digital gold.

news.bitcoin.com

news.bitcoin.com