Bitcoin has struggled to keep pace with gold in 2025, as geopolitical instability and Trump’s trade war policies push investors toward traditional safe-haven assets.

Gold Outperforming Bitcoin in 2025

Bitcoin, which outperformed most asset classes last year, is now lagging behind gold, as investors flock to stability amid growing geopolitical tensions.

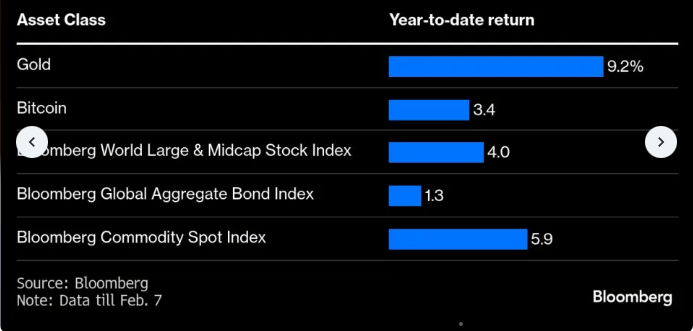

According to a recent Bloomberg article, the U.S.-China trade war, tariff threats, and Trump’s recent foreign policy remarks have fueled gold’s rally, pushing it to a record $2,882 per ounce. While gold has surged 9% year-to-date, bitcoin has gained just 3%, remaining 10% below its peak.

Despite bitcoin’s built-in scarcity, it has failed to behave as a true store-of-value asset. Unlike gold, which traditionally thrives during economic uncertainty, bitcoin’s price action remains linked to tech stocks.

Aoifinn Devitt, senior investment advisor at Moneta Group LLC, explained that bitcoin is still perceived as a risk-on asset rather than a true hedge against fiat currency. “In time, it will have its characteristics that act separate and apart from markets, but at this point, it is behaving as the riskiest of risk-on assets.”

However, bitcoin advocates remain optimistic. Paul Howard, Senior Director at Wincent, believes that spot Bitcoin ETFs will help stabilize price fluctuations, allowing bitcoin to gradually evolve into a true store of value, similar to gold in the long run.

news.bitcoin.com

news.bitcoin.com