KULR Technology Group, Inc. (NYSE: KULR) is a company focused on advanced energy management solutions, targeting a $24 billion market for thermal management systems. The company develops technologies aimed at improving safety and efficiency in renewable energy, aerospace, and defense sectors. Its products include thermal interface materials, lightweight heat exchangers, and systems designed to address lithium-ion battery thermal runaway—a critical safety issue in energy storage and electric vehicles. KULR’s offerings are tailored for industries experiencing rapid electrification and transitions toward more sustainable energy systems.

On December 4, KULR announced a new strategy: incorporating Bitcoin as a primary asset in its treasury program. With over $12 million in cash reserves, the company’s Board of Directors committed to allocating up to 90% of surplus cash to Bitcoin. This decision reflects the company’s belief in Bitcoin’s long-term value and its role as a hedge against inflation, geopolitical risks, and other macroeconomic trends.

CEO Michael Mo explained that Bitcoin’s growing global acceptance—from companies and financial institutions to governments—makes it a unique asset for strengthening KULR’s financial position. By adopting a Bitcoin treasury strategy, KULR aims to enhance its ability to manage capital responsibly while expanding its operations.

Unlike some companies that adopt a rigid approach to Bitcoin investments, KULR emphasized its adaptability. The company’s acquisitions will be guided by market conditions and cash flow requirements, allowing for adjustments based on evolving strategic considerations. This cautious yet ambitious approach underscores KULR’s commitment to balancing innovation with financial prudence.

On December 26, KULR announced its first major step in this strategy: the purchase of 217.18 Bitcoin for approximately $21 million at an average price of $96,556.53 per Bitcoin. This purchase marks the beginning of an ongoing series of Bitcoin acquisitions as the company deploys its surplus cash. To ensure secure storage and transactions, KULR partnered with Coinbase Prime for custody, USDC, and self-custodial wallet services. This partnership demonstrates KULR’s focus on leveraging institutional-grade platforms to support its treasury strategy.

KULR’s Bitcoin strategy has drawn comparisons to that of MicroStrategy, a software analytics company that has made Bitcoin the centerpiece of its financial strategy. Under Michael Saylor’s leadership, MicroStrategy has aggressively converted its cash reserves into Bitcoin, even issuing debt to fund additional purchases. While KULR’s approach may appear similar, there are key differences that set the two strategies apart.

Firstly, KULR’s strategy is more conservative. The company explicitly ties its Bitcoin acquisitions to surplus cash, ensuring that operational and cash flow needs are prioritized. In contrast, MicroStrategy has taken a more aggressive stance, leveraging financial instruments such as bonds to acquire Bitcoin on a much larger scale. This distinction highlights KULR’s focus on maintaining financial flexibility while gradually building its Bitcoin holdings.

Secondly, KULR frames its Bitcoin strategy within the broader context of its core business and market trends. By aligning its decision with increasing governmental and institutional acceptance of Bitcoin—such as Senator Cynthia Lummis’s proposal for a national strategic Bitcoin reserve and President-Elect Trump’s comments about a national Bitcoin stockpile—KULR positions itself as a forward-thinking company that is both innovative and adaptable. MicroStrategy, on the other hand, has largely positioned itself as a Bitcoin-centric entity, with its corporate identity heavily intertwined with the cryptocurrency.

Lastly, KULR’s measured approach includes a commitment to evaluating market dynamics and evolving circumstances. This adaptability contrasts with MicroStrategy’s unwavering focus on Bitcoin accumulation, regardless of market conditions. By maintaining a balance between ambition and caution, KULR’s strategy reflects a nuanced understanding of both the opportunities and risks associated with Bitcoin.

Today, December 26, KULR’s stock has surged significantly, closing at $4.56, a remarkable 33.19% increase from the previous day’s close of $3.42. This spike appears to be driven by the company’s announcement earlier in the day of its $21 million Bitcoin purchase, marking the first major step in its treasury strategy.

KULR Technology Group, Inc. ( $KULR ) begins its Bitcoin Treasury strategy with the purchase of 217.18 $BTC for $21M, averaging $96,556 per BTC.

— KULR Technology (@KULRTech) December 26, 2024

Using $COIN ’s Prime platform for custody and wallets, KULR is allocating up to 90% of surplus cash to BTC.https://t.co/GClCvKTjUH pic.twitter.com/DFqAxDm0vS

The news has generated considerable interest among investors, with trading activity reflecting heightened enthusiasm for the company’s forward-looking financial decisions.

Looking at KULR’s performance over the past one-month period, the stock has shown extraordinary growth, climbing 486.36% from $0.77 to $4.51. This sharp upward trajectory began gaining momentum in mid-December. The sustained rise highlights market optimism about KULR’s ability to execute its strategy effectively while maintaining focus on its core business areas of energy management and thermal technologies.

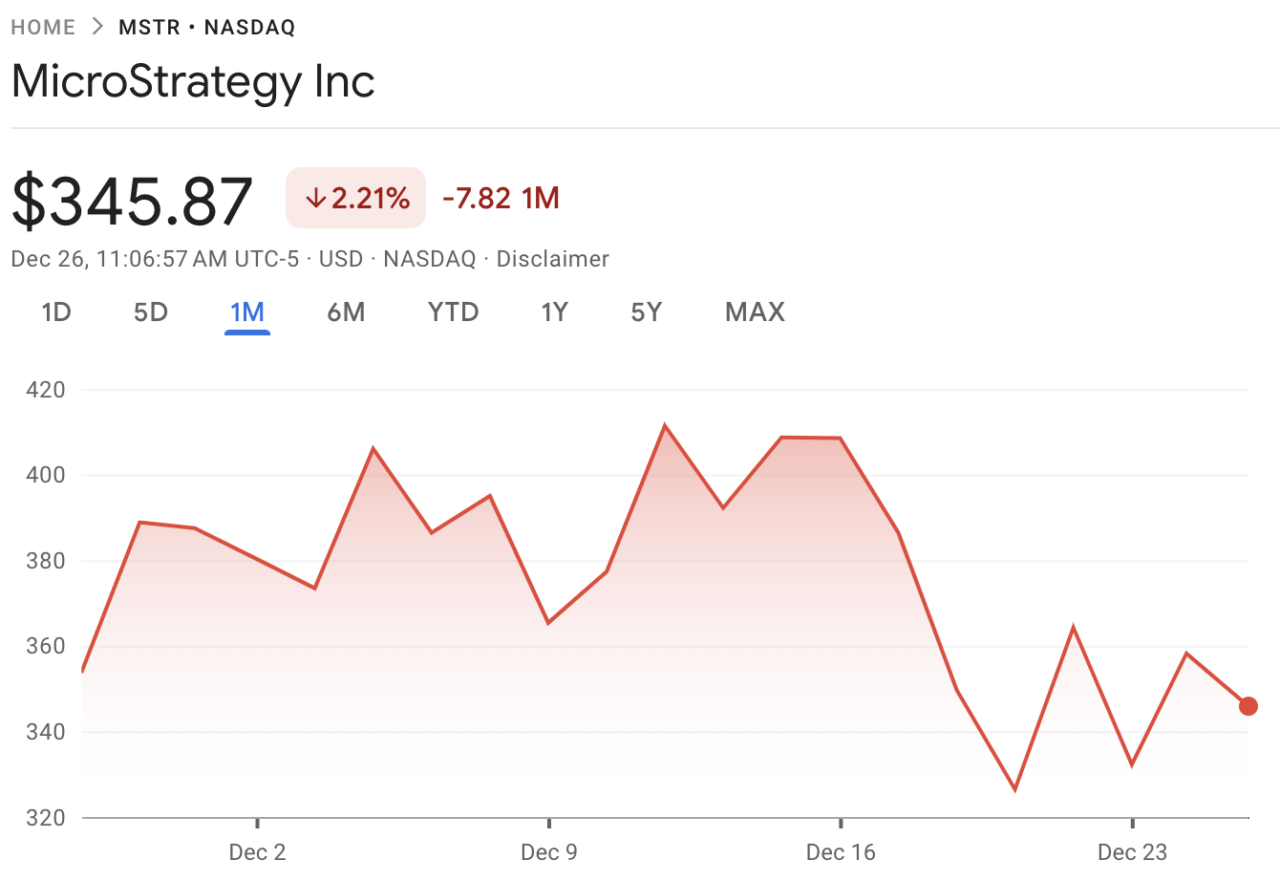

In contrast, MicroStrategy (MSTR), a company well-known for its aggressive Bitcoin treasury strategy, has faced a different trajectory. Today, MicroStrategy’s stock price has dropped by 3.38%, currently trading at $346.07 compared to its previous close of $358.18. Over the past month, MSTR has seen a decline of 2.21%, with its stock price moving from $353.69 to $345.87. This volatility reflects a more challenging period for MicroStrategy, potentially tied to broader market trends or Bitcoin’s performance.

The diverging stock performances of KULR and MicroStrategy highlight key differences in market perception and strategy execution. While KULR has been gaining investor confidence, as evidenced by its substantial one-month gain of 486.36%, MicroStrategy’s stock has struggled to maintain upward momentum. This contrast may stem from KULR’s cautious and adaptable approach to integrating Bitcoin into its treasury strategy, in contrast to MicroStrategy’s more aggressive and highly leveraged model. Additionally, MicroStrategy’s challenges could also be influenced by increased short selling, as some investors may be betting against the company’s Bitcoin-heavy strategy in light of market volatility or broader economic concerns.

Featured Image via Pixabay

cryptoglobe.com

cryptoglobe.com