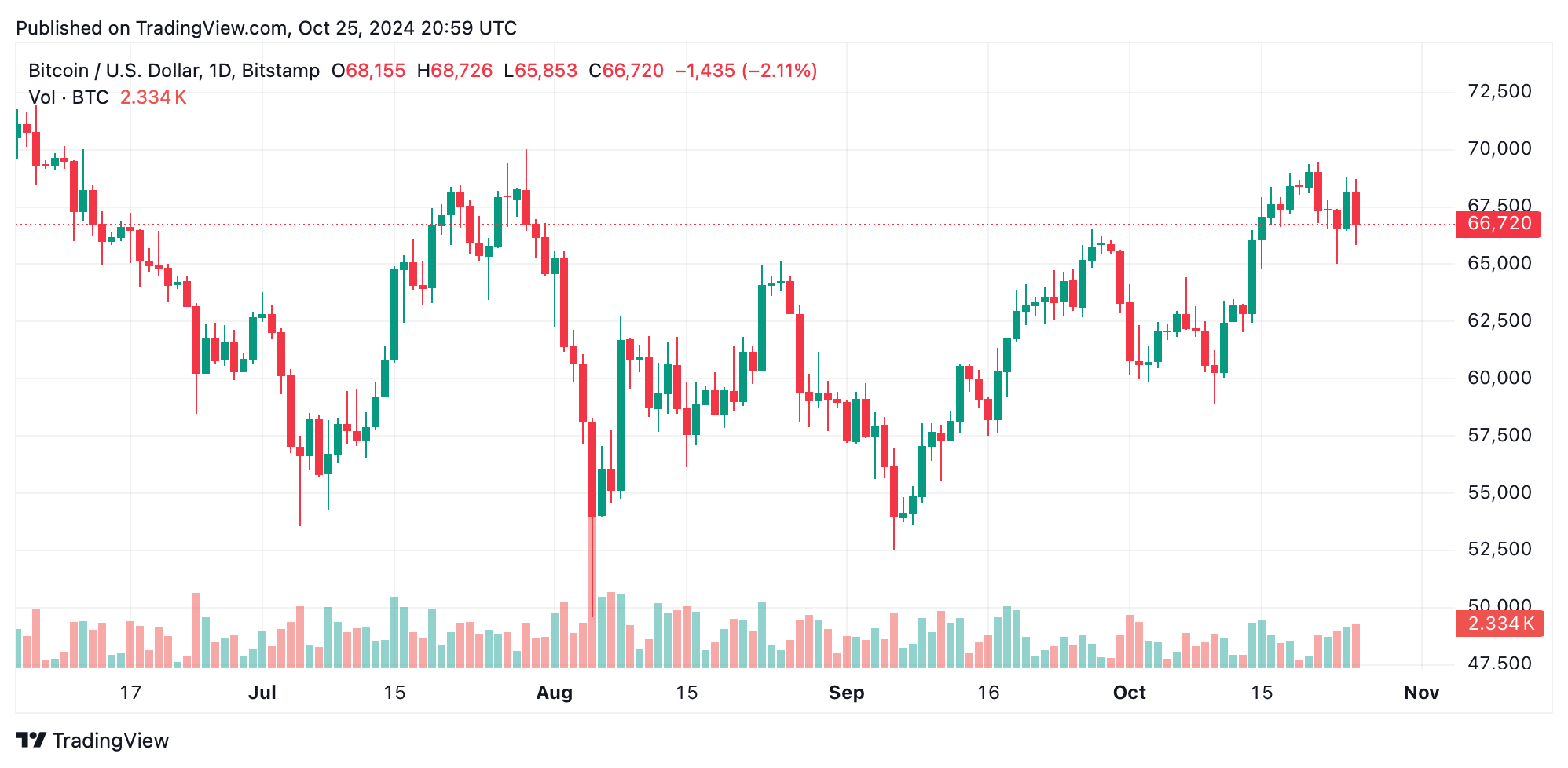

Bitcoin’s price danced through a roller-coaster ride on Friday, hitting an intraday high of $68,700 before plunging to a 24 hour low of $65,853.

Speculation Unsettles Bitcoin Market – Are We in for More?

The dip came right after the Wall Street Journal published claims that Tether was allegedly facing a probe by U.S. authorities. Both Tether and its CEO quickly dismissed the report as merely “regurgitating old noise.” Still, the story had an impact on markets, pushing bitcoin (BTC) below the $66,000 mark at 2:10 p.m. EDT. By 4:59 p.m., the price had regained some ground, hovering in the $66.7K range.

This slump triggered widespread liquidations in crypto derivatives markets, wiping out $233 million in the past day. A total of 80,771 traders saw their positions liquidated, with $169 million in long positions affected as bitcoin had been edging toward $69,000 before the Tether news hit. Out of the liquidated long positions, $34 million were BTC long trades, while $33.92 million came from ether (ETH) longs. The largest single liquidation took place on Binance, with a trader losing $3.59 million in a BTC position.

Bitcoin’s price swings on Friday highlight how sensitive the market remains to regulatory news and speculation. Tether, widely used to maintain liquidity and buffer against volatility, is pivotal in crypto trading, so any hint of regulatory trouble tends to ripple across the market. Similar reactions followed major events like China’s crackdowns on crypto in 2013, 2017, and 2021, the collapse of Mt Gox in 2014, Tesla’s BTC endorsement in February 2021, and the fall of FTX with its subsequent contagion fears in 2022.

The upcoming 2024 U.S. election, with former President Donald Trump and current Vice President Kamala Harris in the race, is expected to be a key influence on bitcoin’s trajectory due to their contrasting cryptocurrency stances. Trump has shown support for crypto, leaning towards lighter regulations, while Harris, though less outspoken, may favor maintaining the current regulatory approach. Many believe a Trump win could ease restrictions, possibly boosting BTC prices. In contrast, a Harris victory might usher in stricter regulation, which could curb institutional interest and reduce BTC demand.

news.bitcoin.com

news.bitcoin.com