Investment management company VanEck has set a wild target for Bitcoin. They think it could hit $3 million per coin by 2050. They believe Bitcoin could get integrated into global finance, even replacing traditional currencies as a reserve currency.

VanEck’s report is pretty optimistic about Bitcoin’s future. They think Bitcoin will solve its current scalability problems. Right now, Bitcoin can’t handle a huge number of transactions at once, which is a big problem if it’s going to be used worldwide.

But VanEck believes that new technologies, known as Layer-2 solutions, will fix these issues. These solutions are expected to make Bitcoin faster and more efficient.

Bitcoin will hit $3 million by 2050

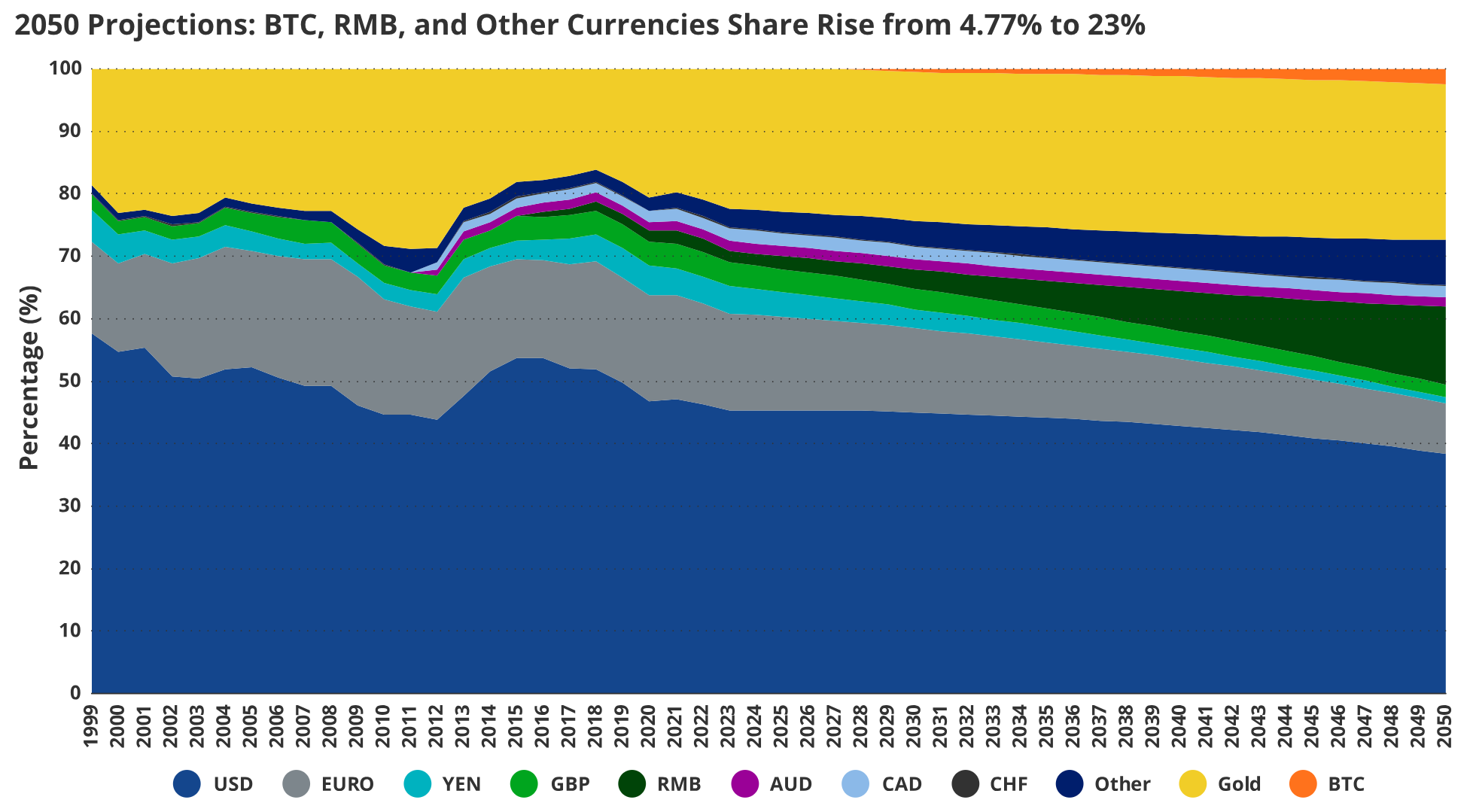

The report goes further to say that by 2050, Bitcoin could be used for 10% of all international trade and 5% of domestic trade. That’s a huge chunk of the global economy.

They also predict that central banks might start holding Bitcoin, with these institutions possibly keeping about 2.5% of their assets in Bitcoin.

If all this happens, they say the price of Bitcoin could skyrocket to $3 million per coin, giving it a total market cap of around $61 trillion.

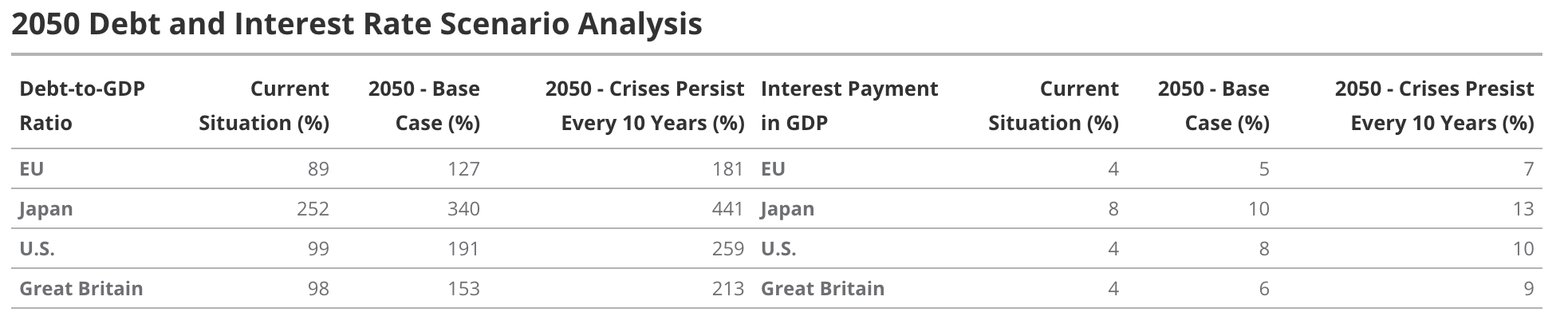

They also estimate that Layer-2 solutions could add another $7.6 trillion in value. The report also points out that the current International Monetary System (IMS) is not in great shape.

Trust in traditional reserve currencies like the US dollar is dropping. This is partly because of excessive government spending and some questionable geopolitical decisions.

What makes Bitcoin special

So why is Bitcoin such a strong candidate to take over global finance? VanEck points out that first, Bitcoin is decentralized and operates on a trustless system. This makes it resistant to corruption and political manipulation.

It’s also neutral and has an immutable monetary policy, meaning its supply is capped at 21 million coins. This scarcity gives it a unique value compared to traditional currencies, which can be printed in unlimited quantities.

Another important point is Bitcoin’s strong property rights. Once you own Bitcoin, it’s yours. There’s no way for governments or other entities to seize it without your private key.

This feature is increasingly attractive in a world where asset seizures and financial censorship are becoming more common. VanEck also mentions that Bitcoin’s design removes the need for intermediaries like banks or payment processors.

The challenges

But let’s not get ahead of ourselves. Bitcoin has a lot of things to overcome. One of the biggest issues is its current inability to handle a large volume of transactions.

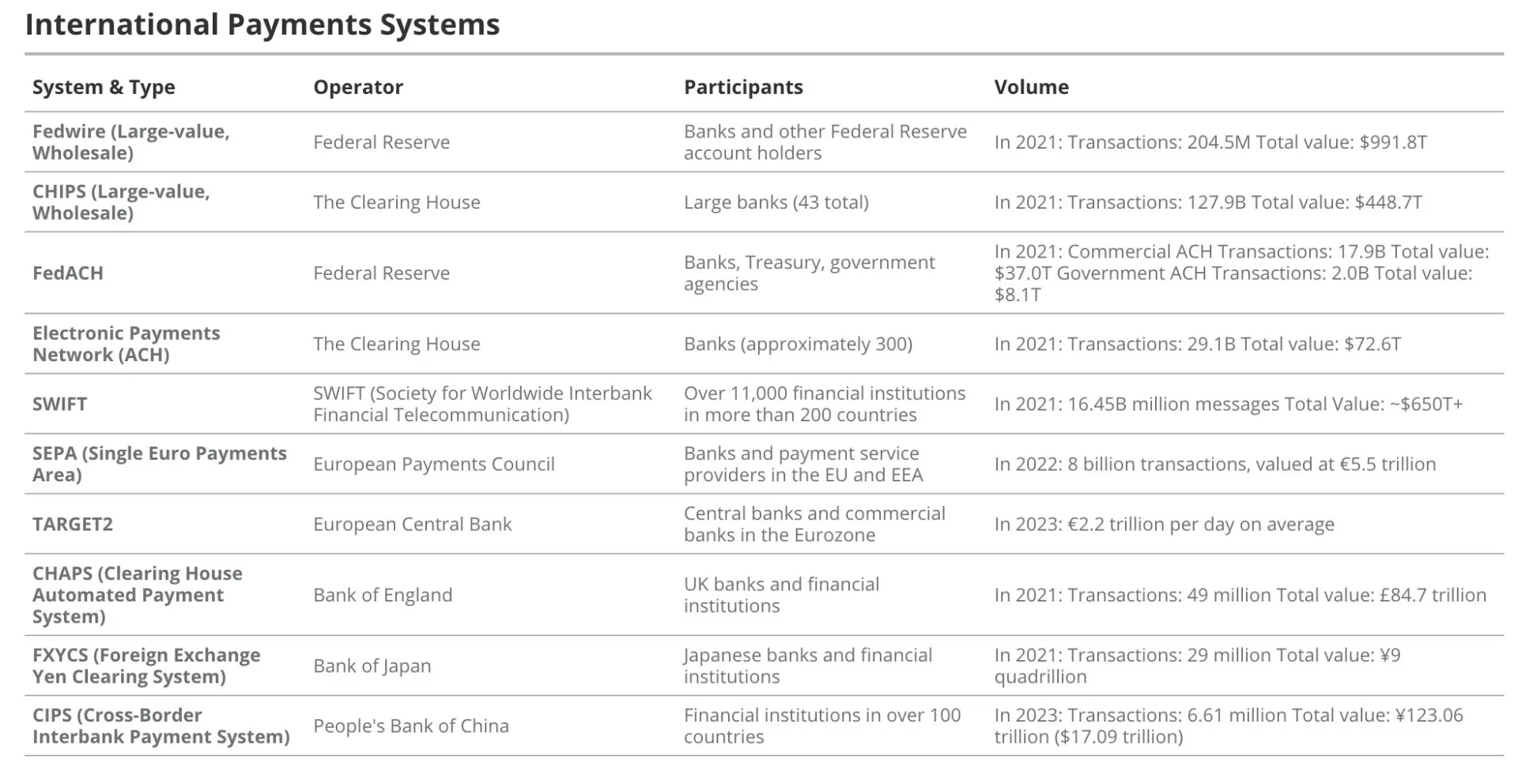

At the moment, Bitcoin can process about 7-15 transactions per second. Compare this to the SWIFT system, which handles 45 million messages daily, and you see the problem.

Bitcoin’s network is simply not fast enough for global trade on a large scale.

Also, Bitcoin doesn’t support complex smart contracts, which are needed for creating sophisticated financial applications. So for more complicated financial transactions, users would still need to rely on traditional systems or Ethereum.

This limitation is a deliberate design choice to keep the network secure and decentralized, but it also means that Bitcoin might not be as versatile as some other options.

cryptopolitan.com

cryptopolitan.com