Bitcoin’s ($BTC) weekend share of trading volume has reached an all-time low in 2024, with a trending dominance of weekdays. This trend highlights an important shift for the leading cryptocurrency, approaching the traditional finance market behavior as institutions take over.

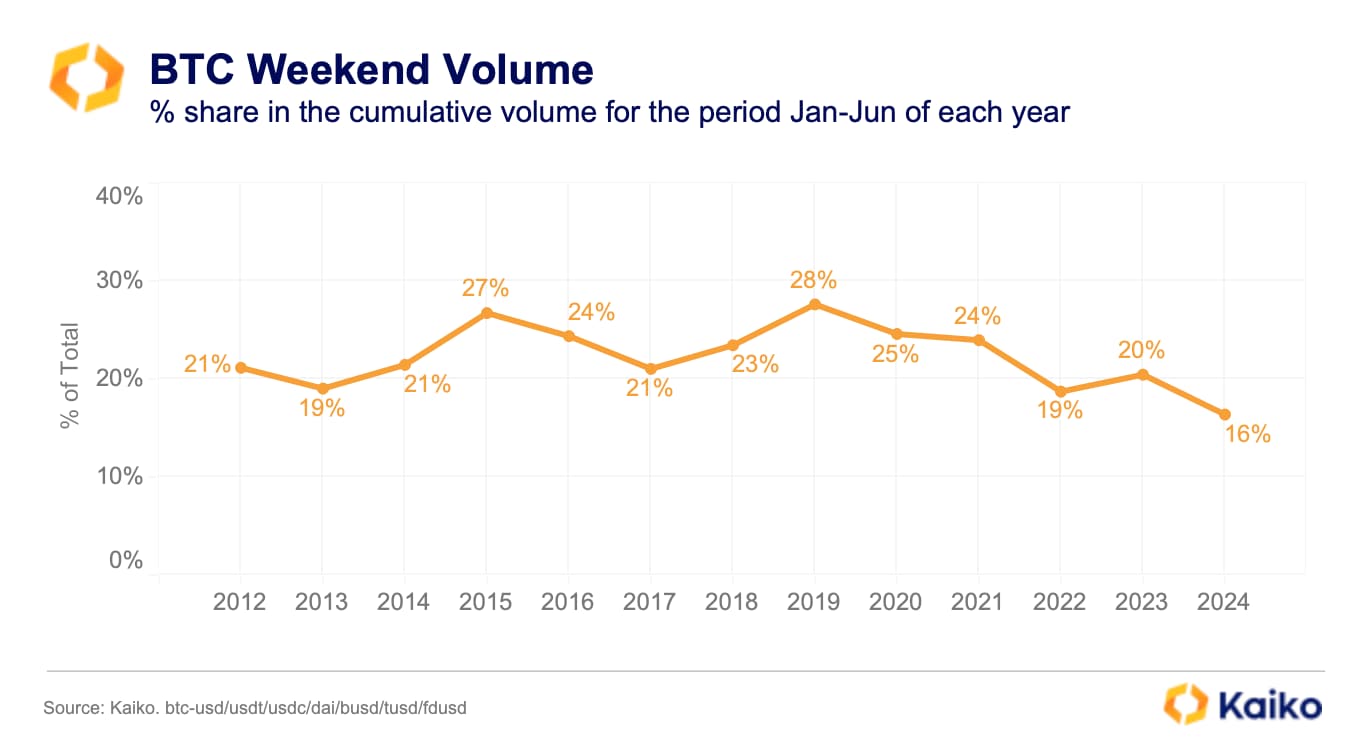

This data was recently highlighted in a Kaiko report comparing the trading volume on weekends to weekdays. Notably, Bitcoin registered a 16% share of the trading volume during the weekends from January to June. This marks an all-time low for the same period, with Kaiko looking at data from seven $BTC pairs since 2012.

Previously, higher lows were in 2022 and 2013, both with 19% of the overall trading volume happening on weekends. Moreover, there has been a notable downtrend since 2019’s 28% peak, with weekend volume making lower highs every two years.

The report suggests Bitcoin spot ETFs could be partially blamed for the record lows, driving the action to weekdays. These financial products operate under traditional finance rules, so they are limited to Wall Street’s weekday operations, no different from stocks and other exchange-traded funds.

Bitcoin is not dying, but its trading behavior has changed

Interestingly, the weekend share downtrend is just one piece of the puzzle that shows Bitcoin’s changing behavior.

The leading cryptocurrency once started in a small community of cypherpunks, following a vision of being an electronic peer-to-peer cash system whose core value was based on the non-reliance of intermediaries to fix the issues within traditional finance. A financial system that never sleeps and an asset that its users could do self-custody and avoid the monetary debasement from inflation and fractional reserves.

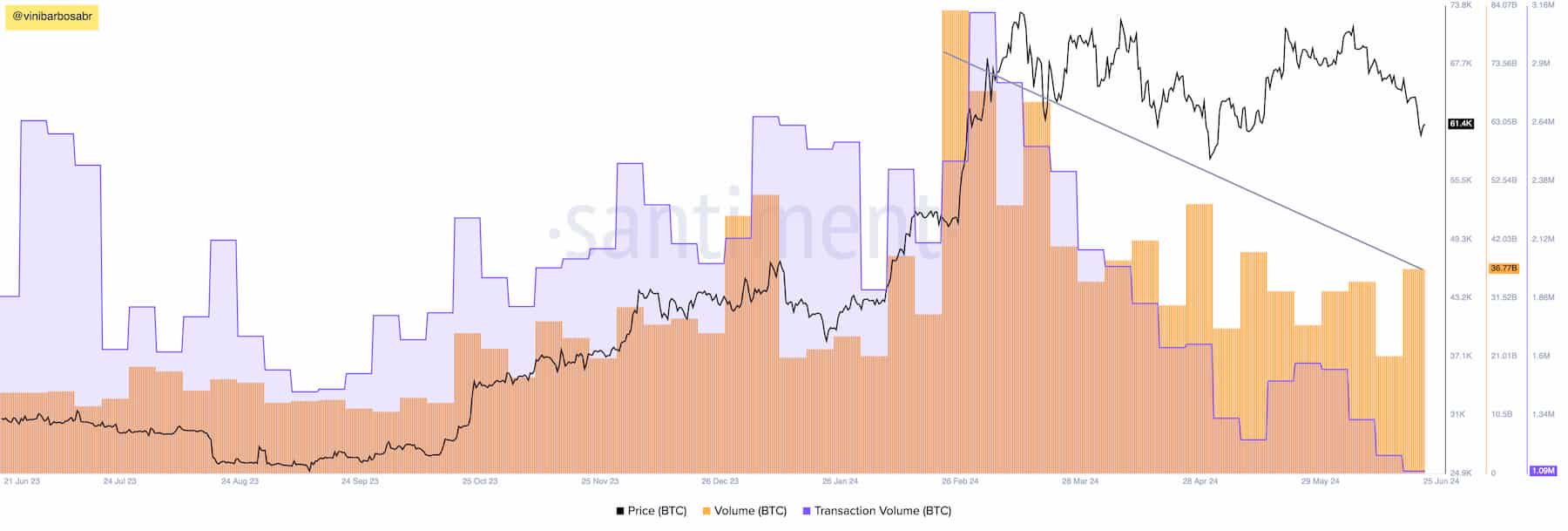

However, the market has seen diminishing on-chain and spot trading volumes. Conversely, derivatives and ETF volumes have been increasing in the opposite direction of the first two, challenging the original vision. Finbold reported the aforementioned divergence on June 2.

According to data gathered from Santiment’s SanBase Pro on June 25, the scenario remains the same by press time. $BTC trades in a price range, currently at $61,400, while trading and transaction volumes make lower highs.

Furthermore, a significant part of this volume is made inside centralized databases from crypto exchanges, not using the blockchain. For example, a report from Altcoinbuzz highlighted how BlackRock (NYSE: BLK) can borrow Bitcoin from Coinbase without providing a 1:1 holding ratio, which could suggest the use of what the market calls “paper bitcoin,” allowing unbacked short-selling.

You read it right: BlackRock has been settling its $BTC transactions with Coinbase without using Bitcoin's settlement network.

— Vini Barbosa (@vinibarbosabr) May 20, 2024

We are not talking about "buying a coffee," but institutional settlements of a $18.5 billion fund.

The reason: Transaction speed and fees.

Got it now?… pic.twitter.com/SxzAcHyzlJ

Only time will tell whether these changes could positively or negatively affect the price of Bitcoin in the long run. Right now, it is clear that $BTC is going through a behavior change, and investors must evaluate these changes to make decisions accordingly.

finbold.com

finbold.com