While there are crypto-specific factors that can boost Bitcoin, there’s no denying that prices are often influenced by macroeconomic and global events.

Sometimes, Bitcoin’s price can suddenly leap or plunge without warning.

And in many cases, this is because of macroeconomic and global events outside of $BTC’s control — rather than sentiment directly related to the cryptocurrency itself.

Here, we’ll explore the data and developments that can have an outsized influence on the digital asset’s performance.

Inflation

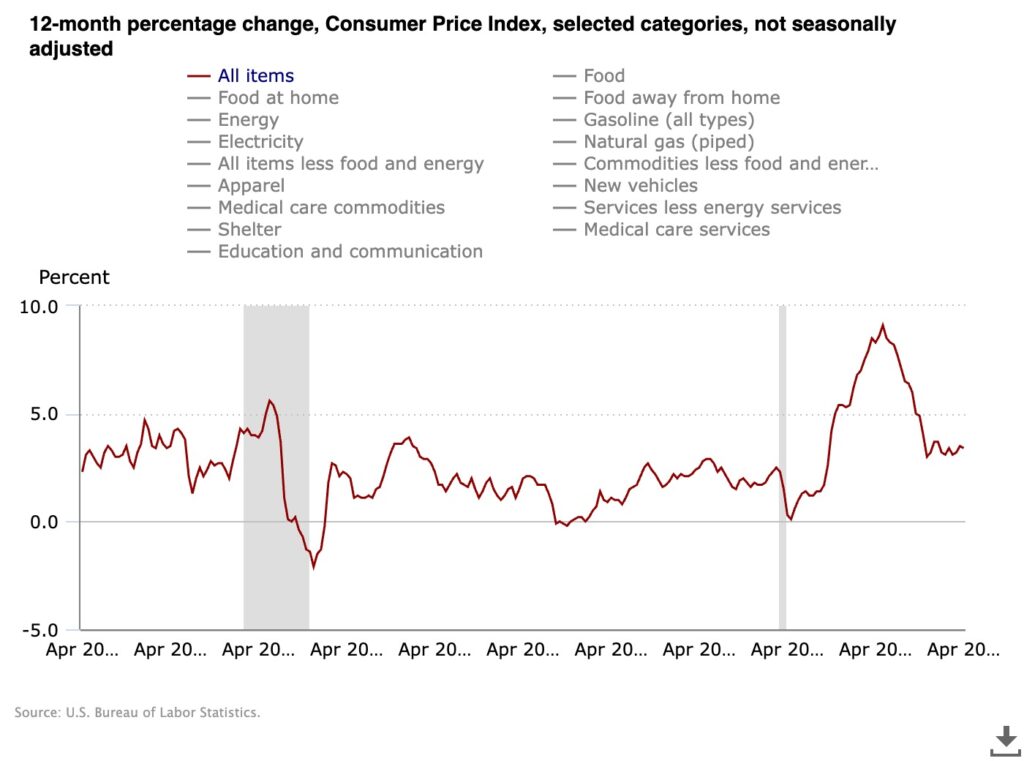

After the cost of living in the U.S., U.K., and beyond surged to 40-year highs, inflation has become a closely watched barometer of health in major economies.

The likes of the Federal Reserve and the Bank of England have a long-established target of 2% for the Consumer Price Index, but this went out the window after the coronavirus pandemic.

American CPI spiked to a jaw-dropping 9.1% in June 2022 — and over in Britain, double-digit highs of 11.1% were recorded in October of that year. Central bankers in both nations have admitted inflation has proven sticky, and difficult to bring back under control.

Bitcoiners often like to refer to dollar and pound inflation as an invisible thief because of how it erodes spending power — and point to the fact that $BTC has a fixed supply of 21 million coins.

For that reason, you may think that worse-than-expected CPI readings would serve as good news for Bitcoin’s price, and increase demand for this digital asset.

But a lot of the time, the opposite has proven to be true.

A classic example of this came in May 2024, when CPI reached at 3.4% — less than what analysts had been expecting.

In the four hours after the data was released, Bitcoin surged from $62,650 to $65,000, a considerable uptick of 3.8%. Wall Street also ascended to record highs.

And that brings us neatly on to the reason for this little rally.

Interest rates

When Bitcoin launched in January 2009 — a cryptocurrency that was designed as a protest to how the 2007/08 global financial crisis was handled — the Fed’s interest rate stood at 0.25%, lows that hadn’t been seen at any point in the previous 40 years.

They stayed there for about six years, before beginning to climb slightly as confidence in the bounceback from the recession grew. Then the coronavirus pandemic happened, and they were slashed to 0.25% once again.

Critics say this ushered in an era of free money — not least because it lowered the cost of borrowing. Consumers were incentivized to spend, especially considering the returns in savings accounts would have been tepid to say the least. But as inflation grew red hot with alarming speed, central banks needed to slam on the brakes and hike interest rates quickly to their current level of 5.5%, a high not seen since 2001.

Unfortunately, bumper interest rates tend to be bad news for Bitcoin. That’s because appetite dwindles for riskier assets, as investors can get pretty healthy returns on their cash by parking it in savings accounts or bonds.

For months and months now, there has been a growing expectation that the Fed will finally move to cut interest rates — and analysts believe this could be a catalyst for Bitcoin. Back in March 2024, a note by Deutsche Bank strategists said:

“More investors will likely seek out higher-yielding alternative assets as Treasury returns decline. This flow of capital into nontraditional investment classes like cryptocurrencies could further support an ongoing rally in digital currency prices.”

Marion Laboure and Cassidy Ainsworth-Grace

The stock market

At times, there has been a close correlation between Bitcoin and flagship indices such as the S&P 500 or the tech-heavy Nasdaq 100.

And you could argue that this will move even closer now exchange-traded funds based on $BTC’s spot price are in operation on U.S. markets — allowing institutional investors to gain exposure to the flagship cryptocurrency’s price fluctuations without owning it directly.

When it comes to the global events that can influence Bitcoin’s value, unrest in the Middle East has proven to have a dramatic effect on $BTC several times in recent months.

One such decline was seen in the middle of April, when it was announced that Iran had launched a drone and missile attack against Israel. Bitcoin plunged from $70,000 to $62,000 in a matter of hours as the market digested the news, but rather quickly rebounded.

There was another drop a few days later when Israel retaliated, amid fears that existing conflict in the region could widen.

While there are specific factors that can boost Bitcoin — including excitement around halvings, news of nation-state adoption or accelerating beyond psychologically significant price points — there’s no denying that $BTC’s fortunes can also hinge upon the dollar-based economy it was designed to offer an alternative to.