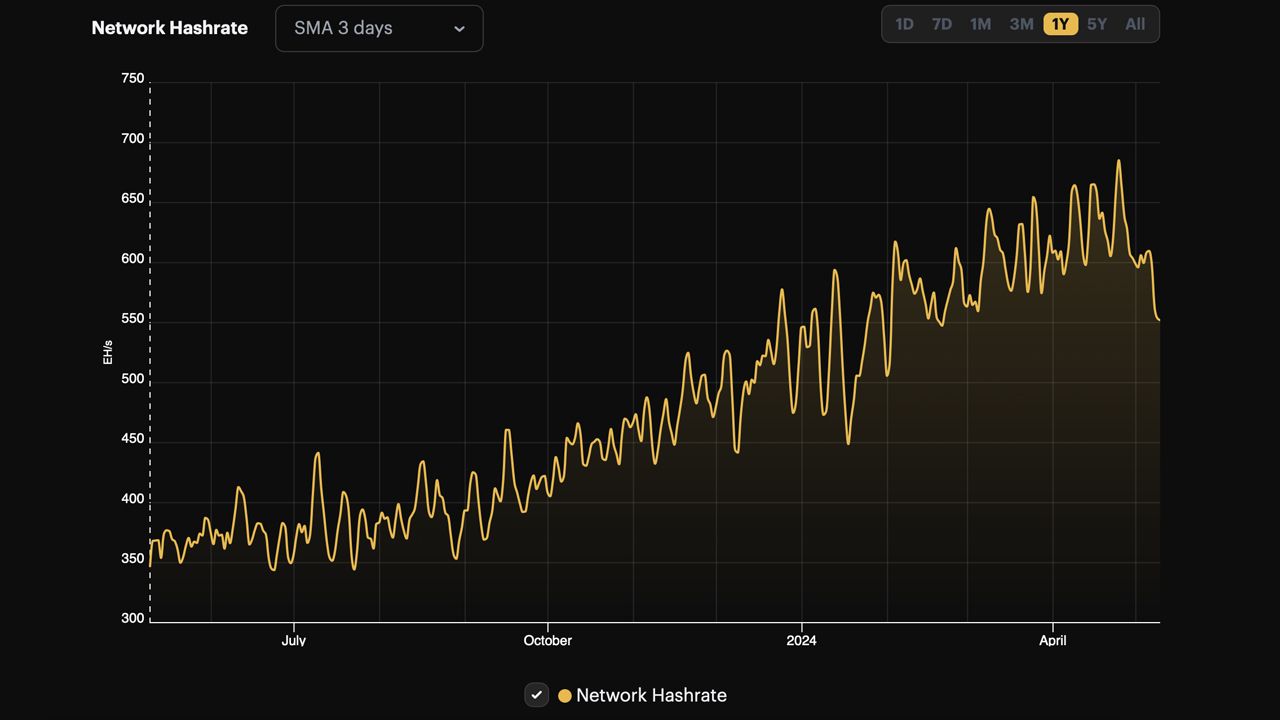

Based on the three-day simple moving average, Bitcoin’s hashrate has continued its downward trend, registering at about 550 exahash per second (EH/s). Following the halving, onchain costs have decreased significantly, with data indicating transfer fees ranging from $1.50 to $3.65 per transaction.

Bitcoin’s Hashrate Slides 19% in 16 Days

According to statistics, the three-day simple moving average (SMA) for Bitcoin’s hashrate, which reveals greater volatility compared to the seven-day SMA, recorded a peak of 685 EH/s on April 24, 2024. The all-time high (ATH) for the seven-day SMA stands at 655 EH/s. Using the 72-hour average, about 135 EH/s has been subtracted from the network. Consequently, in just over two weeks since the ATH, the network experienced a 19.7% decrease in hashrate.

Following the recent reward halving, onchain fees have significantly decreased since April 24. On that date, the average onchain fee stood at $28, but it dropped to just 0.00006 BTC or $3.65 per transaction 16 days later. Current data from mempool.space indicates that fees range from $1.50 to $1.96 for low to high-priority transactions, respectively. Despite these reductions, over 216,000 transactions in the mempool are still pending confirmation.

This ongoing congestion stems from continued strong activity across financial transfers, Ordinal inscriptions, and Runes protocol engagements. Although a record high of over 927,000 transactions was confirmed on April 23, the daily transaction confirmation rate has since adjusted to between 400,000 and 700,000. While the number of daily confirmed transactions remains high, the fees are considerably lower, as all three types of users are opting to pay fewer satoshis per virtual byte (sats/vB) on the Bitcoin network.

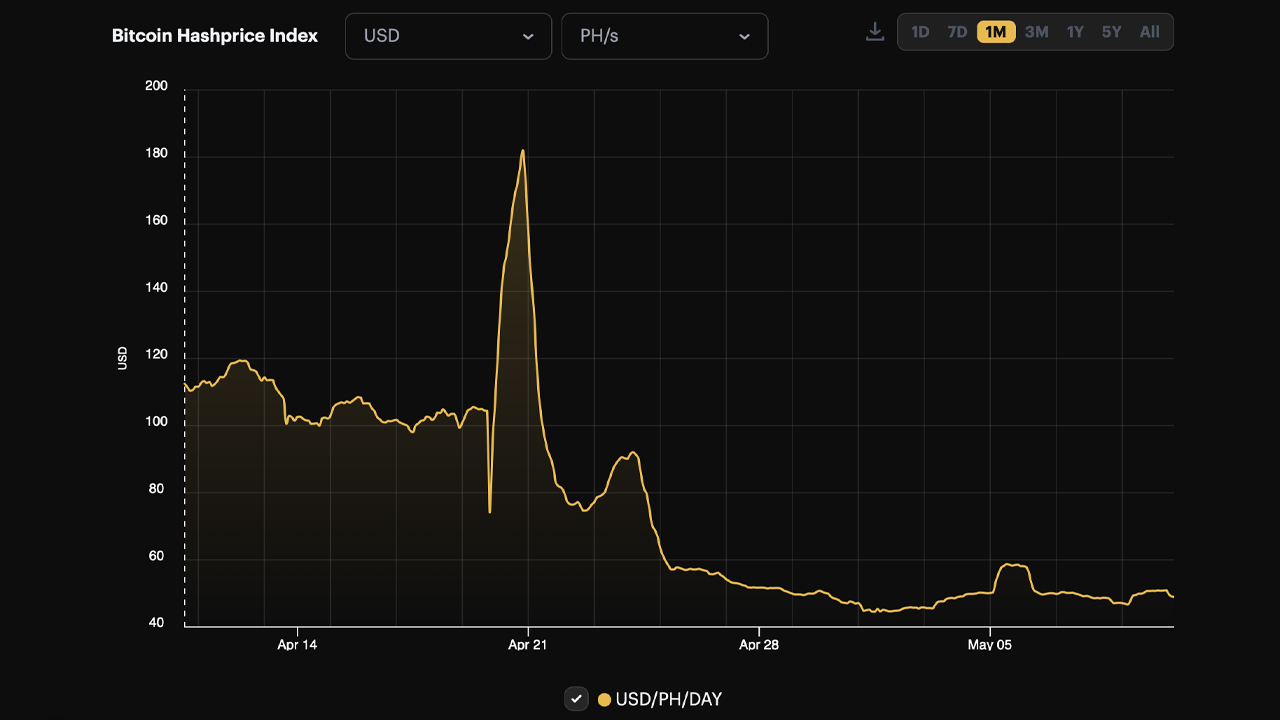

At the same time, bitcoin miners are contending with fluctuations in BTC’s market value, which has been struggling to maintain a position above the $60,000 mark per unit, falling by 3% this week. Coupled with reduced fees and lower rewards, the hashprice, or cost per petahash per second (PH/s) per day, has declined to around $48. As the hashprice continues to drop, profitability diminishes, which has been a significant factor in reducing the overall hashpower.

With a continued downtrend in profits and fluctuating market values, additional reductions in the network’s computational strength may loom on the horizon. This may result in additional shifts in the dynamics of mining profitability and difficulty. The network recently underwent its most significant difficulty retarget since December 2022, with a decline of 5.62% at block height 842,688. Current estimates suggest that another reduction in difficulty might be forthcoming.

What are your thoughts on the future of Bitcoin’s mining profitability as the network faces volatile changes? Share your insights in the comments below

news.bitcoin.com

news.bitcoin.com